The communication services sector is currently showing promising signs for investors, with oversold stocks offering a chance to capitalize on undervalued companies.

One indicator gaining attention is the Relative Strength Index (RSI), a momentum indicator used to assess a stock’s performance based on price movements. An RSI below 30 is often seen as a signal of oversold conditions, indicating potential buying opportunities. This metric, when combined with price action analysis, provides valuable insights for short-term trading strategies.

Let’s delve into three key players in this sector that are currently experiencing oversold conditions, making them worth watching closely:

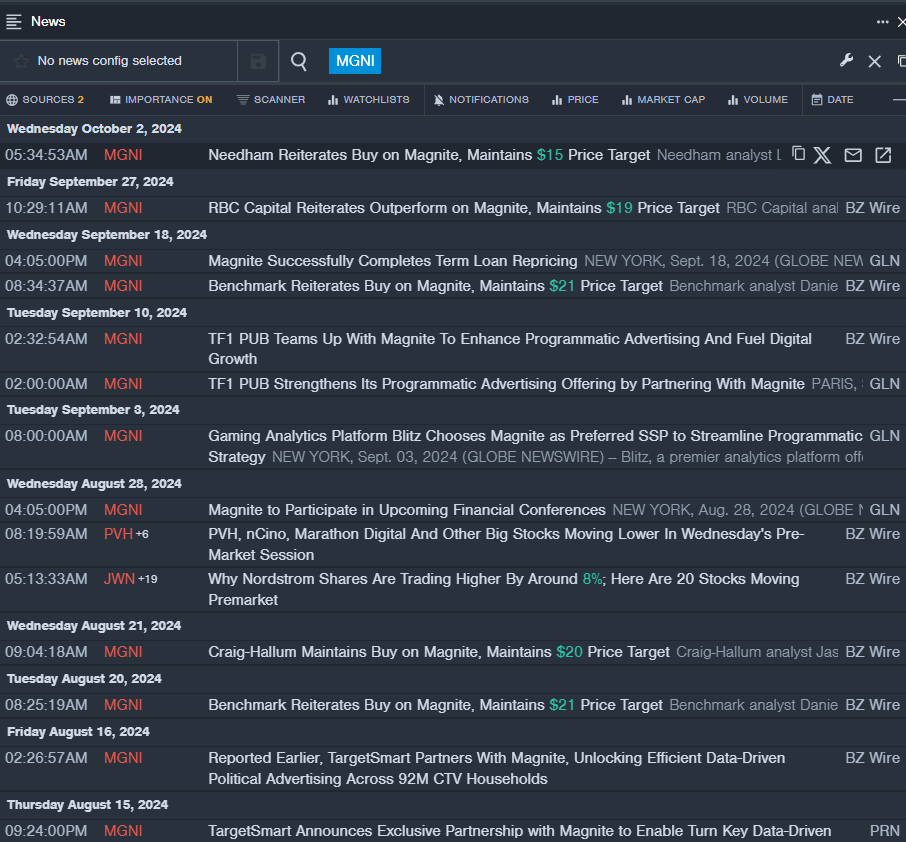

Exploring Magnite Inc’s Potential

- Analyst Laura Martin’s recent endorsement of Magnite Inc with a Buy rating and a $15 price target on October 2 has sparked interest among investors. Despite a recent 8% decline in stock value and hitting a 52-week low of $6.28, Magnite’s RSI stands at 29.99, suggesting oversold territory.

- RSI Value: 29.99

- MGNI Price Action: The stock closed at $12.36 on Tuesday, reflecting a 10.8% decrease in value.

- Real-time updates from Benzinga Pro serve as a valuable resource for staying informed on Magnite’s latest developments.

Assessing Shutterstock Inc’s Position

- A recent disclosure from Shutterstock Inc regarding the departure of its Chief Product and Digital Officer, John Caine, has contributed to a 6% decline in the company’s stock value over the past five days. With an RSI of 28.00 and hitting a 52-week low of $32.38, Shutterstock is exhibiting oversold indications worth monitoring.

- RSI Value: 28.00

- SSTK Price Action: Closing at $32.81 on Tuesday, the stock experienced a 7.2% drop in value.

- Utilizing Benzinga Pro’s charting tool can offer valuable insights into the trend analysis of Shutterstock’s stock.

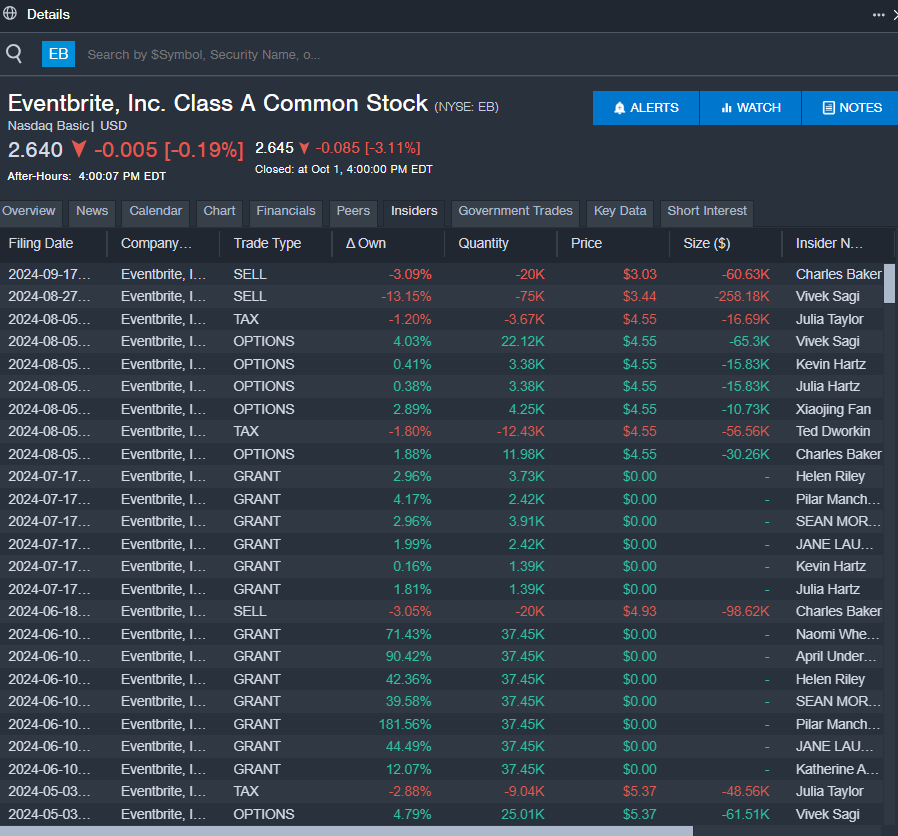

Reviewing Eventbrite Inc’s Performance

- An announcement by Eventbrite Inc on August 21 regarding repurchase transactions of its 5.00% Convertible Senior Notes has influenced a 14% decrease in the company’s stock value over the past month. With an RSI of 26.12 and a 52-week low of $2.51, Eventbrite is currently positioned in oversold territory.

- RSI Value: 26.12

- EB Price Action: Closing at $2.64 on Tuesday, the stock showed a 3.3% decline in value.

- Insights from Benzinga Pro’s insiders feature can aid in tracking insider trading activities related to Eventbrite’s shares.

Stay informed on potential opportunities in the market by closely monitoring these oversold tech and telecom stocks.