Exploring Undervalued Gems in the Stock Market

Amidst the tumult of the stock market lies a glimmer of hope for investors eyeing undervalued opportunities.

One metric that traders often rely on is the Relative Strength Index (RSI), a barometer of a stock’s momentum and potential. When the RSI dips below 30, a stock is typically considered oversold, presenting a possible buying opportunity.

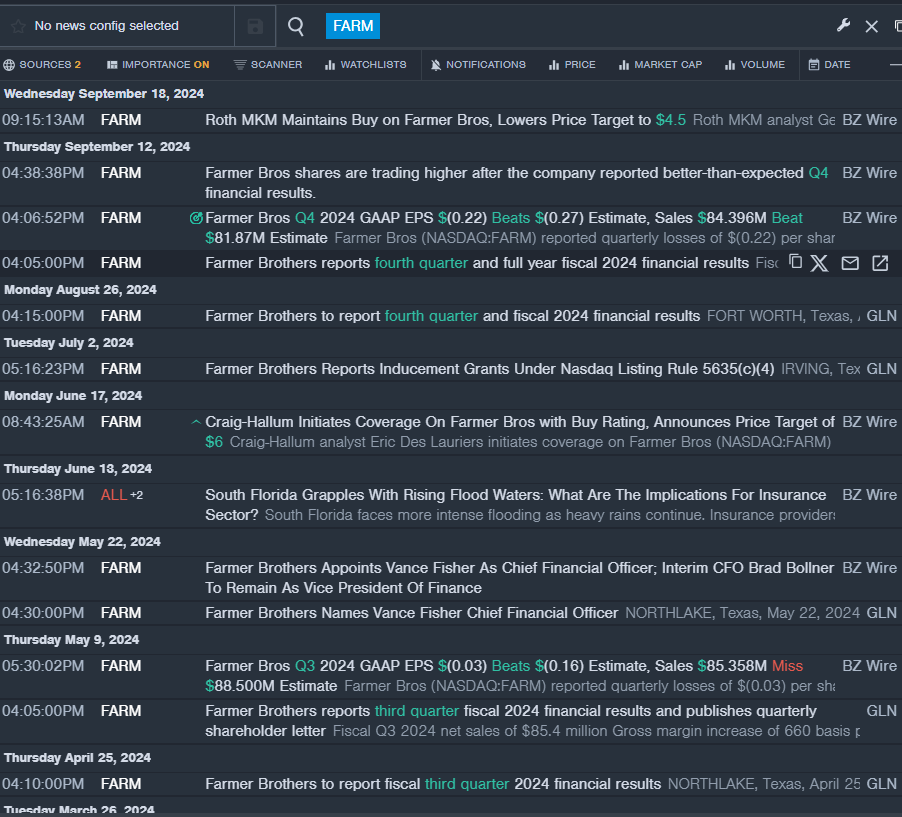

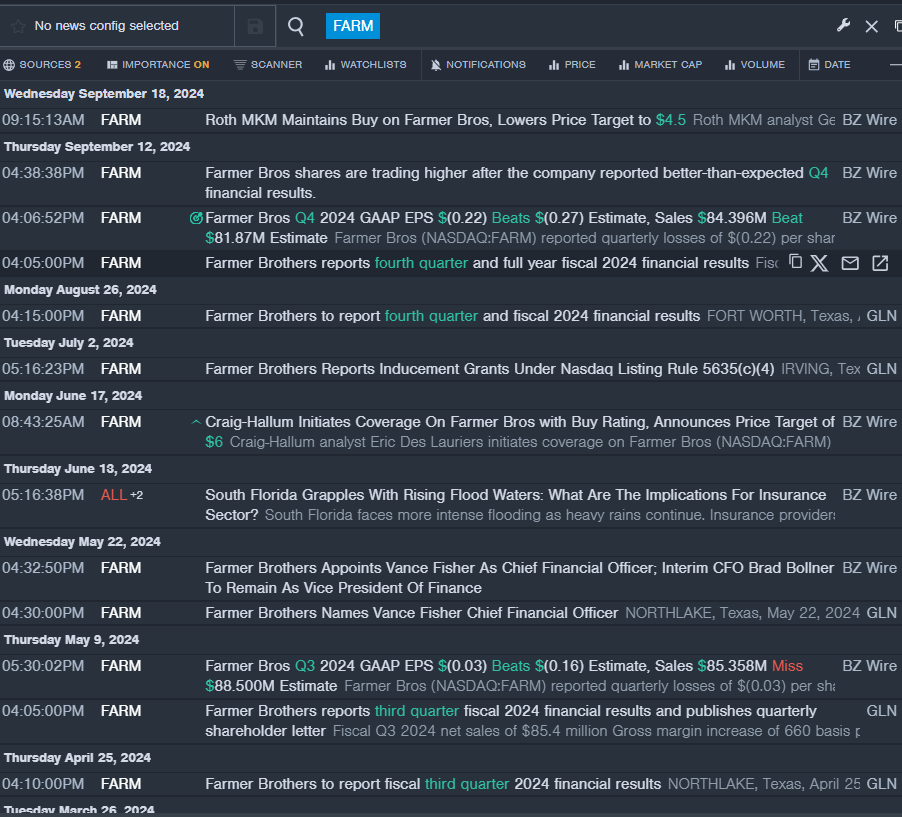

An Awakening in Farmer Bros Co – FARM

- Farmer Bros Co recently surprised investors with better-than-expected financial results, marking a turning point for the company. Despite this positive development, its stock plummeted by 30% over the past month, reaching a 52-week low of $1.85.

- RSI Value: 27.27

- FARM Price Action: Thursday saw a 2.1% decline in Farmer Bros Co shares, closing at $1.89.

- Market insights from Benzinga Pro served as a guiding light during this turbulent period for FARM.

British American Tobacco PLC – BTI

- British American Tobacco faced headwinds with a decrease in adjusted EPS for H1, causing a 6% drop in its stock over five days. With a 52-week low of $28.25, investors are closely monitoring this industry giant.

- RSI Value: 24.49

- BTI Price Action: Thursday witnessed a 2.4% decline in British American Tobacco shares, closing at $35.11.

- The analytical prowess of Benzinga Pro’s tools highlighted crucial trends impacting BTI’s stock.

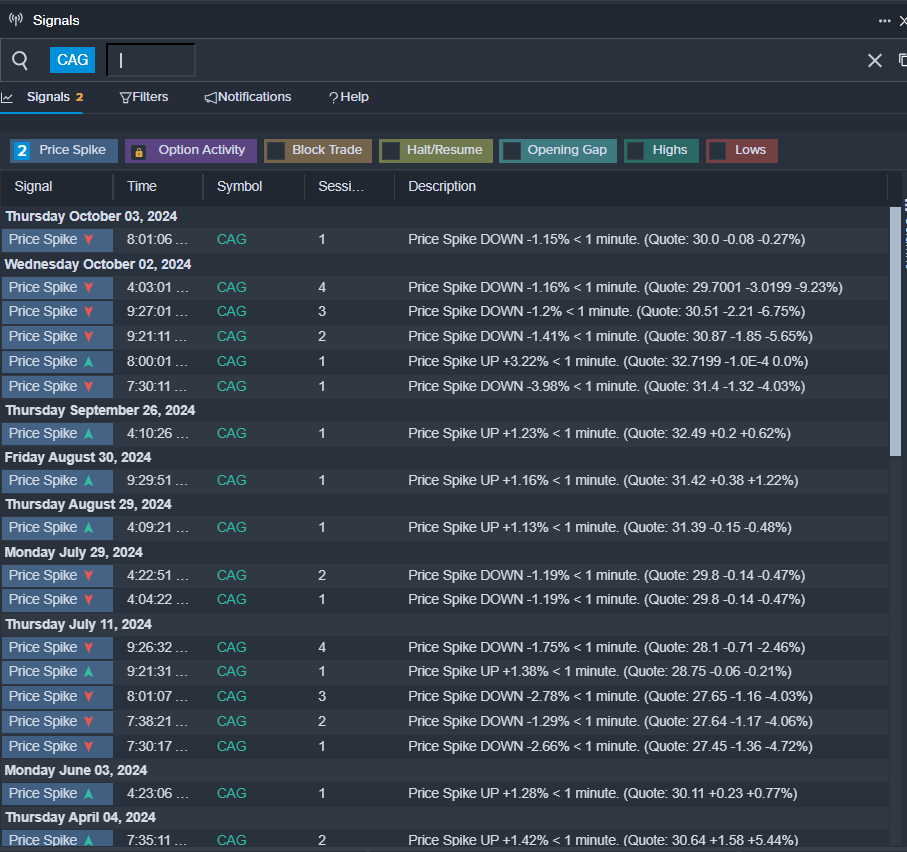

Conagra Brands Inc – CAG

- Conagra Brands faced a setback with first-quarter results missing expectations. Despite reaffirming guidance for fiscal 2025, the stock tumbled by 10% over five days, hitting a 52-week low of $25.16.

- RSI Value: 25.52

- CAG Price Action: Thursday’s trading session ended with a 2.4% dip in Conagra Brands shares, closing at $29.35.

- Benzinga Pro’s signals pointed towards a potential turning point for CAG, sparking interest among astute investors.

Unlocking Hidden Value:

Market News and Data brought to you by Benzinga APIs