Diving into Industrials Sector Opportunities

Diving headfirst into the sea of opportunities that the oversold stocks in the industrials sector provide, investors are presented with a chance to purchase undervalued companies that may be on the brink of a significant rebound.

Understanding Relative Strength Index (RSI)

The Relative Strength Index (RSI) stands as a pivotal indicator, offering a comparison of a stock’s strength during upward and downward price movements. This comparison provides traders with valuable insight into potential short-term stock performance. Traditionally, a stock is deemed oversold when the RSI dips below 30, as noted by market experts.

Identifying Major Oversold Players

Pulling back the curtain on the latest major oversold players in the industrials sector, we focus on those companies with an RSI hovering near or below the critical 30 threshold.

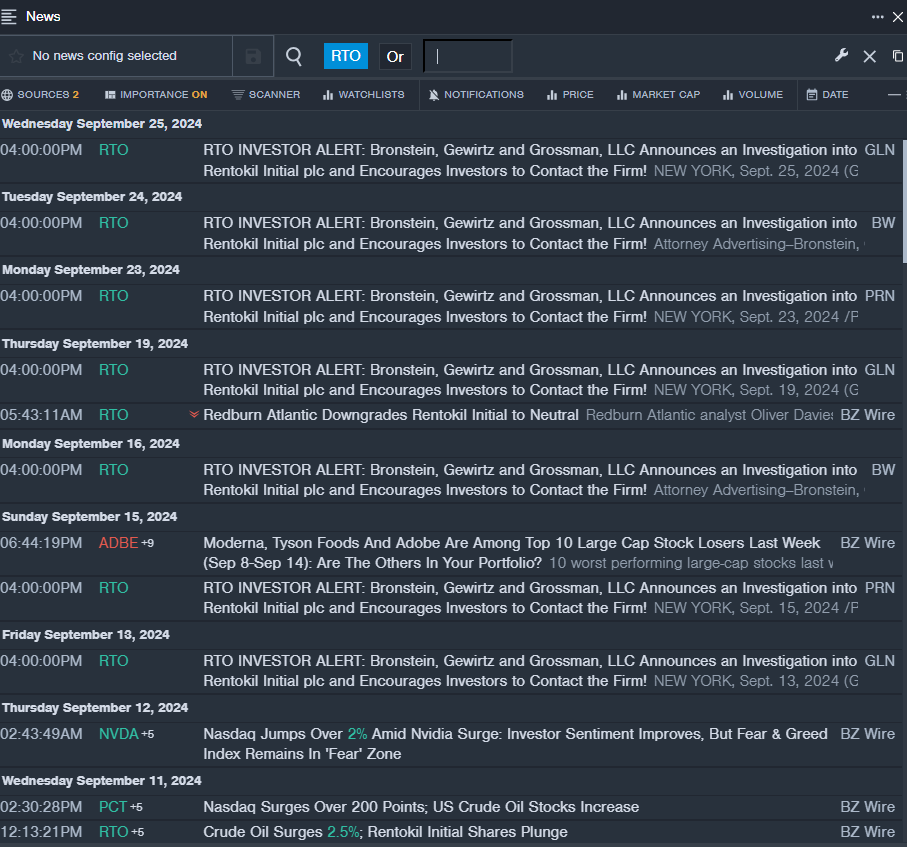

The Story of Rentokil Initial plc (RTO)

- Rentokil Initial plc recently adjusted its guidance for the second half of FY24, foreseeing organic revenue growth for its North America operations to hover around 1%. The company anticipates that operating profit will be impacted by escalating sales, service, and associated costs. Over the past month, Rentokil Initial’s stock took a notable hit, plummeting approximately 25% and reaching a 52-week low of $23.39.

- RSI Value: 29.83

- RTO Price Action: Rentokil Initial’s shares experienced a 0.6% drop, concluding at $23.55 at the end of Tuesday’s trading session.

- Market intelligence from Benzinga Pro brought the latest developments concerning Rentokil Initial plc to light.

In the Nest of Blue Bird Corp (BLBD)

- Blue Bird Corp faced a recent downgrade from Buy to Neutral by Roth MKM analyst Craig Irwin on October 3, maintaining the price target of $48. In the last five days, the company witnessed a 10% decline in its stock price, with a 52-week low of $17.60.

- RSI Value: 27.62

- BLBD Price Action: Blue Bird’s shares saw a 1.8% decrease, settling at $41.28 at the close of Tuesday’s trading.

- Insights from Benzinga Pro’s charting tool provided essential data on the trend in Blue Bird Corp stock.

The Journey of Concentrix Corp (CNXC)

- Concentrix Corp embarked on a new chapter on October 3 when Baird analyst David Koning initiated coverage with an Outperform rating and unveiled a price target of $70. The company’s shares experienced a significant 32% decline over the past month, reaching a 52-week low of $48.71.

- RSI Value: 17.33

- CNXC Price Action: Concentrix registered a 5.6% drop, finishing at $48.74 at the conclusion of Tuesday’s trading session.

- Through Benzinga Pro’s signals feature, investors received notifications of a potential breakout in Concentrix Corp shares.

Read More:

Market News and Data brought to you by Benzinga APIs