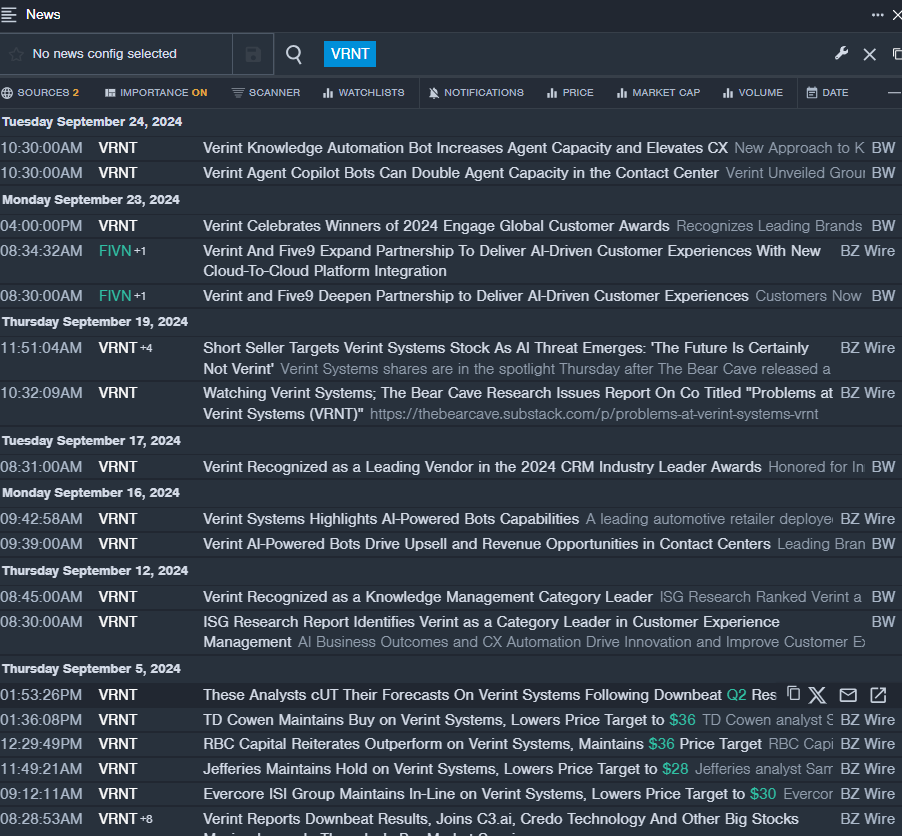

Verint Systems Inc. – VRNT

Investors on the lookout for opportunities amidst the turmoil of oversold stocks may find Verint Systems Inc. catching their eye. With a recent plunge of around 24% and an enticing RSI value of 26.27, VRNT offers a potential recovery play. CEO Dan Bodner’s optimism about the company’s AI momentum may be music to investors’ ears, especially with a 52-week low of $18.41.

Braze Inc – BRZE

For those seeking resilience in the face of recent dips, Braze Inc could be a beacon of hope. Despite a 29% fall in recent weeks, BRZE’s RSI value of 27.87 hints at possible upside. CEO Bill Magnuson’s upbeat remarks on the company’s Q2 performance and strong demand for the Braze Customer Engagement Platform provide a silver lining for investors eyeing a potential turnaround.

YXT.Com Group Holding Ltd – ADR – YXT

With an RSI value as low as 15.60, YXT.Com Group Holding Ltd may have hit rock bottom. The recent 59% fall and a 52-week low of $3.21 may seem daunting, but for contrarian investors, this could present an opportunity for a rebound. Keeping a close watch on signals suggesting a breakout in YXT shares could be key for those considering an entry point into this oversold stock.

TROOPS Inc – TROO

TROOPS Inc faced an 18% decline over the past five days, reflecting short-term challenges. However, with an RSI value of 29.69 and shares closing at $2.97, TROO might offer a speculative play for those anticipating a recovery. Utilizing tools like Benzinga Pro’s earnings calendar to monitor TROO’s upcoming earnings reports could provide valuable insights for potential investors.

The Unraveling Story of eGain Corp: Unveiling Financial Realities

Challenges and Growth Opportunities Revealed

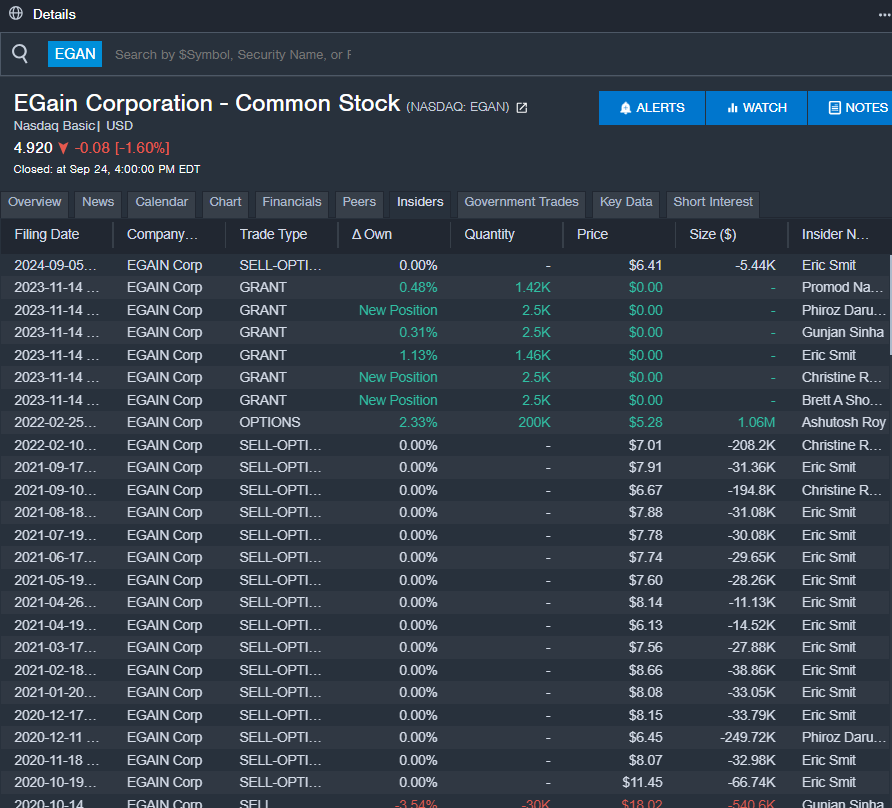

eGain Corp EGAN

On September 5, eGain disclosed its fourth-quarter financial results, along with issuing a less-than-optimistic FY25 adjusted EPS guidance, missing analyst estimates. “As businesses delve into Gen AI at scale, our AI Knowledge Hub is at the forefront of delivering reliable answers for customer service, ultimately cutting costs and enhancing user experience,” commented Ashu Roy, the CEO of eGain. Roy further emphasized, “New logo wins and RFPs for AI Knowledge surged by 50% throughout the fiscal 2024, signifying our deep commitment to tapping into the expanding market potential for AI Knowledge.” However, despite these strides, the company’s shares saw a significant decline of approximately 35% over the past month, with the 52-week low hitting $4.81.

Key Metrics Unveiled

RSI Value: 29.12

EGAN Price Action: The downward trajectory continued for eGain Corp, with its shares slipping by 1.6% and settling at $4.92 at the end of trading on Tuesday.

Insider Trading Insights

Benzinga Pro’s insiders feature enabled a thorough tracking of insider activities and movements within EGAN’s stock, shedding light on potential shifts and sentiment within the company.

Read More: