The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

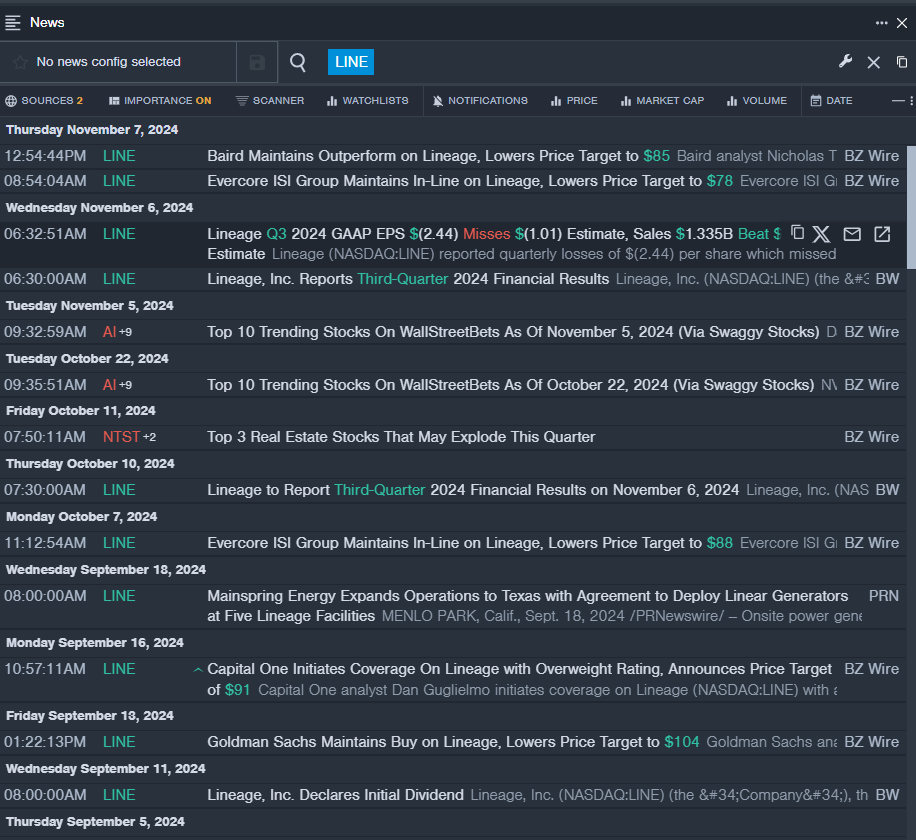

Lineage Inc LINE

- On Nov. 6, Lineage reported a quarterly loss of $2.44 per share which missed the analyst consensus estimate of a loss of $1.01 per share. The company reported quarterly sales of $1.335 billion which beat the analyst consensus estimate of $1.329 billion by 0.44 percent. The company’s stock fell around 11% over the past month and has a 52-week low of $66.94.

- RSI Value: 22.05

- LINE Price Action: Shares of Lineage fell 1.1% to close at $67.32 on Friday.

- Benzinga Pro’s real-time newsfeed alerted to latest LINE news.

Americold Realty Trust Inc COLD

- On Nov, 7, Americold Realty Trust reported worse-than-expected third-quarter financial results. George Chappelle, Chief Executive Officer of Americold Realty Trust, stated, “We are pleased with our third quarter results where we delivered AFFO per share of $0.35, an increase of 11% versus prior year’s quarter. This performance was again driven by organic growth as we produced double digit year-over-year growth in the Global Warehouse Same Store NOI of approximately 11% on a constant currency basis.” The company’s stock fell around 15% over the past month and has a 52-week low of $21.87.

- RSI Value: 18.80

- COLD Price Action: Shares of Americold Realty Trust fell 1.8% to close at $22.76 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in COLD stock.

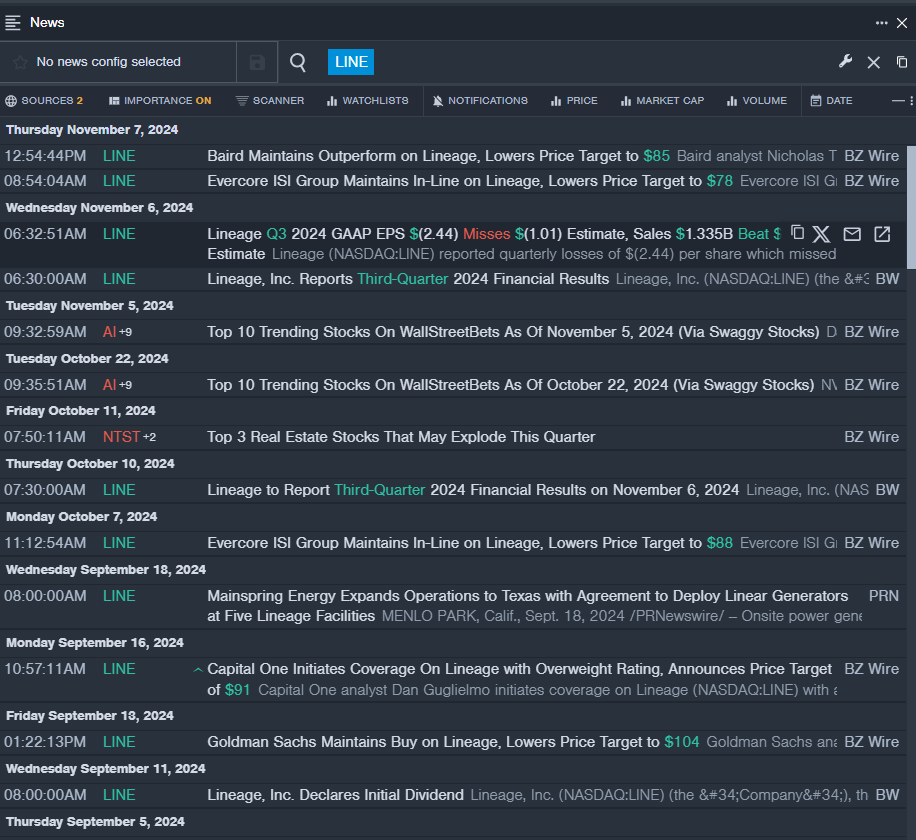

Diversified Healthcare Trust DHC

- On Nov. 4, Diversified Healthcare Trust shares are trading lower after the company reported worse-than-expected third-quarter financial results. The company’s stock fell around 25% over the past five days and has a 52-week low of $1.94.

- RSI Value: 25.68

- DHC Price Action: Shares of Diversified Healthcare Trust fell 1.9% to close at $2.63 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in DHC shares.

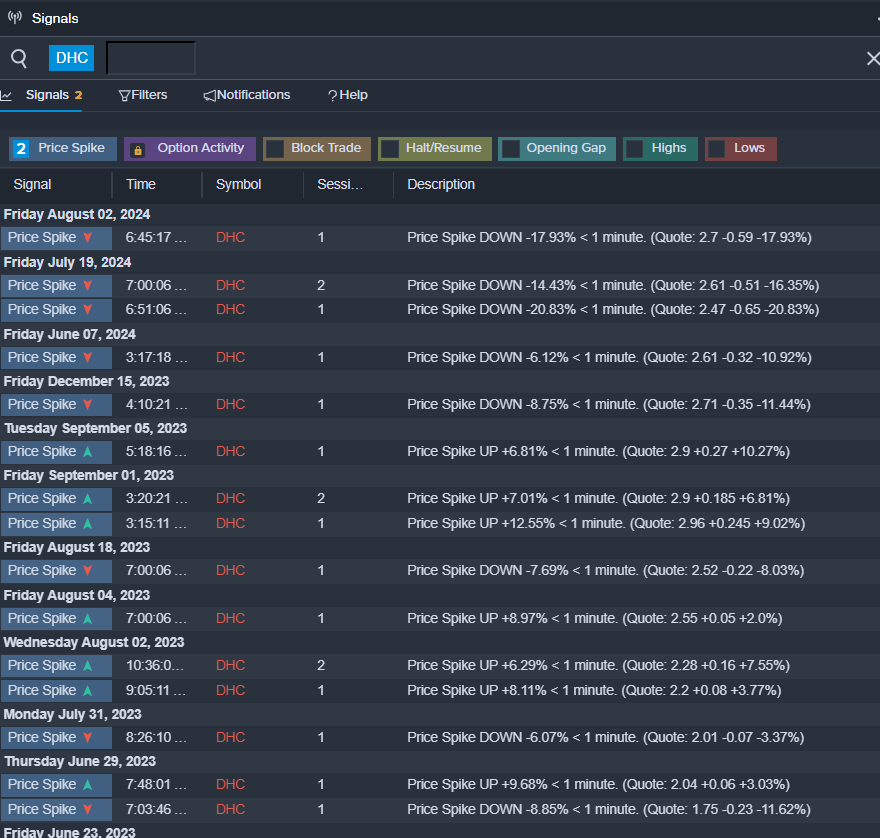

Innovative Industrial Properties Inc IIPR

- On Nov. 6, Innovative Industrial Properties reported worse-than-expected third-quarter financial results. The company’s shares lost around 16% over the past five days. The company’s 52-week low is $73.04.

- RSI Value: 20.87

- IIPR Price Action: Shares of IIPR fell 3.4% to close at $106.37 on Friday.

- Benzinga Pro’s earnings calendar was used to track upcoming IIPR earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs