For investors seeking diamonds in the rough, the health care sector is currently a gold mine of oversold stocks with potential for future growth.

Unlocking the RSI Code

The Relative Strength Index (RSI) is akin to a seasoned detective, shedding light on a stock’s journey through the market’s labyrinth. A stock is deemed oversold when its RSI dips below 30, offering intrepid traders a map to hidden treasures.

Below lies a treasure trove of underappreciated health care equities basking in the glow of an RSI nearing or below 30.

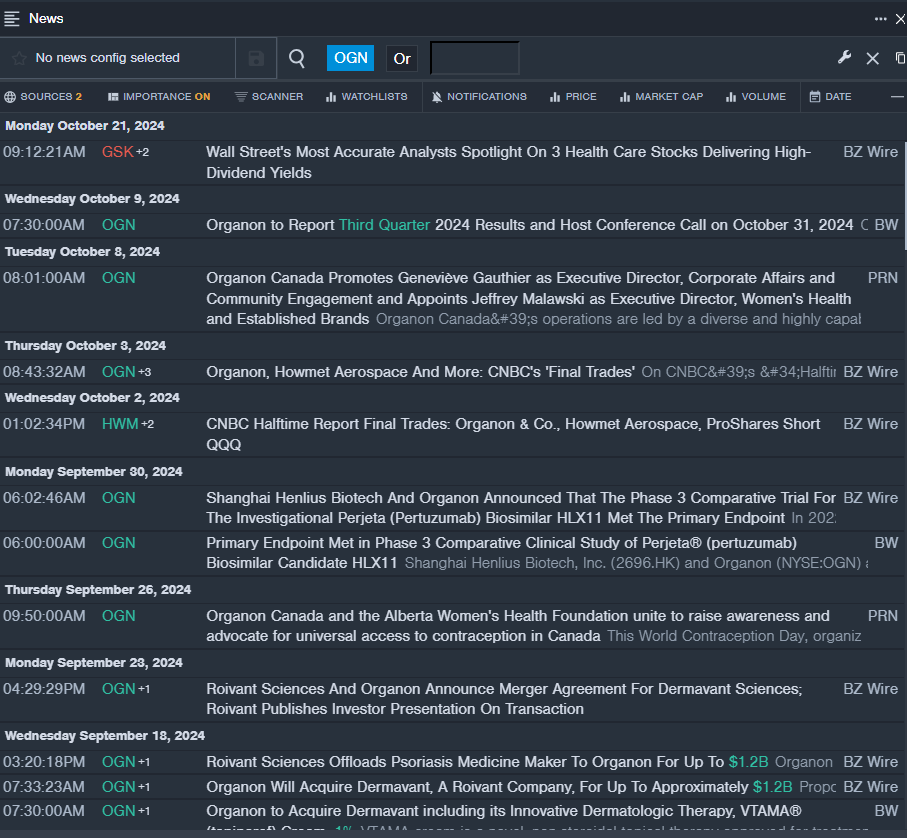

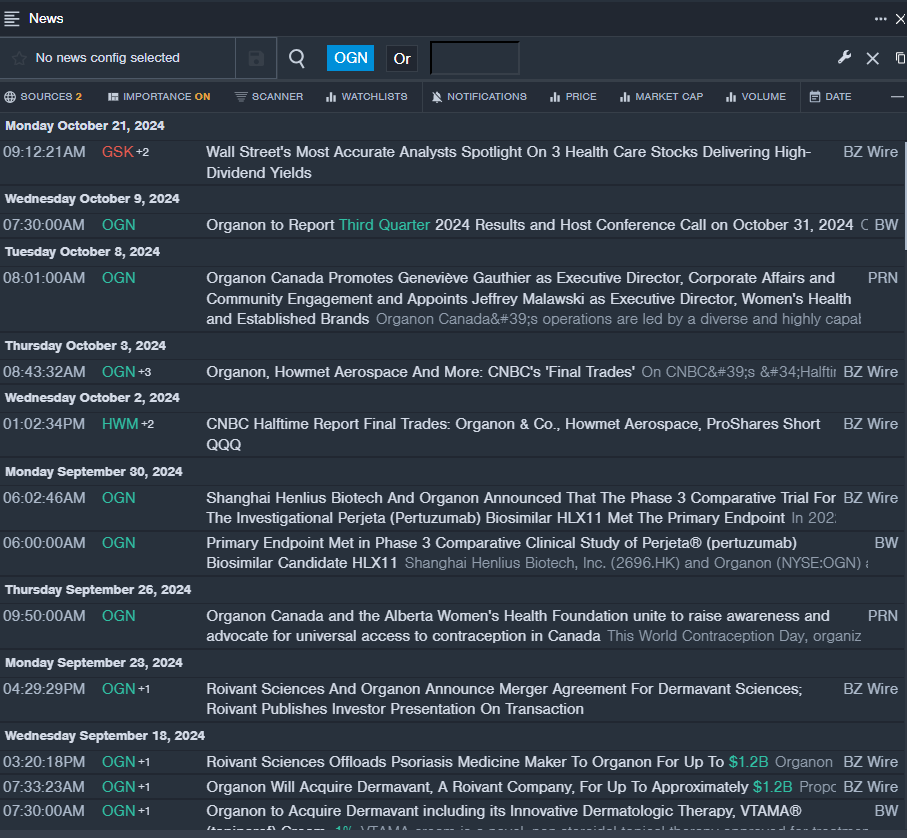

Organon & Co – An Undervalued Gem OGN

- Despite the impending reveal of its Q3 2024 financial results on October 31, Organon & Co’s stock has tumbled approximately 12% in the previous month, hitting a 52-week low of $10.84.

- RSI Value: 28.28

- OGN Price Action: The stock staggered 0.9% lower to settle at $17.45 on Monday.

- Benzinga Pro’s real-time newsfeed acts as a guiding compass for investors navigating through the turbulent waters of Organon & Co.

Arcutis Biotherapeutics Inc – A Rising Star ARQT

- Arcutis Biotherapeutics garnered Health Canada’s approval for ZORYVE® Foam to combat seborrheic dermatitis, marking a pivotal milestone. Despite this triumph, its stock stumbled by 14% over the past five days, kissing a 52-week low of $1.76.

- RSI Value: 28.13

- ARQT Price Action: The stock plunged by 4.7% to close at $8.31 on Monday.

- Benzinga Pro’s advanced analytics shine a light on the trajectory of Arcutis Biotherapeutics.

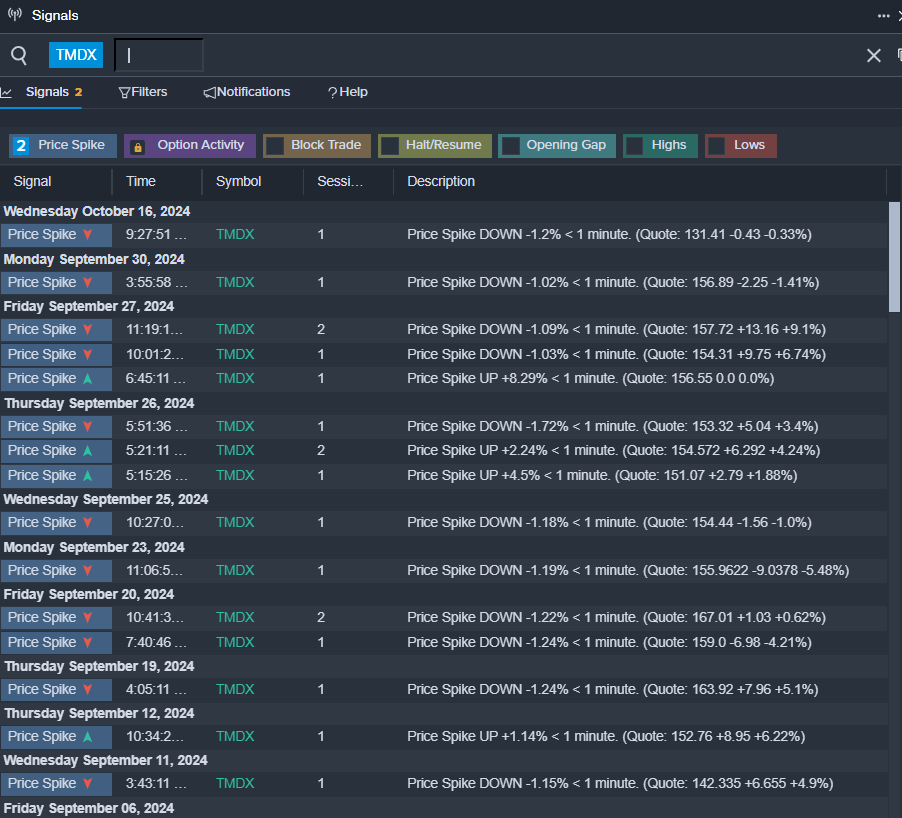

TransMedics Group Inc – A Diamond in the Rough TMDX

- As TransMedics Group gears up to unveil its Q3 financial results post-market closure on October 28, its stock has witnessed a downturn of 22% over the past month, touching a 52-week low of $36.42.

- RSI Value: 29.60

- TMDX Price Action: The stock dwindled by 1.7%, ending at $124.48 on Monday.

- The analytical prowess of Benzinga Pro’s signals offers a guiding beacon for investors navigating the tumultuous waters of TransMedics Group Inc.

Read More:

Market News and Data brought to you by Benzinga APIs