Seizing Undervalued Opportunities

In the tumultuous waters of the stock market, the health care sector has recently thrown up a lifeboat for prospective investors. Amidst the chaos of oversold stocks lie hidden treasures waiting to be discovered, embraced, and nurtured back to financial health.

One key indicator that has piqued the interest of astute traders is the Relative Strength Index (RSI). This powerful momentum indicator, which oscillates between 0 and 100, compares the magnitude of recent gains to recent losses. When this metric dips below 30, a clarion call emerges for those seeking to dive into oversold territory and potentially reap the rewards of a market correction.

The Ailing Titans:

In the annals of recent market unrest, names like Agilon Health Inc, Verrica Pharmaceuticals Inc, and ALX Oncology Holdings Inc stand out as wounded warriors in the health care domain. These once-promising entities have faced the brunt of selling pressure, leading to sizable declines in their stock prices.

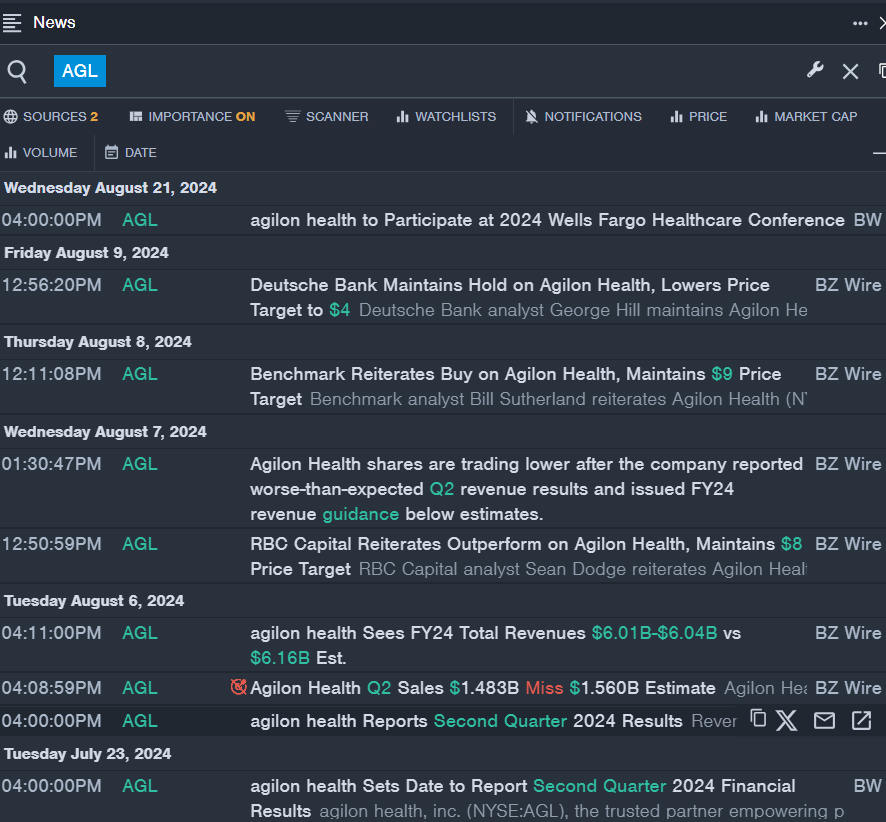

Agilon Health Inc (AGL)

Aug. 6 marked a somber day for Agilon Health Inc when the company unveiled worse-than-expected second-quarter revenue figures, coupled with a tepid FY24 revenue forecast. The stock plummeted by a staggering 37% over the past month, finding itself adrift near its 52-week low of $4.38. With an RSI hovering at a mere 27.10, the company beckons forth with an air of vulnerability juxtaposed against the hope of resurgence.

Verrica Pharmaceuticals Inc (VRCA)

On Aug. 14, Verrica Pharmaceuticals sought to mend its battered reputation with better-than-expected second-quarter financial results. Despite this effort, the company saw its stock crumble by 64% over the last month, languishing close to a 52-week low of $2.53. A paltry RSI value of 19.52 hangs over VRCA like a storm cloud, hinting at potential turbulence ahead despite recent positive news.

ALX Oncology Holdings Inc (ALXO)

Amidst the chaos, ALX Oncology Holdings Inc offered a glimmer of hope on Aug. 8 by posting a narrower-than-expected quarterly loss. The company treads cautiously as its shares plummeted by 56% in the preceding month, edging perilously close to a 52-week low of $2.30. With an RSI of 28.48, ALXO finds itself at a crossroads, where resilience meets uncertainty, leaving investors to ponder the path ahead.

The stock market is a tempestuous sea, full of surprises, opportunities, and risks. As investors navigate the treacherous waters of undervalued stocks, each decision becomes a pivotal moment of calculated risk-taking. Will these health care stocks weather the storm and emerge stronger, or will they succumb to the depths of financial obscurity? Only time will tell as the saga of market volatility continues.