Seize the moment in the communication services sector as the most oversold stocks shine a light on undervalued gems ready to be unearthed.

Identifying the Relative Strength Index (RSI) as a momentum gauge, discerning traders keep a keen eye on how a stock’s strength on positive versus negative days may reflect on its short-term performance. When the RSI dips below 30, it signals a potential buying opportunity, a chance to grab stocks at bargain prices.

The Undervalued Contenders:

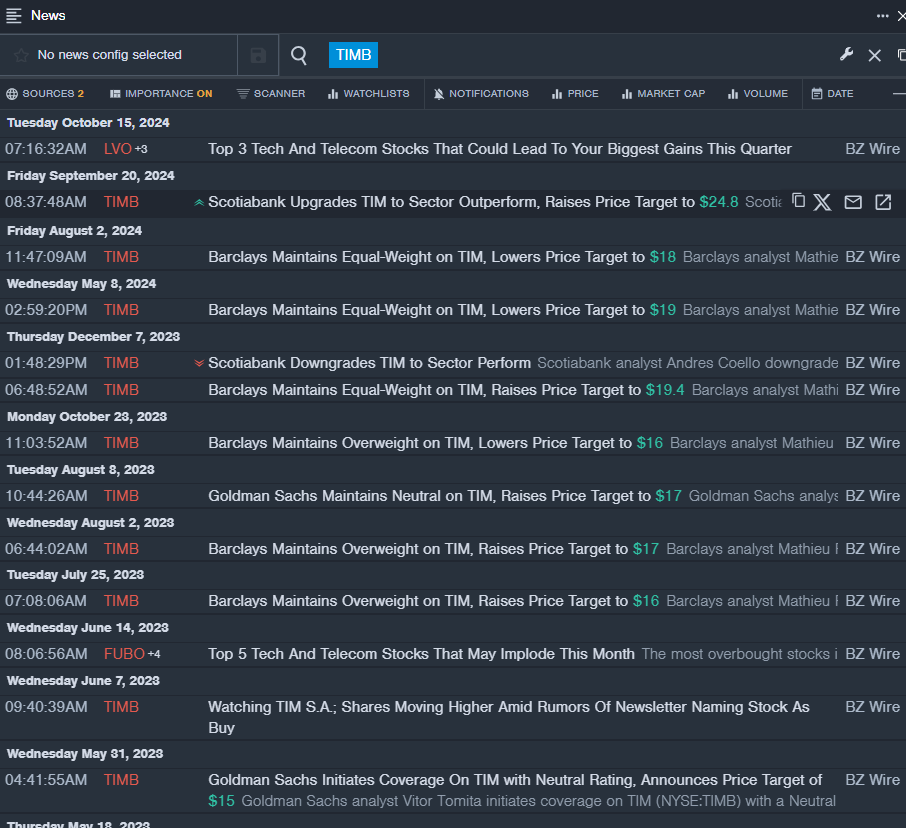

Tim SA TIMB

- Recently, Scotiabank analyst Andres Coello upgraded TIM from Sector Perform to Sector Outperform, setting a new price target of $24.8, up from $17.5. The stock, which has seen a 10% decline over the past month, is flirting with a 52-week low of $13.84.

- RSI Value: 29.36

- TIM Price Action: Tim shares inched up 0.1% to close at $15.21 on the latest trading day.

LiveOne Inc LVO

- In a strategic move, LiveOne recently extended its partnership with Tesla TSLA till May 2026, envisioning positive outcomes. Despite a significant pullback of around 55% in the last month, the stock holds a 52-week low at $0.60.

- RSI Value: 23.74

- LVO Price Action: LiveOne shares retreated by 7.4% to close at $0.66 in the latest trading session.

Trivago NV – ADR TRVG

- Trivago displayed a strong performance in their quarterly results posted on July 30, surpassing expectations. Despite a recent dip of approximately 7%, the stock maintains a 52-week low at $1.61.

- RSI Value: 27.82

- TRVG Price Action: Trivago’s shares saw a slight decline of 0.6%, closing at $1.69 in the most recent trading day.