Plunging into the realm of materials stocks can liken you to a treasure hunter, poised to unearth hidden gems amongst the rubble of the market downturn.

One noteworthy metric in identifying undervalued gems is the Relative Strength Index (RSI), a magnetic lodestar guiding traders through the choppy waters of market fluctuations. When RSI values hover at or below 30, a shimmering beacon of opportunity may beckon savvy investors to seize the moment.

Diving into the latest roll call of materials players teetering on the edge of oversold territories can provide a sighting of potential stars amidst the dimming lights of the market.

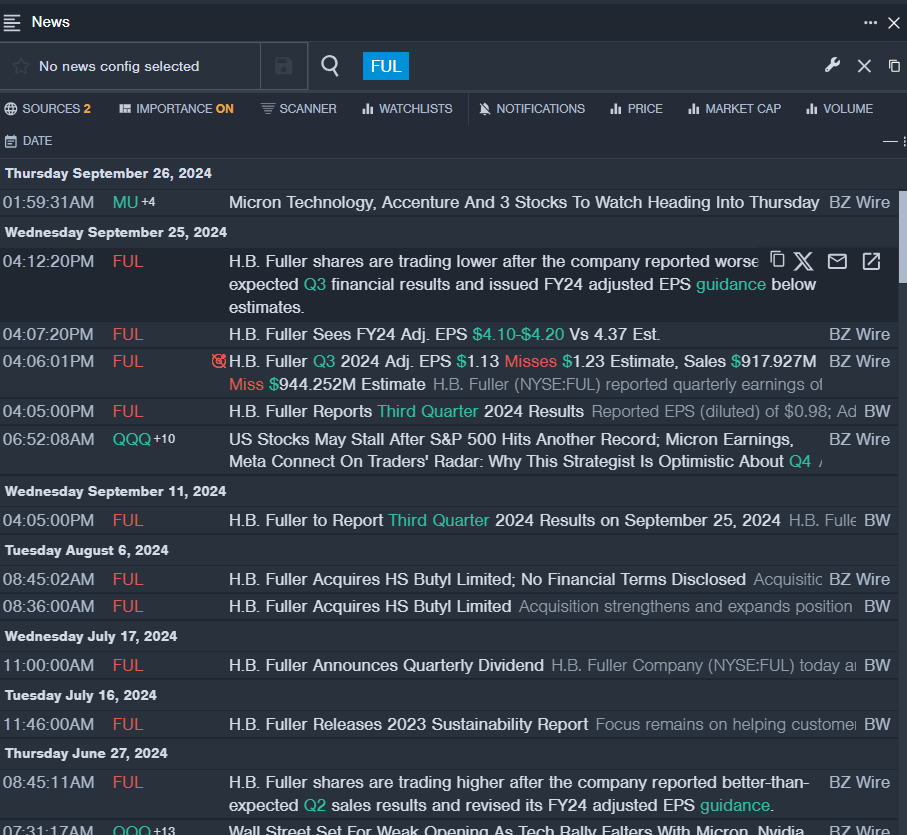

H.B. Fuller Company FUL

- Braving headwinds, H.B. Fuller saw its stock stumble post worse-than-expected third-quarter financial results, dimming the outlook for the company. The President and CEO, Celeste Mastin, noted the strategic advancements despite the setback, underscoring resilience in the face of adversity. With a current RSI of 28.45, the stock drifts close to the 52-week low of $64.64.

- RSI Value: 28.45

- FUL Price Action: Witnessing a 1.8% descent in share price to $80.63 at the close of Wednesday’s trading session, H.B. Fuller navigates stormy seas as investors gauge the company’s future trajectory.

Clearwater Paper Corp CLW

- Clearwater Paper faced turbulence following quarterly losses of $1.55 per share, driving the stock down by 15% over the past month. Amidst the gloom, Arsen Kitch, the company’s president and CEO, struck a note of optimism regarding the acquisition integration and outlook for the paperboard market. With an RSI of 28.90, the stock lingers near its 52-week low of $27.69.

- RSI Value: 28.90

- CLW Price Action: As shares tumbled by 4.7% to $28.40, Clearwater Paper grapples with challenges while charting a path towards recovery in a volatile market terrain.

Bioceres Crop Solutions Corp BIOX

- Bioceres faced a setback with worse-than-expected fourth-quarter sales results, triggering a 22% drop in share value over the past month. Despite the daunting fiscal landscape, Mr. Federico Trucco, the CEO, accentuated resilience in achieving record-high financial performance amidst agricultural headwinds. With an RSI of 21.88, the stock hovers near the 52-week low of $7.74.

- RSI Value: 21.88

- BIOX Price Action: Experiencing a 3.3% decline to $7.85 in Wednesday’s trading, Bioceres Crop Solutions weather the storm with investors eyeing signals of a potential resurgence.

Market News and Data brought to you by Benzinga APIs