The Unsteady Climate in January

January was a turbulent month for Wall Street, as uncertainty around Fed rate cuts marred the first half. However, the release of strong economic data and declining inflation turned the tides in the second half. Despite this positivity, the month ended on a sharp decline after the Fed dispelled hopes of an imminent rate cut in March.

Momentum Likely to Continue

The U.S. economy defied expectations with growth at 3.3% in the fourth quarter of 2023, well above the consensus estimate of 2%. The steady decline in inflation was another boost, with the PCE price index indicating a significant drop compared to the previous year. Additionally, personal spending and consumer confidence showed remarkable growth, pointing toward a positive trajectory for the U.S. economy.

Promising Selections for Investors

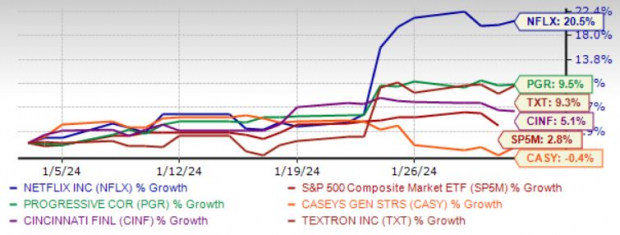

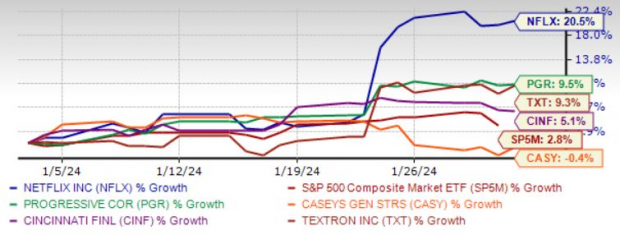

Amid the current climate, it’s wise to focus on momentum stocks, particularly those with large market capitalization. Five companies have stood out as top picks due to their strong potential for 2024. Each has a Zacks Rank #1 (Strong Buy) and a Momentum Score of A or B.

Image Source: Zacks Investment Research

The Stars of the Show

Netflix Inc. has seen a rise in paid subscribers and a steady increase in average revenue per subscription, setting the stage for continued dominance in the streaming industry. The company is expected to maintain its control over the market, backed by heavy investments in localized and foreign-language content. With an expected earnings growth rate of 40.7% for the current year, Netflix is displaying robust performance.

The Progressive Corp. continues to thrive on higher premiums, driven by its strong product portfolio and leadership position in the insurance sector. The company’s focus on providing a range of insurance products, including home and auto coverage, is expected to sustain its growth momentum. With an expected revenue growth rate of 12.6% for the current year, The Progressive Corp. is well-positioned for success.

Casey’s General Stores Inc. has delivered impressive results, with significant growth in inside sales and same-store sales. The company’s strategies in price and product optimization, along with digital engagement, are bolstering its position in the industry. Casey’s General Stores is expected to see a 7.4% increase in earnings for the current year, indicating a promising outlook for investors.

Cincinnati Financial Corp. has maintained a disciplined approach in expanding its business, particularly through Cincinnati Re, which has contributed significantly to the company’s earnings. With a focus on agent-driven growth and an emphasis on new business development, Cincinnati Financial Corp. aims to achieve long-term premium growth.

Analyst Insights: Textron Inc. and Cincinnati Financial Show Robust Growth

Tough Competition but Impressive Growth for Cincinnati Financial

Despite stiff competition, Cincinnati Financial (CINF) is set to witness an 8% growth in property-casualty premium in 2023. The company prides itself on a business model that focuses on agents, which is expected to contribute to long-term premium growth.

CINF’s solid capital position supports effective capital deployment. Moreover, consistent cash flow and substantial cash balances continue to bolster the company’s liquidity.

The Zacks Consensus Estimate for current-year earnings has improved by 0.2% over the last 30 days, with expected revenue and earnings growth rates of 8% and 8.1% respectively.

Textron Inc.’s Diverse Offerings Contributing to Growth

Textron Inc. (TXT), a global multi-industry company, manufactures aircraft, automotive engine components, and industrial tools. It is renowned for its valuable brand names including Bell Helicopter, Cessna Aircraft Company, Jacobsen, Kautex, E-Z-GO, and Greenlee.

TXT offers solutions and services for aircraft, fastening systems, and industrial products, manufacturing products such as commercial and military helicopters, lightweight and mid-size business jets, plastic fuel tanks, automotive trim products, golf carts and utility vehicles, turf-care equipment, industrial pumps, and gears.

The company is expected to achieve a revenue growth rate of 6.8% and an earnings growth rate of 7.7% for the current year. The Zacks Consensus Estimate for current-year earnings has improved by 3.8% over the last seven days.