Q4 earnings season is beginning to wind down amid several pleasant surprises that propelled key indexes to new highs. But amidst the overall positive trend, there is a selected group of companies beyond the ‘magnificent 7’ that notably outperformed in terms of financial performance and warrant a closer look. These are: Palantir (NYSE:), Arm Holdings ADR (NASDAQ:), and Super Micro Computer (NASDAQ:), which have been absolutely soaring since reporting better-than-expected numbers, both in terms of EPS and sales. But as the market keeps testing new all-time-highs, the question arises: have they gone too far? In this article, we will review the remarkable performances of these companies and evaluate whether they still present attractive investment opportunities or if their recent gains have exhausted their bullish potential.

Palantir – A Stratospheric Surge

Intelligence and defense software company Palantir is undoubtedly one of the stocks that has rallied the most since the publication of its Q4 results. At Wednesday’s closing price of $25.17, PLTR posted a gain of 50.6% since the publication of its results on February 5 after the market close. In particular, the stock gained over 30% the day after publication. EPS had risen by +100% compared with the same quarter the previous year and had also exceeded expectations.

However, despite the quality of the results, there are indications that Palantir shares may now be overvalued. Indeed, the InvestingPro fair value of the stock, which synthesizes several recognized financial models, stands at $15.83, more than 37% below the current price. Analysts, although slightly more optimistic, with an average target of $18.63, also consider the stock to be grossly overvalued. Although the recent results were indeed solid and undoubtedly justified a bullish reaction in Palantir shares, the scale of the gains recorded since publication should prompt investors to be cautious about the risk of profit-taking.

Arm Holdings: A Thrilling Rally and a Descent

Arm Holdings, a chip and semiconductor company, has also seen its share price soar since the publication of its earnings on February 7. At Wednesday evening’s closing price of $126.4, Arm Holdings shares were up 64%. However, it should be noted that the stock has corrected since Monday’s peak of $164, on which the impact of the results was calculated at +112%. The company surprised many with its EPS and revenues.

However, valuation models indicate that the recent rise has largely exhausted the share’s potential. Fair value stands at $79.23, 37.3% below the current price, with valuations ranging from $67 to $91, depending on the model. The 29 professional analysts who follow the stock are also cautious, with an average target of $94.52, representing a downside risk of over 25%. Given the scale of the gains posted following the results, some of which have already been corrected, buying Arm Holdings shares at the current price would undoubtedly be a timing error.

Super Micro Computer: A Meteoric Rise

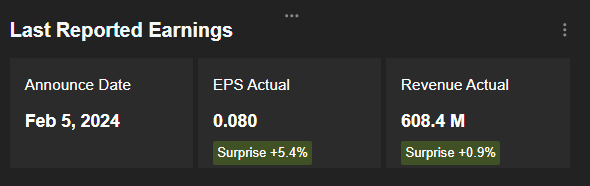

In the 12 sessions between the release of Super Micro Computer’s earnings on January 29, and Tuesday’s close, the stock declined in just one session (and by only -0.66%). At yesterday’s closing price of $880.55, the stock was up more than 77% on the day before publication. The company significantly exceeded EPS and sales expectations, while posting strong year-on-year growth.

Super Micro Computer Inc: A Bullish Run or a Bubble?

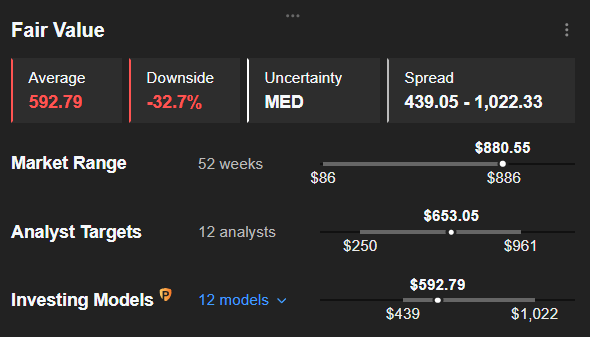

Super Micro Computer Inc has enjoyed a powerful bullish reaction following its recent earnings results. However, analysts and InvestingPro valuation models are pointing towards a potential downside. The current fair value of $592.79 entails a risk of 32.7%. Despite this, one model values the stock at $1022, representing a 16% premium over Wednesday’s closing price.

SCMI Fair Value

Source : InvestingPro

While there are worrying weaknesses highlighted, such as low gross margins according to InvestingPro ProTips, there are also evident strengths, as can be seen from a partial extract from Bullish Tips. As a result, Super Micro Computer remains a solid stock, but with a current valuation that suggests it may be prudent to await a correction before considering a purchase.

The Bigger Picture

Super Micro Computer Inc’s bullish performance is not unique in the technology sector. The company’s strong potential, evident from its quality results and the robust bullish reaction of its share prices, is mirrored by several other technology companies.

However, valuations of these stocks have become particularly stretched, indicating the possibility of an impending correction in the near term.

This perspective is further compounded by recent macroeconomic developments, with the release of hotter-than-expected US data casting a shadow over the market’s outlook.

As the saying goes, trees never reach the sky, and with current valuations at elevated levels, caution may be warranted.

Investors would be wise to exercise prudence in the current market climate. It’s a time for vigilance, not exuberance, as the risk of overvaluation looms amidst increasingly uncertain economic conditions.

At the end of the day, the market is a reflection of the ever-evolving dynamics of supply and demand, and investors should remain cognizant of the potential for abrupt shifts in sentiment and pricing levels.

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.