Uncovering Hidden Gems in the Consumer Sector

Recently, a silver lining has emerged in the consumer discretionary sector as oversold stocks offer a beacon of hope for investors seeking value in undervalued companies. The Relative Strength Index (RSI), a crucial momentum indicator that sheds light on a stock’s performance in the short term, has pinpointed several significant players with an RSI near or below the critical threshold of 30.

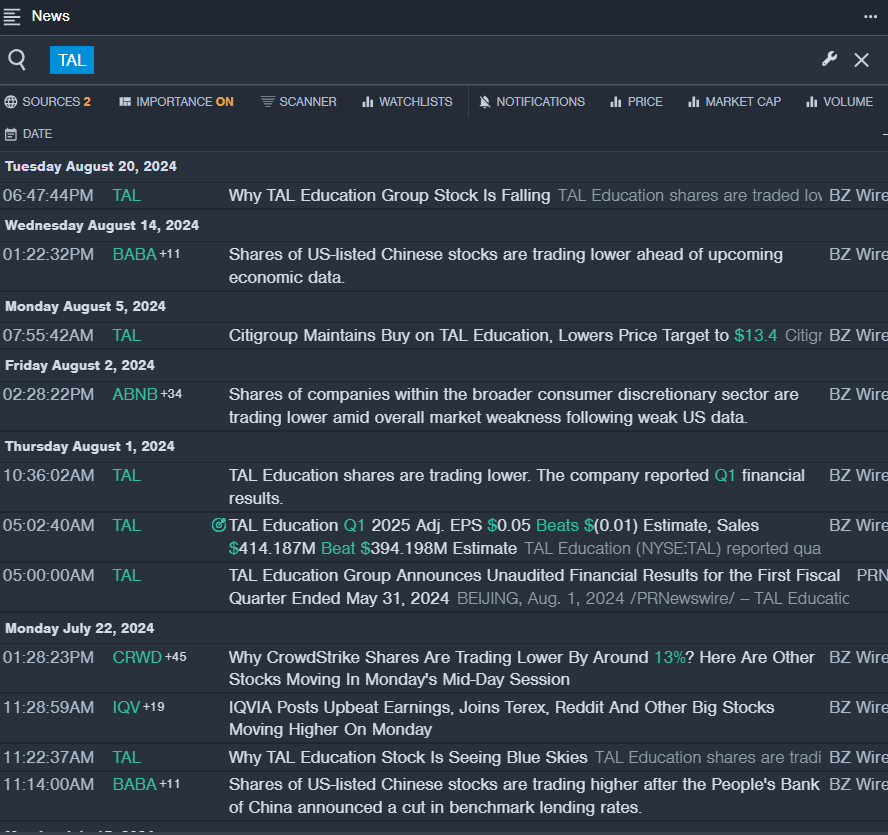

Weathering the Storm: TAL Education Group

Despite the recent turbulence, TAL Education Group managed to stay afloat by posting positive quarterly results on August 1st. Alex Peng, TAL’s President and CFO, emphasized the company’s unwavering commitment to high-quality products and operational efficiency to cater to their learners effectively. Despite a challenging month that saw the stock plummet by around 18%, TAL Education Group remains steadfast, with a 52-week low of $6.81.

RSI Value: 29.74

TAL Price Action: Shares of TAL Education closed at $7.42 on Monday, marking a minor decline of 0.1%.

Navigating Rough Seas: Gaotu Techedu Inc

Aug. 27 revealed a rough patch for Gaotu Techedu Inc as they reported a larger-than-expected quarterly loss. Despite the setback, Larry Xiangdong Chen, the company’s founder and CEO, remained optimistic about their growth prospects. The stock experienced a substantial 39% decline over the past month, with a 52-week low of $2.22.

RSI Value: 27.21

GOTU Price Action: Shares of Gaotu Techedu closed at $2.67 on Monday, reflecting a modest decrease of 0.7%.

Into the Fray: Gogoro Inc

On Aug. 27, Gogoro Inc and Nebula Energy unveiled their battery swapping and Smartscooters in the Kathmandu Valley. Despite this promising development, the company’s shares took a nosedive, plunging by approximately 36% over the past month with a 52-week low of $0.84.

RSI Value: 21.96

GGR Price Action: Gogoro’s shares closed at $0.86 on Monday, registering a significant 14.1% decrease.

Contemplating the Future: