Unveiling Oversold Opportunities in the Energy Sector

Investors are always on the lookout for the next big thing in the stock market, searching for undervalued gems that may soon shine bright. The energy sector, known for its volatility, is currently presenting an intriguing opportunity with some of the most oversold stocks coming into focus.

Evaluating Companies with RSI Indicator

One popular metric frequently used by traders to gauge the short-term performance of a stock is the Relative Strength Index (RSI). Stocks with an RSI below 30 are often considered oversold, hinting at a potential rebound in the near future. Let’s delve into the latest list of major oversold players in the energy sector:

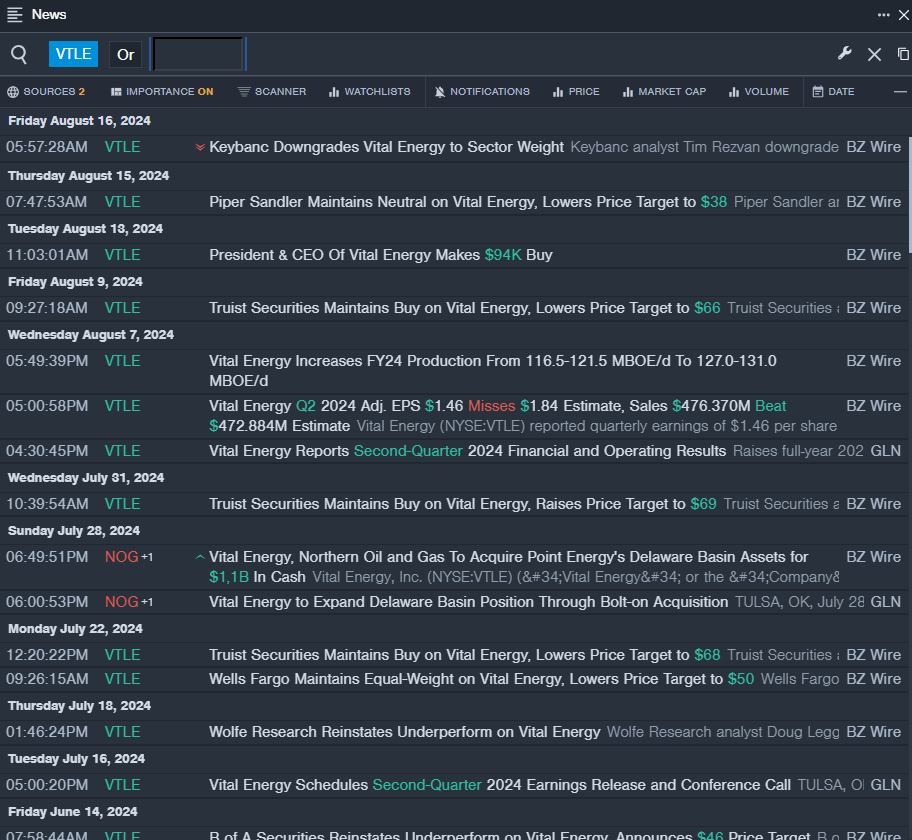

Vital Energy Inc – VTLE

- Despite posting downbeat quarterly earnings, Vital Energy Inc has shown resilience in its operational strategies. The stock’s recent fall of 16% and a 52-week low of $30.57 have attracted investor attention.

- RSI Value: 23.69

- VTLE Price Action: Closing at $30.57 on Thursday

Torm PLC – TRMD

- Torm PLC, backed by an Outperform rating, has seen a 10% decline in its stock value over the past month. With an RSI value of 29.27, the company is poised for a potential upturn.

- RSI Value: 29.27

- TRMD Price Action: Closing at $33.21 on Thursday

New Fortress Energy Inc – NFE

- Reporting disappointing second-quarter results, New Fortress Energy Inc faced a 29% decline in its shares in the past month. However, with an RSI value of 29.64, the company is showing signs of a turnaround.

- RSI Value: 29.64

- NFE Price Action: Closing at $11.61 on Thursday

Gulf Island Fabrication, Inc. – GIFI

- Despite a subpar second-quarter financial report, Gulf Island Fabrication remains optimistic about strategic objectives. With a 7% dip in share value over the past five days and a 52-week low of $3.13, the company’s potential for recovery is under scrutiny.

- RSI Value: 29.73

- GIFI Price Action: Closing at $5.54 on Thursday