Seizing Opportunities in the Oversold IT Sector

The allure of undervalued stocks in the tech realm is like stumbling upon hidden treasures in a digital jungle.

One metric garnering attention is the Relative Strength Index (RSI), a tool that gauges a stock’s momentum, offering insights into its near-term performance based on price movement.

When the RSI dips below 30, it signals an oversold condition, presenting a possible buying opportunity.

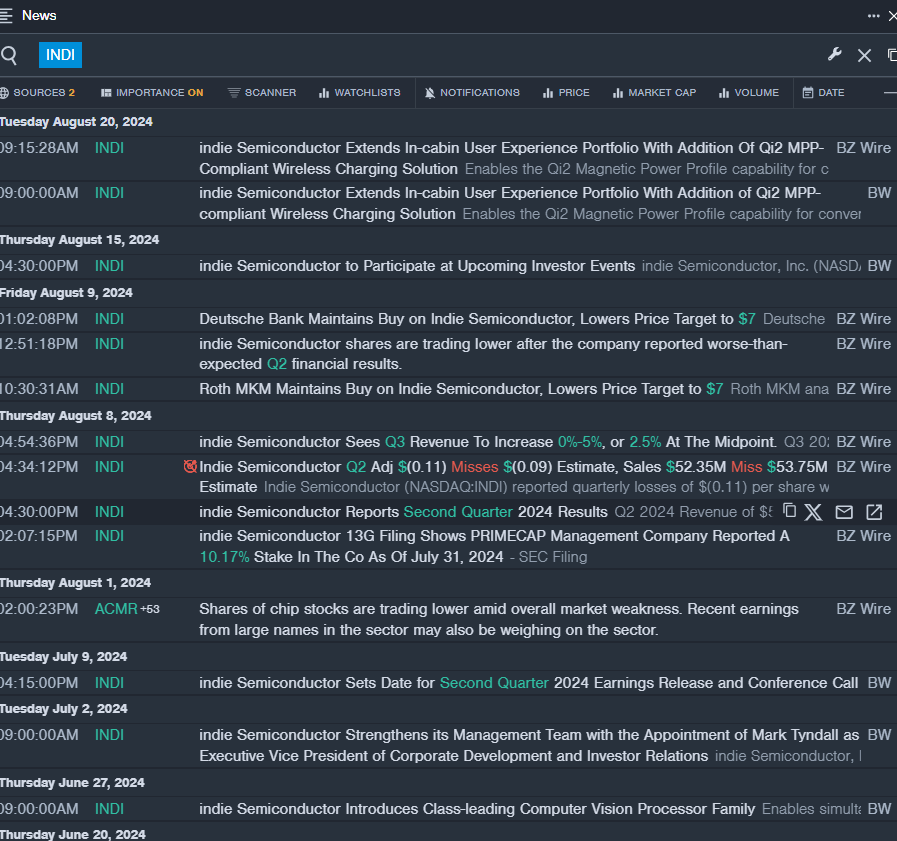

Exploring Indie Semiconductor Inc (INDI)

- Indie Semiconductor faced a setback with disappointing second-quarter financials, leading to a significant stock drop of approximately 37% over the past month, hitting a 52-week low of $3.79.

- RSI Value: 28.53

- INDI Price Action: Shares closed at $3.89 on Wednesday, reflecting a 5.6% decline.

The Journey of Ouster Inc (OUST)

- Ouster stumbled with below-par second-quarter sales figures and subdued third-quarter revenue projections, causing a plunge of about 46% in stock value over the last month, reaching a low of $3.67.

- RSI Value: 25.49

- OUST Price Action: Ouster shares finished at $7.24 on Wednesday, down 3.3%.

Navigating Super Micro Computer Inc (SMCI)

- A critical report by Hindenburg Research took a toll on Super Micro Computer, resulting in a 36% drop in stock value over the past month, touching a 52-week low of $226.59.

- RSI Value: 25.38

- SMCI Price Action: Super Micro Computer shares closed at $443.49 on Wednesday, marking a 19% fall.

These stocks present intriguing opportunities for vigilant investors to capitalize on potential rebounds from oversold conditions.