Exploring Oversold Opportunities

During times of market turbulence, savvy investors sniff out opportunities like truffle-searching hogs. In the industrials sector, such opportunities lurk around stocks deemed oversold, waiting to be plucked like ripe fruit from a neglected garden.

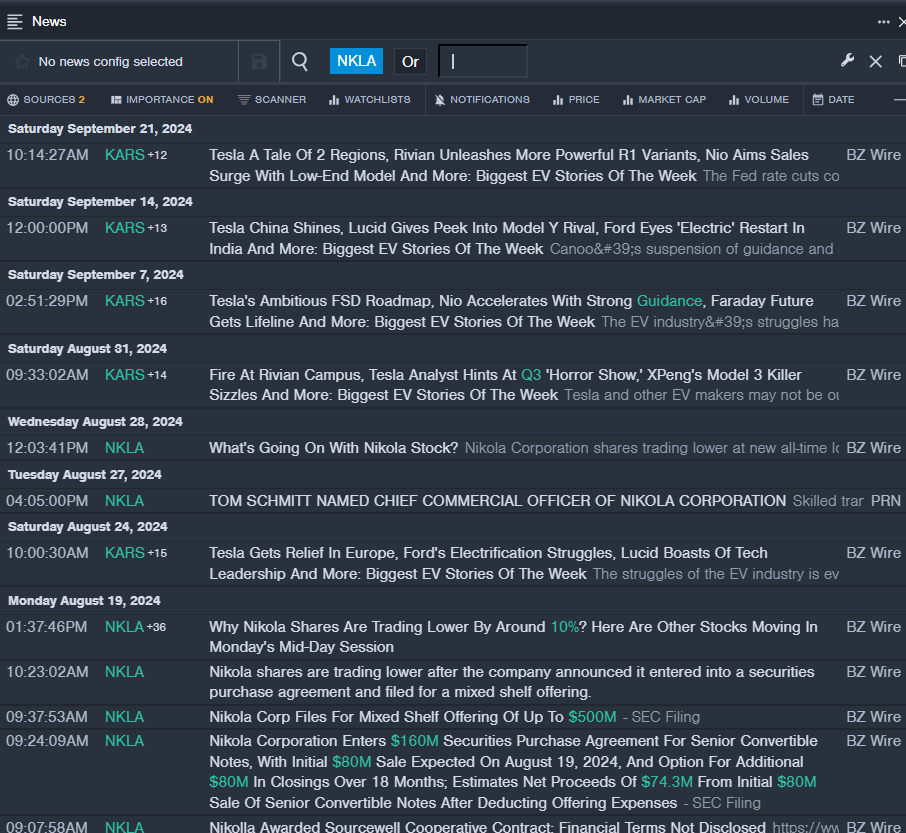

Nikola Corp – NKLA

- Nikola Corp startled the market birds on August 19 with a securities purchase agreement triumphantly at play. Yet, the stock plummeted around 35% in a month, with its 52-week low at a paltry $4.78. RSI Value: 26.27.

- NKLA faced a swan dive of 5% on Monday, closing at $4.78. Maybe the market is ignoring the seedling about to sprout?

SES AI Corp – SES

- SES AI flaunted a sparkling collaboration with NVIDIA, Crusoe, and Supermicro on September 17, diving into AI for scientific initiatives. The stock tumbled around 48% in five days, with a 52-week low of $0.66. RSI Value: 21.33.

- SES stumbled by 13.4% on Monday, closing at a mere $0.66. Can the AI wizardry turn the tide for this underappreciated gem?

Flyexclusive Inc – FLYX

- Flyexclusive Inc felt the turbulence on September 4 when Volato Group, Inc. SOAR decided to play musical chairs with fleet operations and passed the baton to flyExclusive. Shares dived around 41% in five days, grazing a 52-week low of $2.29. RSI Value: 18.61.

- Flyexclusive nosedived by 33.6% on Monday, closing at $2.29. Is this an opportunity to catch a falling star?

Jet.AI Inc – JTAI

- Jet.AI made waves on August 19 by revealing Executive Chairman and Interim CEO Michael Winston’s daring exchange of Merger Consideration Warrants for Common Stock Shares. The stock tumbled around 45% in a month, with a 52-week low of $0.10. RSI Value: 24.74.

- JTAI slid by 4.5% on Monday, closing at a whisper-thin $0.11. Can this phoenix rise from its ashes?

During these tumultuous times, don’t shy away from the red in the ledger. The market is a fickle beast, and what is discarded today may turn into a diamond tomorrow. Keep a close eye on these industrials stocks and be ready to pounce when others are fearful.