Investors eyeing the energy sector have a lucrative opportunity to snap up undervalued stocks displaying momentum indicators signaling potential growth.

One such indicator, the Relative Strength Index (RSI), offers insights into a stock’s performance based on price fluctuations. An RSI below 30 indicates oversold conditions, suggesting a buying opportunity for savvy traders.

Here’s a rundown of two major energy companies currently trading near or below the critical RSI threshold:

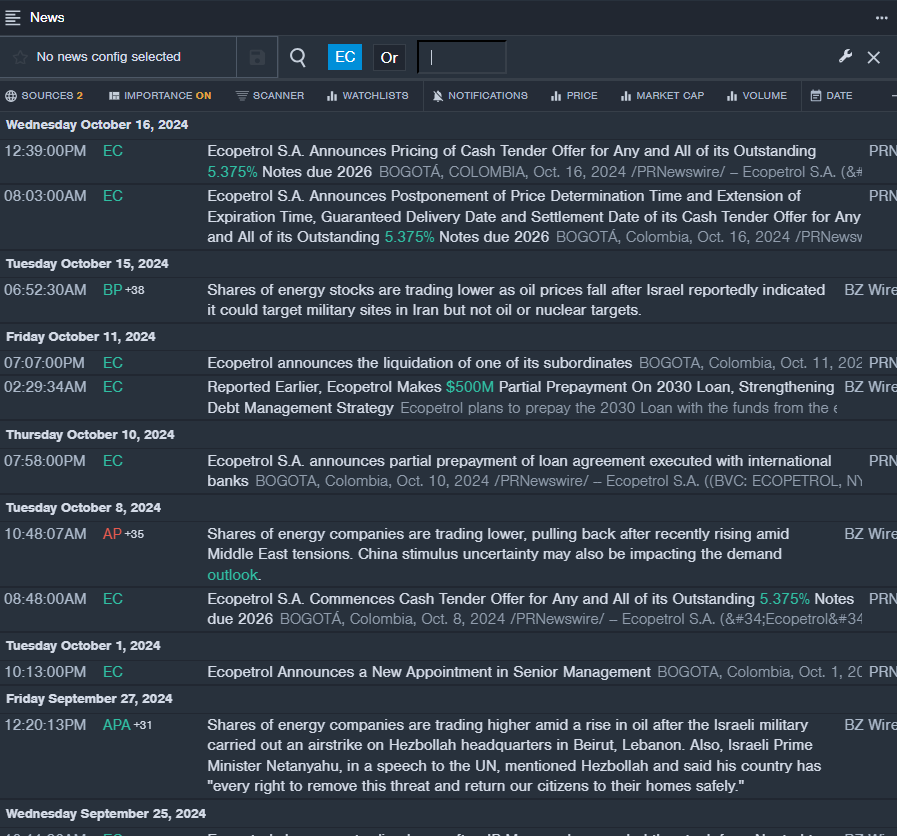

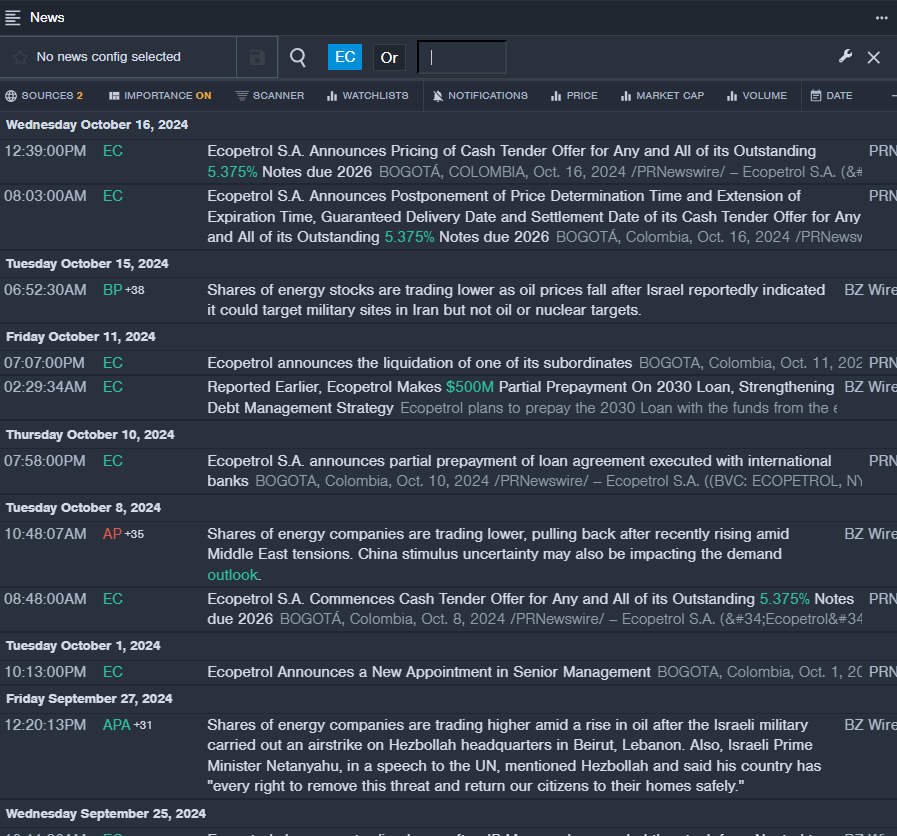

Ecopetrol SA (EC)

- Recently, Ecopetrol announced a cash tender offer for its 5.375% notes due 2026, causing the stock to plummet by approximately 11% over the past week, hitting a 52-week low of $8.13.

- RSI Value: 26.20

- EC Price Action: Ecopetrol’s shares closed at $8.15, reflecting a decline of 1.1% on Thursday.

- Traders utilizing Benzinga Pro’s real-time newsfeed could stay informed about the latest developments surrounding Ecopetrol.

Torm PLC (TRMD)

- Evercore ISI Group analyst Jonathan Chappell’s optimistic Outperform rating and increased price target for Torm failed to shield the stock from a 17% drop in the past month, pushing it close to its 52-week low of $26.10.

- RSI Value: 27.08

- TRMD Price Action: Torm’s shares concluded Thursday at $29.90, reflecting a 0.7% decrease.

- By leveraging Benzinga Pro’s charting tool, traders could track TRMD’s stock trend efficiently.

Read More:

Market News and Data brought to you by Benzinga APIs