The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

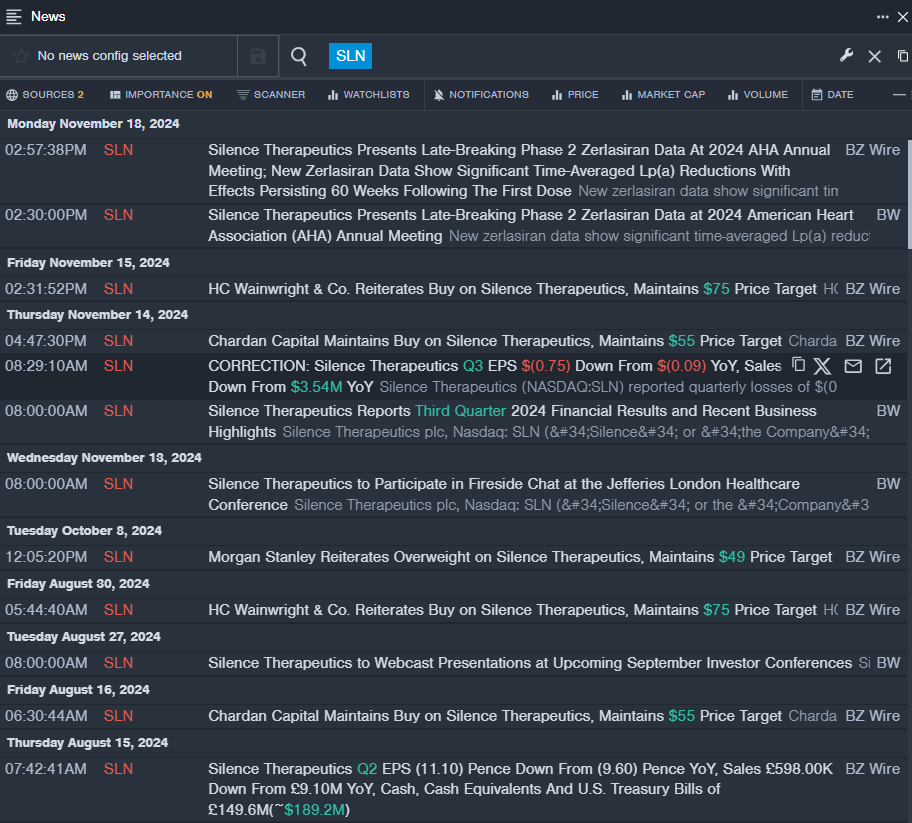

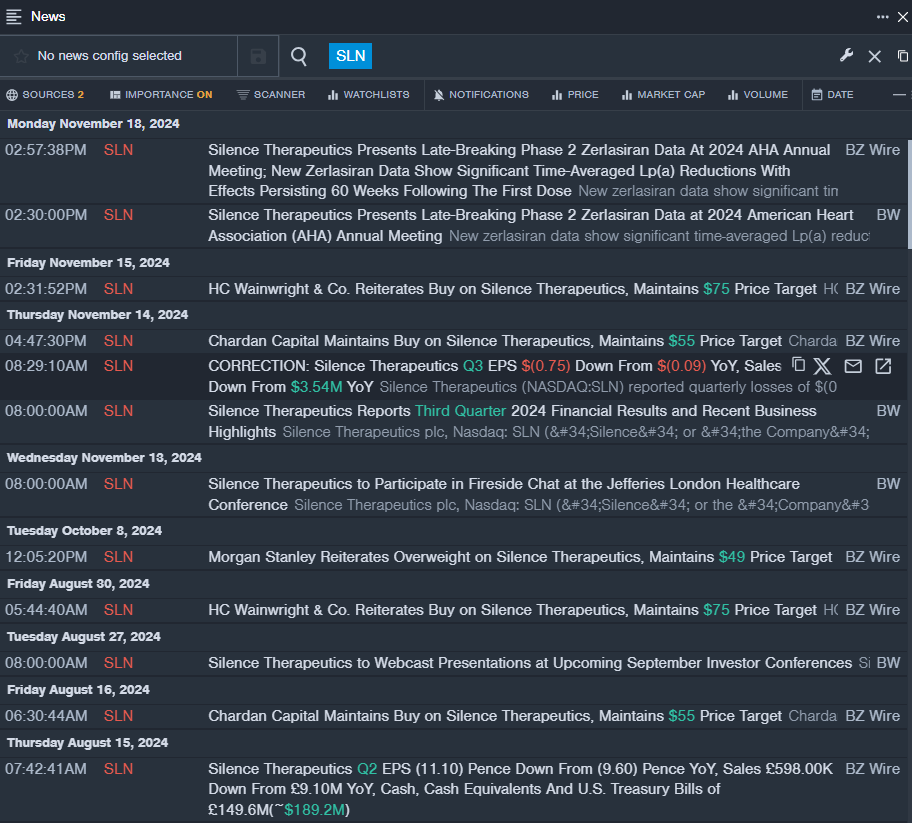

Silence Therapeutics PLC – ADR SLN

- On Nov. 14, Silence Therapeutics reported a quarterly loss of 75 cents per share, versus a year-ago loss of 9 cents per share The company reported $1.49 million in sales. “The Silence team is focused on continued execution across the business,” said Craig Tooman, President and Chief Executive Officer at Silence. “We look forward to presenting additional data from our wholly owned clinical programs at upcoming medical meetings and progressing our pipeline to bring innovative gene silencing medicines to patients around the world.” The company’s stock fell around 37% over the past five days and has a 52-week low of $9.22.

- RSI Value: 12.10

- SLN Price Action: Shares of Silence Therapeutics fell 13.2% to close at $11.02 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest SLN news.

Terns Pharmaceuticals Inc TERN

- On Nov. 12, Terns Pharma posted a third-quarter loss of 28 cents per share, compared to market estimates for a loss of 34 cents per share. “Our progress in the third quarter was highlighted by the compelling topline results from our Phase 1 study of TERN-601, which demonstrated class-leading potential as a differentiated, once-daily, oral GLP-1R agonist for the treatment of obesity and supports its rapid advancement into Phase 2 studies,” stated Amy Burroughs, chief executive officer of Terns. The company’s stock fell around 22% over the past five days and has a 52-week low of $3.59.

- RSI Value: 26.34

- TERN Price Action: Shares of Terns Pharmaceuticals fell 7.6% to close at $5.70 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in TERN stock.

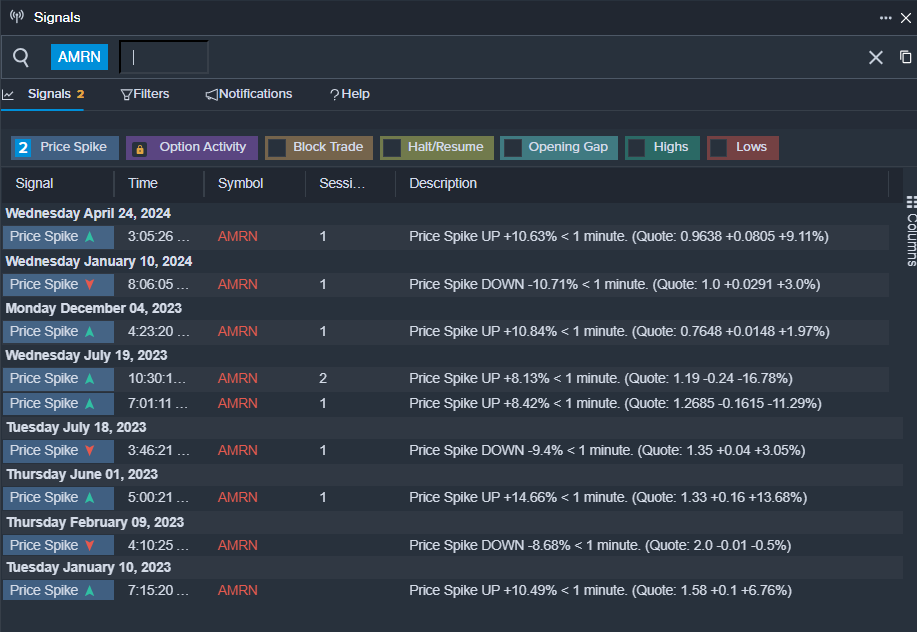

Amarin Corporation plc AMRN

- On Oct. 30, Amarin posted a quarterly loss of 6 cents per share, compared to market estimates of a loss of 5 cents per share. Aaron Berg, Amarin’s President and CEO stated, “While we and our global partners continue to execute on our multipronged global strategy focused on getting VASCEPA/VAZKEPA into the hands of as many patients as possible, the senior leadership team and I, as well as the Board of Directors, remain committed to evaluating all opportunities to maximize the value and impact of this highly impactful product. To that end, we look forward to highlighting the global opportunity for VASCEPA/VAZKEPA and to hear directly from both prescribers and select partners from around the world on the impact of VASCEPA/VAZKEPA during our upcoming virtual Analyst and Investor Day on November 14.” The company’s stock fell around 16% over the past five days and has a 52-week low of $0.46.

- RSI Value: 25.86

- AMRN Price Action: Shares of Amarin fell 7% to close at $0.46 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in AMRN shares.

Read More:

Market News and Data brought to you by Benzinga APIs