Unlocking Opportunities in the Tech Sector

Within the tumultuous realm of information technology, a glimmer of hope shines for astute investors willing to dive into the stocks that have been excessively beaten down. The Relative Strength Index (RSI), a crucial metric gauging momentum, beckons the discerning trader to explore undervalued treasures lurking amidst the din of volatility.

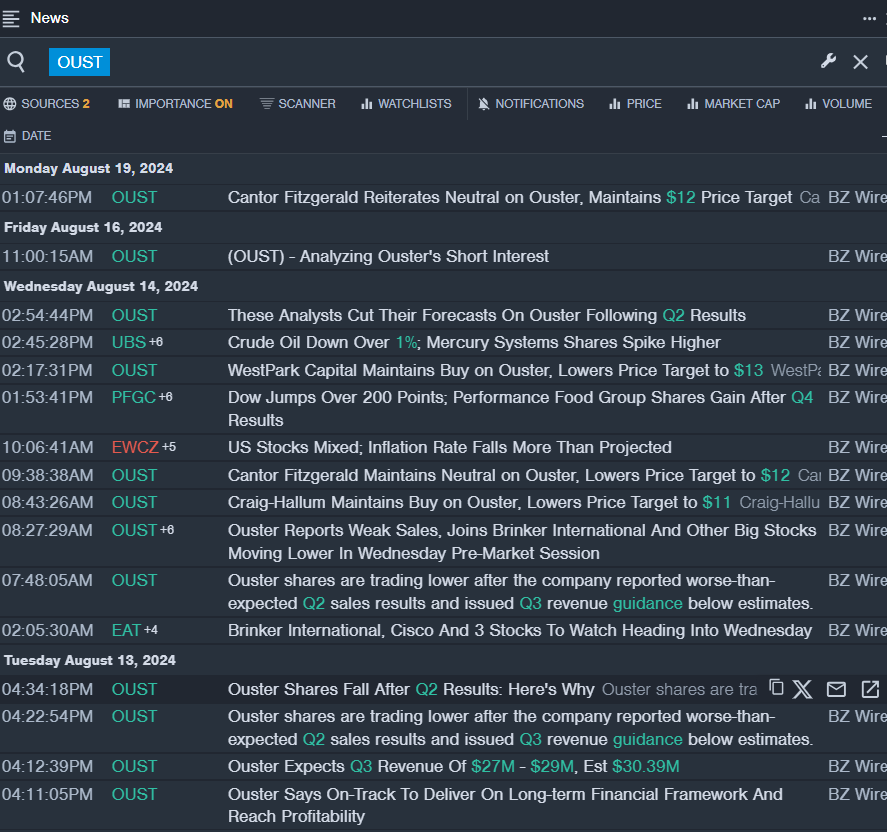

The Underdogs: Ouster Inc

A recent casualty of market turmoil, Ouster Inc stands undeterred despite a staggering 45% decline over the past month, plunging to a 52-week low of $3.67. A bold move from CEO Angus Pacala emphasized their strategic shift towards software solutions, a move that offers a glimmer of hope. With an RSI value at 28.96, the stock’s recent close at $7.85 on Monday invites both caution and curiosity.

Weathering the Storm: Smith Micro Software Inc

Smith Micro Software Inc finds itself battling through a tempestuous sea with a whopping 64% drop in stock value over the last month, touching a 52-week low of $0.77. Despite the gloom, the company’s visionary, William W. Smith Jr., exudes confidence in their ventures. The RSI value scraping at 19.79 paints a picture of extreme pessimism as the stock settled at $0.81 on the last trading day.

Riding the Rollercoaster: 8×8 Inc

Seeking refuge from the turbulence, 8×8 Inc grapples with a tumultuous 44% freefall in share prices in the past month, stooping to a 52-week low of $1.52. As the RSI value lingers at 29.48, a flicker of optimism surfaced as the stock managed to eke out a 2.4% gain to close at $1.73. A potential glimmer of light in an otherwise shadowy scenario.

Amidst the chaos, these tech stocks paint a compelling narrative of resilience cloaked in despair. As investors navigate the treacherous waters of the market, these underdogs present a unique chance for redemption. With due diligence and strategic foresight, could these be the unsung heroes poised to rescue a beleaguered portfolio in the coming quarter?