The Enigmatic Nature of Oversold Stocks

In the realm of information technology, oversold stocks beckon with propositions of untapped value, inviting astute investors to seize the moment and delve into companies that are currently undervalued.

The Relative Strength Index (RSI) functions as a compass in this landscape, juxtaposing a stock’s strength on positive versus negative days. When this metric dips below 30, a stock is typically deemed oversold, alluring opportunistic traders with promises of short-term resilience and growth.

For those seeking such opportunities, here is a curated selection of the most intriguing oversold players in the tech sector, boasting an RSI nearing or below the pivotal 30-mark.

The “eGain” Enigma

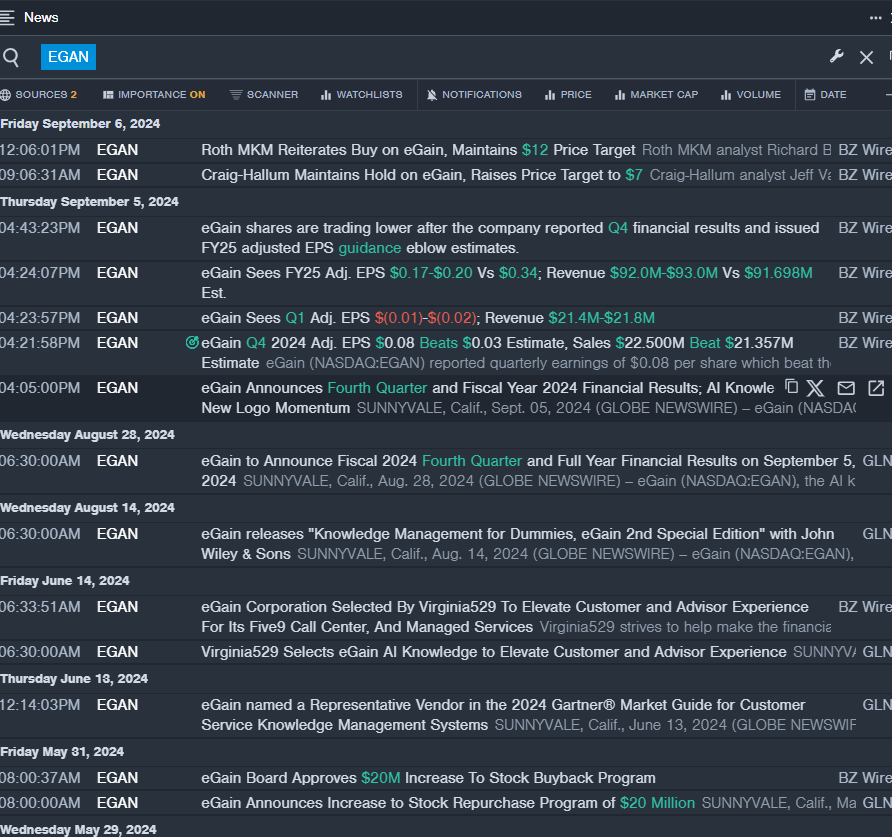

In the aftermath of eGain Corp’s fourth-quarter financial revelation on September 5, a tempest brewed in the market as FY25 adjusted EPS expectations fell short of estimations. CEO Ashu Roy reiterated the company’s commitment to the Gen AI paradigm, emphasizing the AI Knowledge Hub’s prowess in curating impeccable customer service experiences at reduced costs.

Subsequently, eGain’s stock floundered, plunging by approximately 26% over a five-day period, resonating with a somber tone as it recently brushed against its 52-week nadir at $4.81.

The lingering RSI value of 25.80 epitomizes this turmoil, underscoring the challenges faced by eGain. Despite this, the stock’s recent slight uptick to $4.90 on Wednesday provided a glimmer of hope amidst the overarching gloom.

“Five9” – The Tale of Resilience

On August 8, Five9 displayed a show of strength through its second-quarter results, surpassing revenue expectations with a commendable figure of $252.1 million. Chairman and CEO Mike Burkland hailed this achievement, heralding the company’s entrance into the billion-dollar revenue echelon fueled by a 21% year-over-year growth in LTM enterprise subscription revenue.

Despite its recent downward spiral, a 16% decline over the past month, Five9 stands firm with a 52-week floor at $26.60. The RSI value of 26.38 adds nuance to Five9’s tale of resilience, signaling a potential for resurgence. Closing at $27.33 on Wednesday, Five9 hinted at a possible upswing, sparking hope in investors eyeing a turn of fortunes.

“RingCentral” – The Symphony of Change

Amidst the winds of change, RingCentral Inc witnessed turbulence following CFO Sonalee Parekh’s resignation announcement on September 3. Founder and CEO Vlad Shmunis expressed gratitude for Parekh’s strategic contributions, particularly lauding enhancements in profitability and free cash flow under her watchful eye.

Ringing with echoes of a 12% downturn over the past month, RingCentral’s stock tapped into emotional depths, brushing against its 52-week low of $25.08. However, nestled at an RSI value of 29.93, there’s a whisper of optimism lingering around RingCentral. Closing at $28.00 on Wednesday, the stock charted a fragile path towards redemption, hinting at a potential revival in its fortunes.

Read More: