Seizing the opportunity in the mayhem, with the most oversold stocks in the consumer staples sector presenting a golden chance to acquire undervalued companies.

Delving into the world of RSI, a barometer of momentum measuring a stock’s strength on upward versus downward trading days. A vital tool offering insights into short-term performance projections. Marking the threshold at which stocks are deemed oversold when RSI levels dip below 30, as heralded by Benzinga Pro.

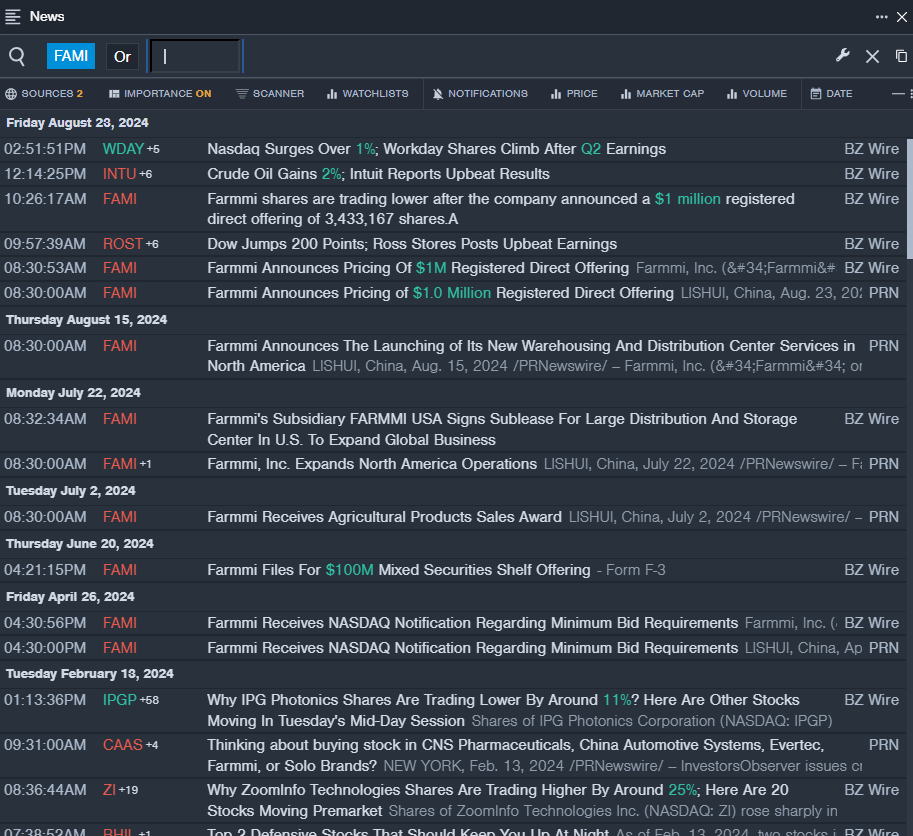

Surveying the battlefield, the latest roster of heavyweight underdogs emerging with RSIs hovering near or beneath the magic 30 mark.

Amidst Gloom, Farmmi Inc Sees a Ray of Hope

- Aug. 23 witnessed Farmmi announcing a $1 million registered direct offering of 3,433,167 shares. The company’s stock stumbled by a staggering 61% over recent weeks, patting its 52-week low at $0.17.

- RSI Value: 29.98

- Farmmi Price Action: Farmmi shares took a 5.1% dip, settling at $0.22 by Tuesday’s closure.

e.l.f. Beauty Inc: Embattled Yet Resilient

- On Sept. 16, Piper Sandler’s analyst Korinne Wolfmeyer upheld the faith in e.l.f. Beauty with an Overweight rating, dialing down the price target from $260 to $162. The company’s stock endured a 30% plunge in recent times, kissing its 52-week low at $88.47.

- RSI Value: 28.33

- e.l.f. Price Action: The elves at e.l.f. saw a 0.7% decline, concluding at $112.43 as curtains fell on Tuesday’s trading.