Opportunity knocks with the most oversold stocks in the utilities sector, offering a chance to invest in undervalued companies.

When examining a stock’s strength on both positive and negative price days, the RSI (Relative Strength Index) stands as a valuable momentum indicator. An RSI below 30 typically suggests that an asset is oversold, hinting at potential short-term gains.

Let’s delve into the details of the top two major oversold players in the sector, each with an RSI near or below 30.

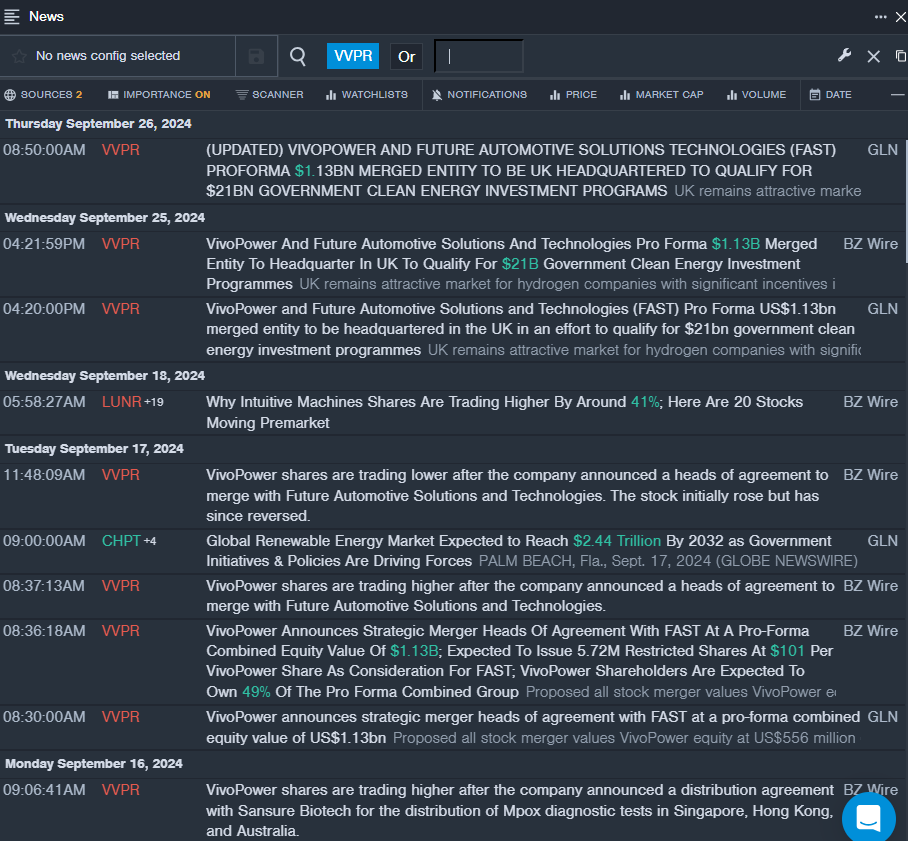

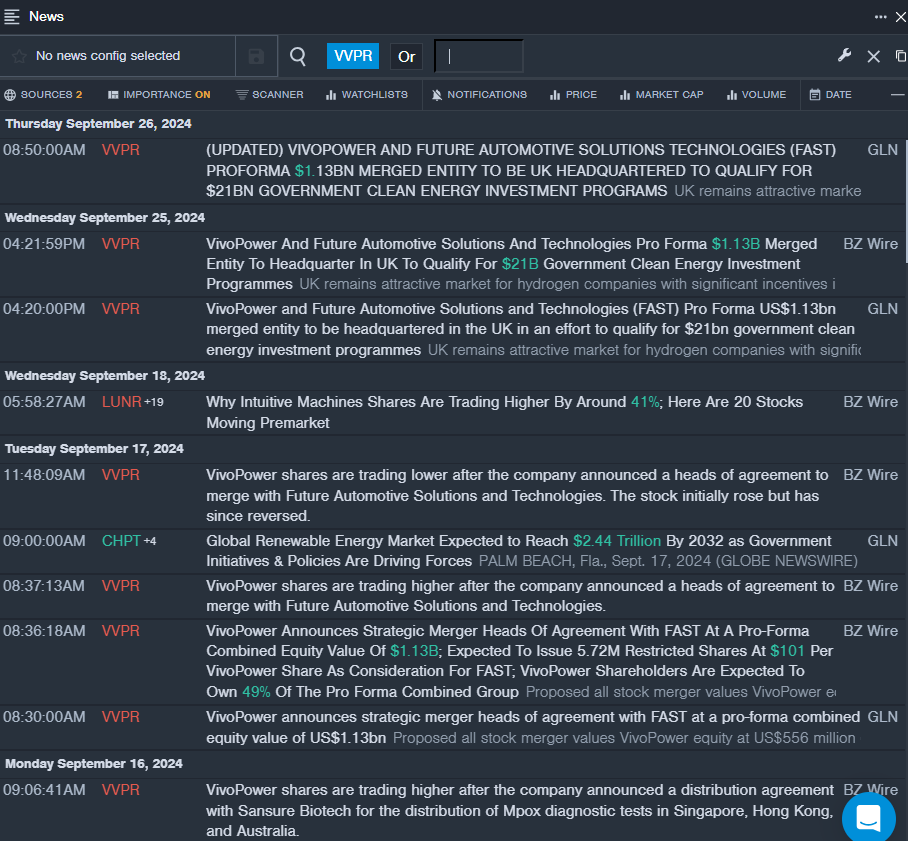

VivoPower International PLC (VVPR)

- Recent news on Sept. 17 unveiled VivoPower’s heads of agreement to merge with Future Automotive Solutions and Technologies. The stock dropped approximately 42% over the past month and holds a 52-week low of $1.02.

- RSI Value: 28.40

- VVPR Price Action: Shares of VivoPower International slipped 7% to close at $1.06 on Friday.

Alternus Clean Energy Inc (ALCE)

- Alternus Clean Energy recently announced the termination of a significant agreement and shared its strategic vision for future growth. Despite a 27% decline over the past month and a 52-week low of $0.15, the company remains focused on renewable energy acquisitions and market expansion.

- RSI Value: 25.93

- ALCE Price Action: On Friday, shares of Alternus Clean Energy decreased by 2%, closing at $0.16.

Read Next:

Market News and Data brought to you by Benzinga APIs