The most oversold stocks in the financials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

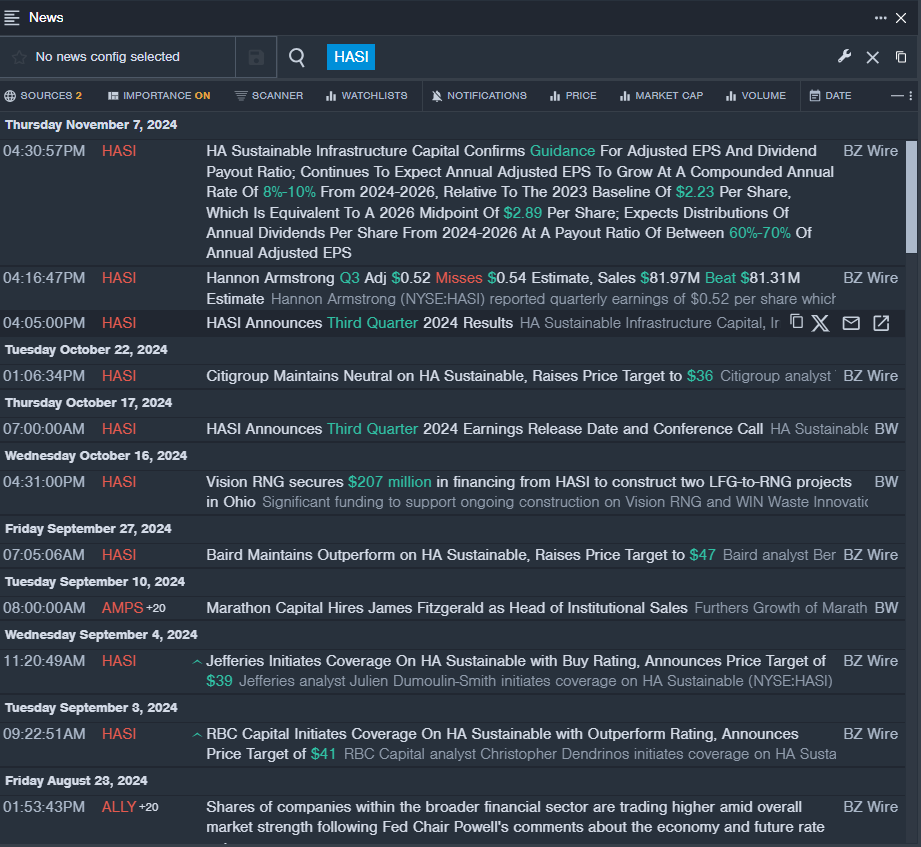

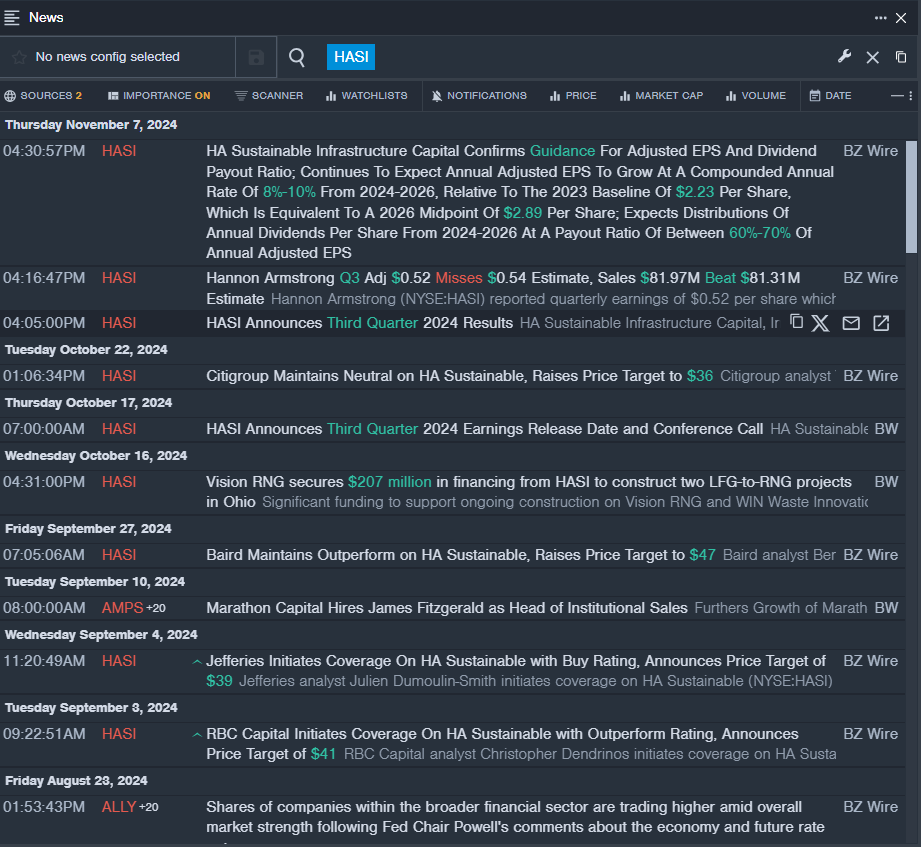

HA Sustainable Infrastructure Capitl Inc HASI

- On Nov. 7, Hannon Armstrong posted mixed results for the third quarter. “Our Q3 and 2024 YTD results underscore the resiliency and consistency of our business,” said Jeffrey A. Lipson, president and CEO of HASI. “We expect to continue to deliver growth in our adjusted earnings and managed assets amidst ongoing volatility in interest rates and uncertainties related to public policy.” The company’s stock fell around 22% over the past month and has a 52-week low of $21.77.

- RSI Value: 25.88

- HASI Price Action: Shares of HASI fell 1.2% to close at $27.22 on Friday.

- Benzinga Pro’s real-time newsfeed alerted to latest HASI news.

Paysafe Ltd PSFE

- On Nov. 13, the company reported third-quarter adjusted earnings per share of 51 cents, beating the street view of 2 cents. Quarterly sales of $427.10 million, an increase of 8% year over year, beat the analyst consensus of $423.096 million. Bruce Lowthers, CEO of Paysafe, commented: “Revenue growth continues to be strong this year, reaching 8% for the third quarter and year-to-date, demonstrating execution on our strategic priorities and our focus on delivering higher quality, sustainable revenue growth, while investing in the business and progressively reducing net leverage. We are pleased to reaffirm our full year financial outlook for 2024 and we remain confident that we are taking the right actions to drive continued momentum in 2025 and beyond.” The company’s stock fell around 29% over the past five days and has a 52-week low of $10.05.

- RSI Value: 29.82

- PSFE Price Action: Shares of Paysafe fell 2.3% to close at $17.67 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in PSFE stock.

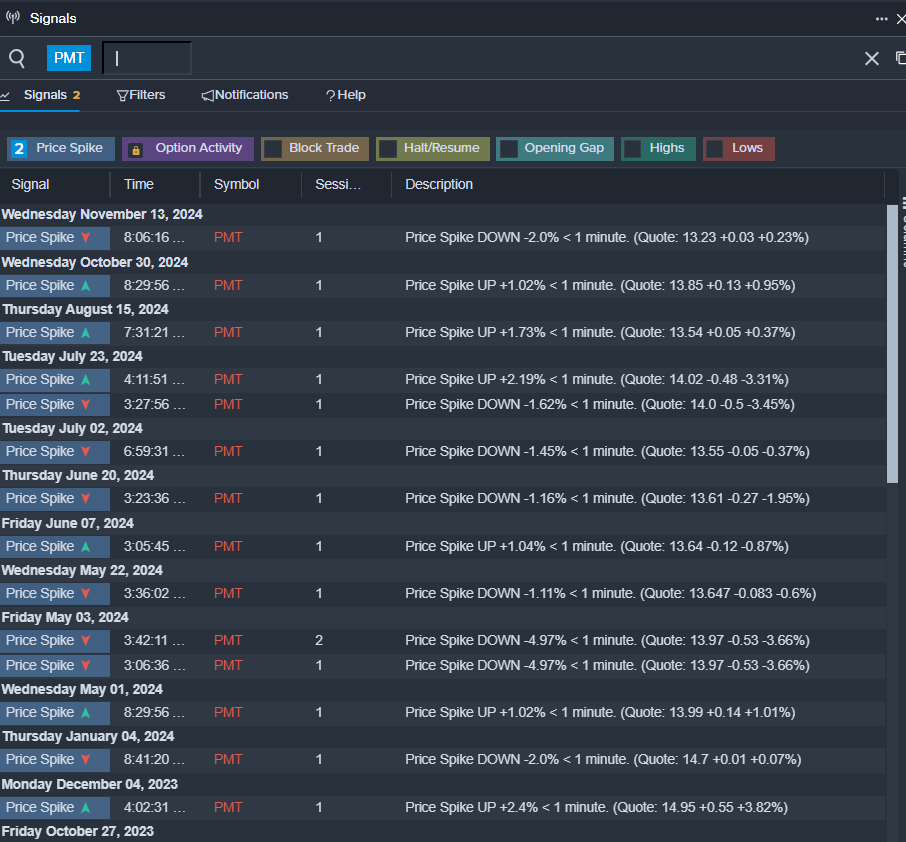

PennyMac Mortgage Investment Trust PMT

- On Oct. 22, PennyMac Mortgage posted mixed quarterly results. “PennyMac Financial reported outstanding results in the third quarter, with an annualized operating return on equity of 20 percent,” said Chairman and CEO David Spector. The company’s stock fell around 7% over the past month and has a 52-week low of $12.81.

- RSI Value: 28.91

- PMT Price Action: Shares of PennyMac Mortgage Investment Trust closed at $13.06 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in PMT shares.

Read More:

Market News and Data brought to you by Benzinga APIs