A Window of Opportunity in the Materials Sector

Amidst lingering bearish sentiments, the materials sector unveils a silver lining for shrewd investors as oversold stocks signal a potential rebound for undervalued companies.

One key metric in the spotlight is the Relative Strength Index (RSI), which gauges a stock’s momentum by comparing its strength on up days versus down days. A stock is deemed oversold when its RSI drops below 30, indicating a potential buying opportunity.

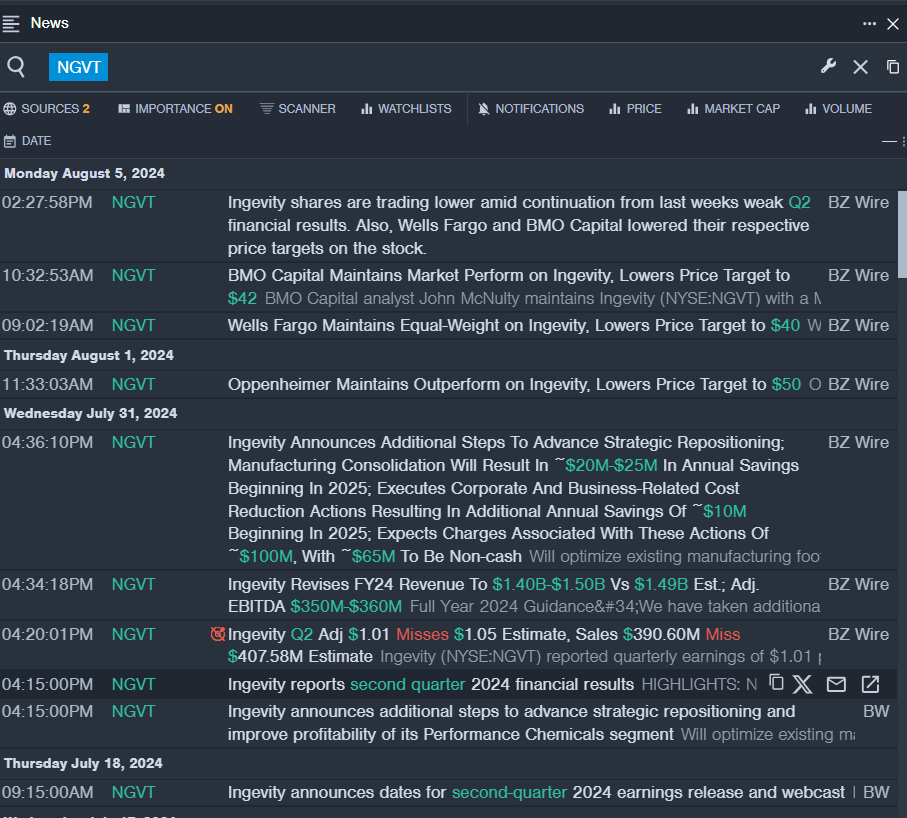

Ingevity Corp NGVT

- After disappointing quarterly results on July 31, Ingevity Corp faces turbulent times, witnessing a 22% decline in stock value over the past week, establishing a new low at $34.37.

- RSI Value: 18.64

- NGVT Price Action: Marking a sharp 14.1% drop, Ingevity’s shares closed at $35.41 on Monday.

Posco Holdings Inc PKX

- Trailing closely behind is Posco Holdings Inc, noting a 10% decline in stock value over the past five days, hitting a 52-week low of $58.00.

- RSI Value: 19.33

- PKX Price Action: With a 9.2% dip, Posco’s shares settled at $58.66 on Monday.

MP Materials Corp MP

- Experiencing a challenging quarter with a 21% dip in share value following disappointing Q2 financial results, MP Materials Corp faces headwinds, plummenting to a 52-week low of $10.02.

- RSI Value: 20.10

- MP Price Action: Closing at $10.52 on Monday after a 5.8% fall, the road to recovery seems steep for MP Materials.

Stepan Co SCL

- Joining the list of underperformers is Stepan Co, grappling with worse-than-expected Q2 results, witnessing an 18% downturn over the past week to $63.60, setting a new low.

- RSI Value: 19.84

- SCL Price Action: Retreating by 6.5%, Stepan’s shares settled at $73.00 on Monday, signaling stormy weather ahead.