Embark on a journey through the world of undervalued tech stocks – a landscape where opportunities abound for those who dare to stake their claim.

The Undervalued Terrain

In the volatile information technology sector lies a treasure trove of stocks that are, as some might say, oversold – primed for the plucking by shrewd investors seeking hidden gems.

The Relative Strength Index (RSI), a momentum indicator, serves as a compass in these uncharted waters, guiding investors to stocks whose strength on the upswing may forecast potential gains. An RSI below 30 often heralds a stock as oversold, signaling a possible bargain to savvy traders.

Endava PLC – ADR (DAVA)

- Endava PLC – ADR, a prominent figure in the IT landscape, recently weathered a season of challenges as revealed in its weaker-than-expected quarterly sales report. Despite a 4.5% decline in revenue, the company’s CEO, John Cotterell, remains hopeful, painting a picture of a resilient organization rebounding from adversity. Endava’s stock, down 23% in the past month, stands at a 52-week low of $23.50.

- RSI Value: 25.95

- DAVA Price Action: Shares dipped 3.8% to close at $23.59 on a recent trading day.

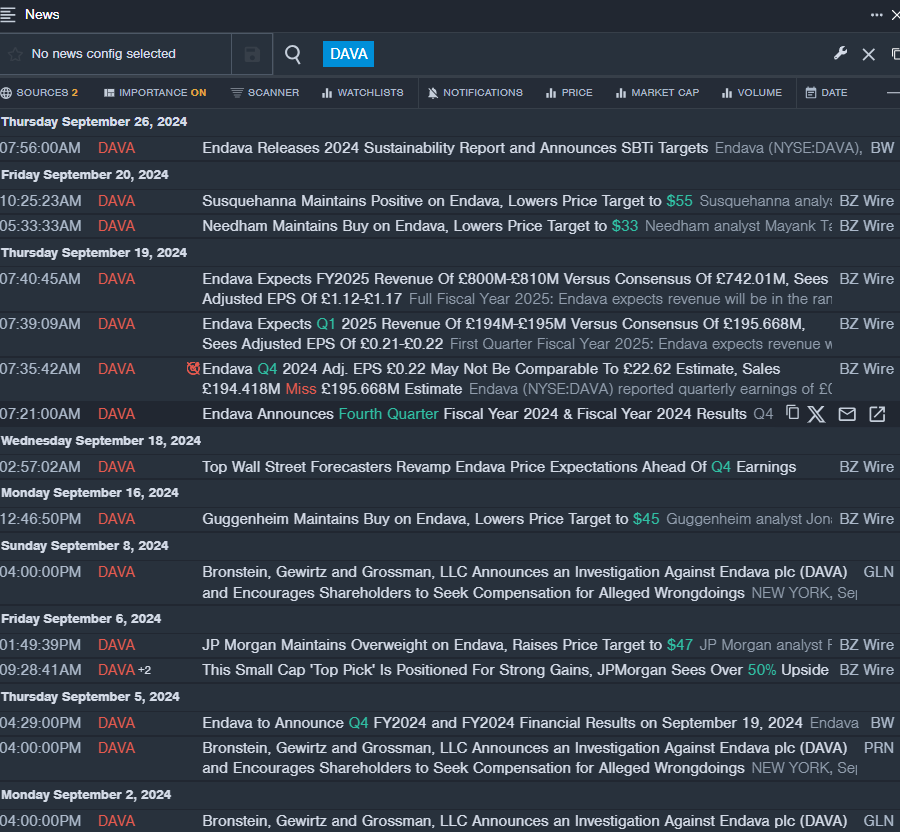

- A watchful eye on Benzinga Pro’s real-time newsfeed offers keen investors a window into the latest developments surrounding DAVA.

Verint Systems Inc. (VRNT)

- Verint Systems Inc., another stalwart in the tech realm, experienced a 9% slump in its stock value over the previous month. Despite this setback, Wedbush analyst Daniel Ives maintained an Outperform rating on the company, signaling confidence in its potential. With a 52-week low at $18.41, VRNT remains poised for a possible upswing in the market.

- RSI Value: 25.50

- VRNT Price Action: Verint shares closed lower by 1.6% at $23.60 in a recent trading session.

- The insights provided by Benzinga Pro’s charting tool unveil trends that may guide investors in navigating the turbulent waters surrounding VRNT.

CoreCard Corp (CCRD)

- CoreCard Corp revealed a brighter side of the story with better-than-expected quarterly earnings, garnering praise from its CEO, Leland Strange. The company continues to attract new customers with its innovative offerings, notwithstanding an 11% drop in share value over the past month. Positioned at a 52-week low of $10.02, CCRD remains one to watch in the tech stock arena.

- RSI Value: 28.61

- CCRD Price Action: CoreCard shares closed at $12.94, down by 2.5% in a recent trading session, showcasing its resilience amid market fluctuations.

- Benzinga Pro’s signals provide timely notifications to investors, giving them a strategic advantage in navigating the ebbs and flows of CCRD shares.

Read Next: