The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

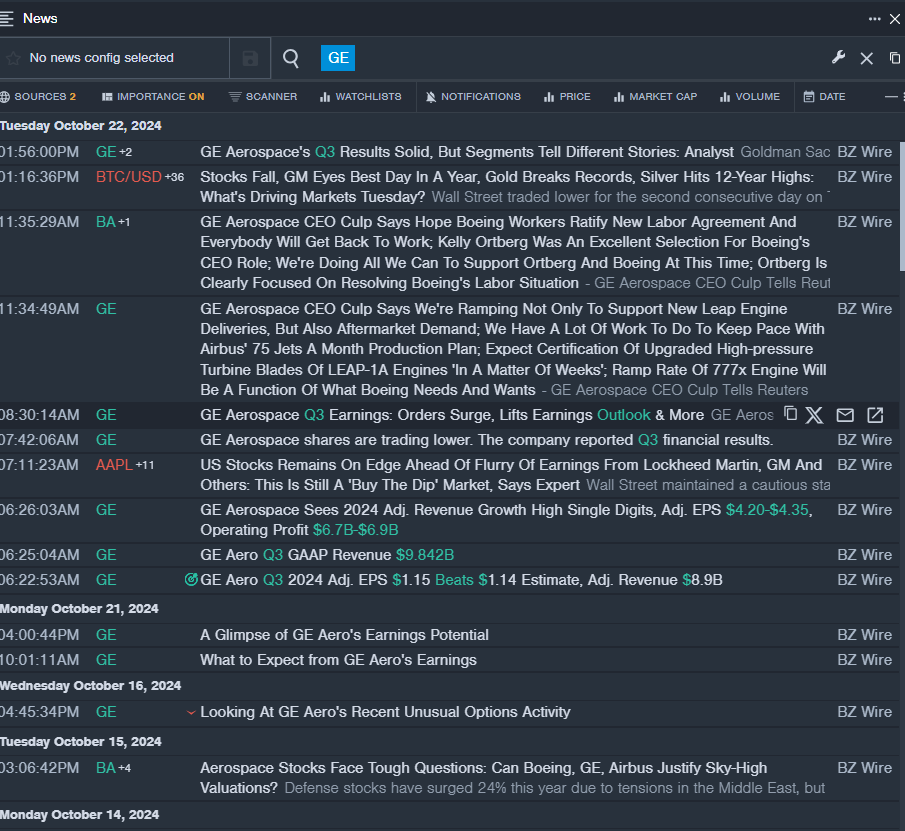

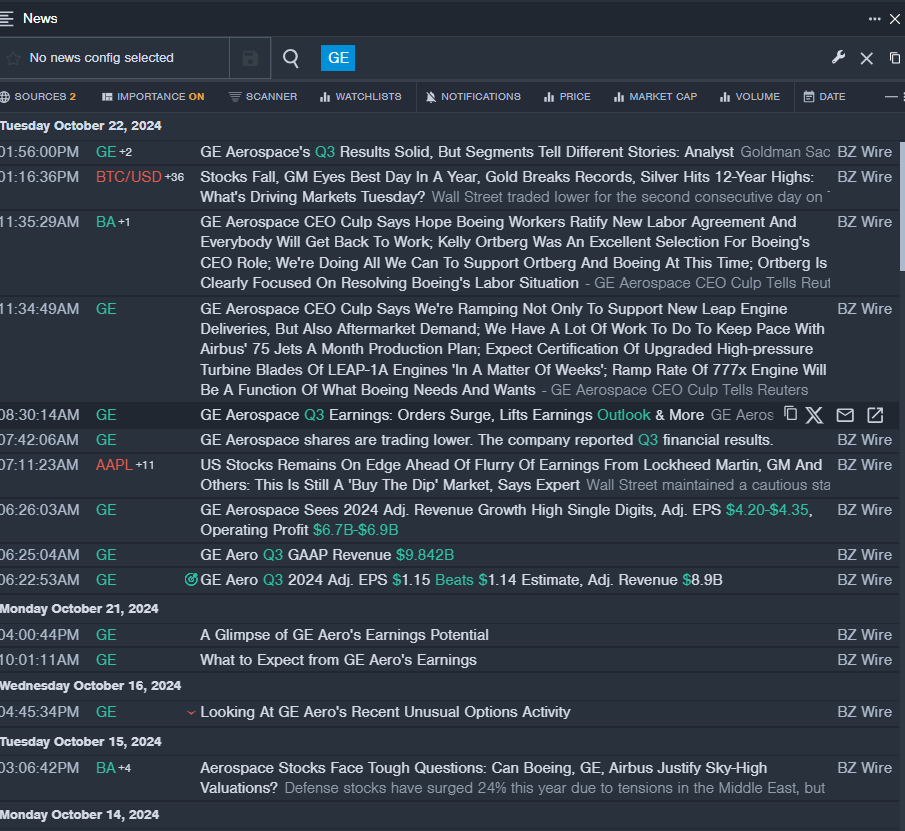

General Electric Co GE

- On Oct. 22, the company reported adjusted revenue growth of 6% Y/Y to $8.943 billion and GAAP revenue of $9.84 billion. “The GE Aerospace team delivered strong results, with demand driving orders up 28%. We grew earnings 25% and produced substantial free cash flow, both largely driven by services. Given the strength of our results and 4Q expectations, we’re raising our earnings and cash guidance for the year,” commented GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. The analyst consensus was $9.022 billion.. The company’s stock fell around 7% over the past five days and has a 52-week low of $84.32.

- RSI Value: 26.67

- GE Price Action: Shares of General Electric fell 9.1% to close at $176.66 on Tuesday.

- Benzinga Pro’s real-time newsfeed alerted to latest GE news.

Lockheed Martin Corp LMT

- On Oct. 22, Lockheed Martin reported mixed third-quarter results. The company reported net sales growth of 1.3% year-over-year to $17.104 billion, missing the consensus of $17.351 billion. Adjusted EPS of $6.84, up from $6.77 in the prior year, topped the consensus of $6.50. “As a result of our strong year-to-date results and confidence in our near-term performance, we are raising the outlook for full year 2024 sales, segment operating profit, EPS and free cash flow,” commented Lockheed Martin Chairman, President, and CEO Jim Taiclet. The company’s stock fell around 4% over the past five days and has a 52-week low of $413.92.

- RSI Value: 29.00

- LMT Price Action: Shares of Lockheed Martin fell 6.1% to close at $576.98 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in LMT stock.

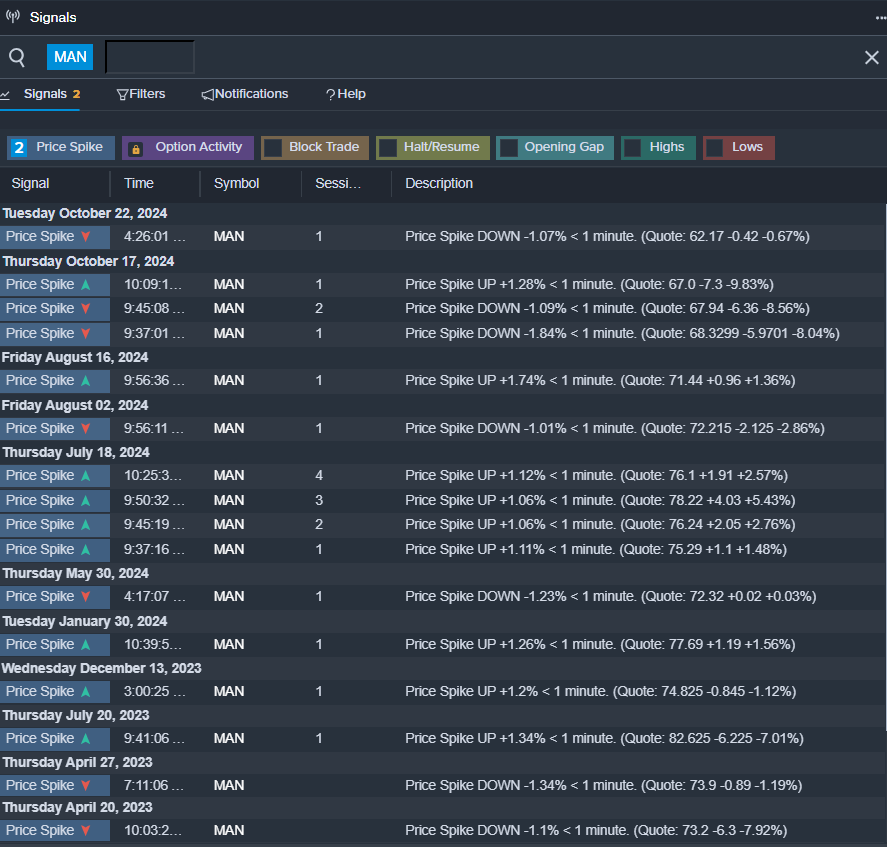

ManpowerGroup Inc MAN

- On Oct. 17, ManpowerGroup issued fourth-quarter EPS guidance below estimates. The company’s shares fell around 13% over the past five days and has a 52-week low of $61.53.

- RSI Value: 29.40

- MAN Price Action: Shares of ManpowerGroup gained 0.4% to close at $62.84 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in MAN shares.

Read More:

Market News and Data brought to you by Benzinga APIs