Unveiling the Financial Landscape

The realm of finance is a tumultuous sea, with storms of volatility and sunshine of stability. In this delicate ecosystem, opportunities arise in the most unexpected corners, giving investors a chance to navigate through undervalued territories and emerge victorious.

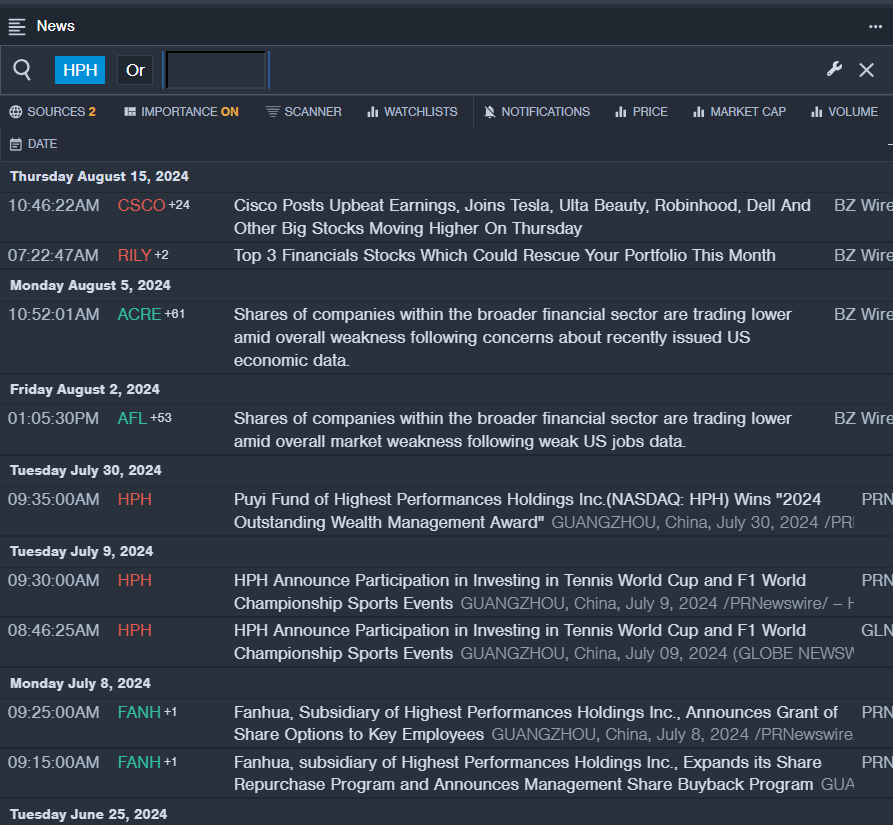

The Story of Highest Performances Holdings Inc

- Recently, Highest Performances Holdings Inc shared news of its 1H 2024 revenue standing at a commendable $5 million. Despite facing economic headwinds, Mr. Yinan Hu, the CEO, exuded optimism. The stock, however, took a hit of approximately 61% in the last month, hitting a 52-week low of $1.70.

- RSI Value: 25.14

- HPH Price Action: The stock of Highest Performances Holdings inched up by 2.5% to close at $2.03 by the end of last week.

The Saga of Katapult Holdings Inc

- On August 22, Katapult took a significant step by appointing Derek Medlin as President and Chief Growth Officer. Orlando Zayas, the CEO, emphasized Medlin’s integral role over the years. Despite this positive development, Katapult’s stock plummeted by about 41% in the preceding month, touching a 52-week low of $8.26.

- RSI Value: 27.04

- KPLT Price Action: Katapult’s shares experienced a slight dip of 0.3%, closing at $11.65 last Friday.

The Journey of DigiAsia Corp

- DigiAsia made headlines on August 20 when it appointed Andreas Gregori to its AI Strategic Advisory Board. However, the company’s shares were not immune to the market turmoil, witnessing a sharp decline of around 66% in the previous month, with a 52-week low of $0.96.

- RSI Value: 25.12

- FAAS Price Action: DigiAsia’s stock tumbled by 14.2%, closing at $0.97 at the end of the trading week.

Exploring New Horizons

As these financial giants weather the storms of market fluctuations, investors stand at a crossroads, pondering whether to seize the moment and capitalise on the undervalued potential lying within. Like sailors navigating a tempestuous sea, strategic decisions and keen insights will guide them through the turbulent waters, towards the sunny shores of profitability.