Investors, like sailors scanning the horizon for land, are eying the health care sector for opportunities amidst stormy market conditions. The current scenario presents a chance to buy into undervalued companies, akin to catching a falling knife, as overbought stocks look to rebound.

Exploring Oversold Candidates

Among the most intriguing prospects are stocks displaying Relative Strength Index (RSI) levels near or below 30. The RSI, acting as a financial compass, guides traders towards potentially lucrative investments by comparing a stock’s momentum during price upticks versus downturns. When the RSI dips below the 30 mark, it signals an oversold condition, hinting at a possible resurgence in value.

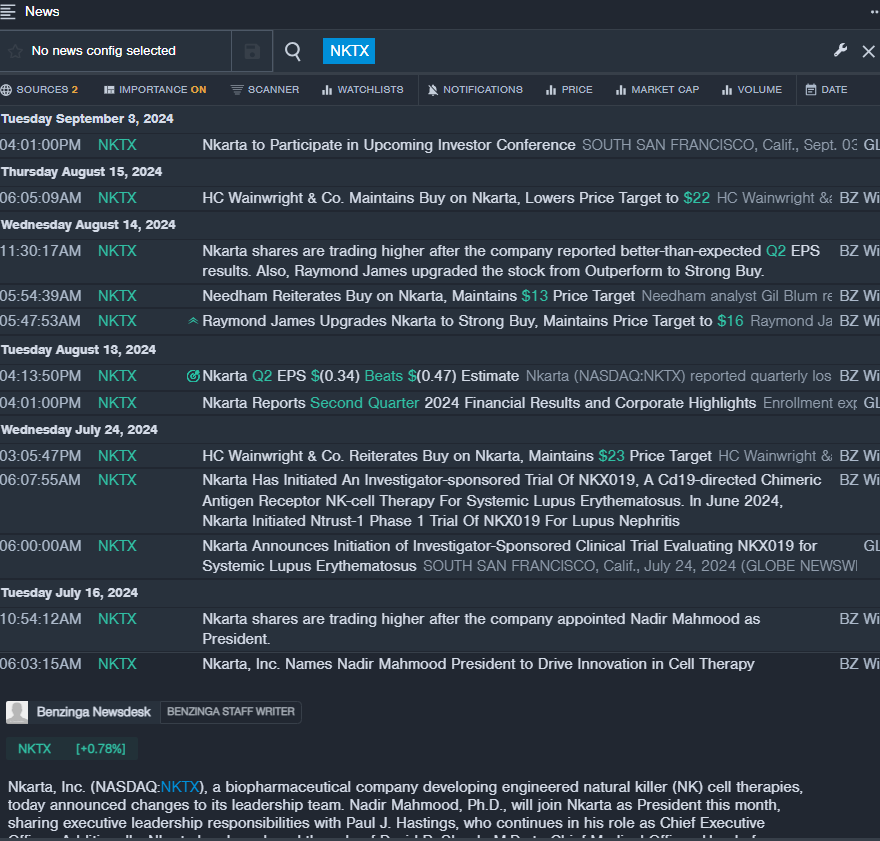

Nkarta IncNKTX

- Nkarta Inc recently unveiled better-than-expected second-quarter earnings, a ray of hope amidst a stormy market. The company, spearheaded by CEO Paul J. Hastings, is focusing on advancing clinical trials across diverse disease areas, showing promise for its NKX019 product. Despite a recent 35% stock decline, Nkarta remains resilient, with room to bounce back from a 52-week low of $1.32.

- RSI Value: 29.34

- NKTX Price Action: Nkarta shares closed at $3.84 on Monday, marking a 2% decrease.

Moderna IncMRNA

- Moderna Inc, a pioneering force in the healthcare realm, recently embarked on a Phase 3 trial for its mRNA-1403 vaccine, targeting the prevalent norovirus. CEO Stéphane Bancel’s commitment to combating health threats is evident as the company addresses a global health concern. Despite a recent 23% stock decline, Moderna’s steadfast approach positions it as a resilient contender in the market, with a 52-week low of $58.33.

- RSI Value: 24.97

- MRNA Price Action: Moderna’s shares closed at $58.72 on Monday, reflecting a 2.5% dip.

AMN Healthcare Services, Inc.AMN

- AMN Healthcare Services, Inc., despite recent challenges, remains a beacon of resilience in the healthcare industry. The company, currently weathering a 15% decline in shares, is led by a resilient team that continues to navigate market turbulence. With a 52-week low of $36.50, AMN’s strategic moves position it as a key player in the sector.

- RSI Value: 29.20

- AMN Price Action: AMN Healthcare’s shares closed at $38.64 on Monday, signaling a steady 0.8% increase.