Chinese ADRs Poised for Growth

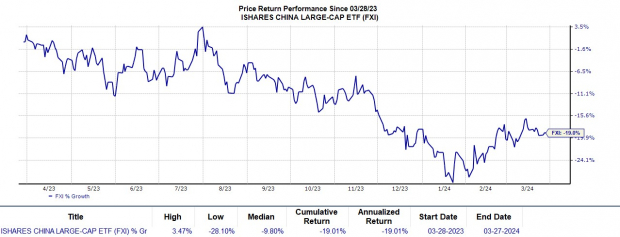

Despite the iShares China Large-Cap ETF FXI experiencing a 19% decline over the past year, there is optimism surrounding various Chinese ADRs signaling a promising rebound. Concerns over China’s economic slowdown have led to some Chinese stocks being oversold, but specific companies within internet-commerce and other lucrative sectors show resilience and promise.

The Lure of Chinese Consumer Market

The allure of investing in Chinese stocks lies in their appealing valuations and exposure to a vast consumer base. Positioned as the second-largest economy globally based on nominal GDP and the largest in terms of purchasing power, China presents a compelling opportunity for investors seeking growth and diversification.

Image Source: Zacks Investment Research

Internet-Commerce Leaders on the Rise

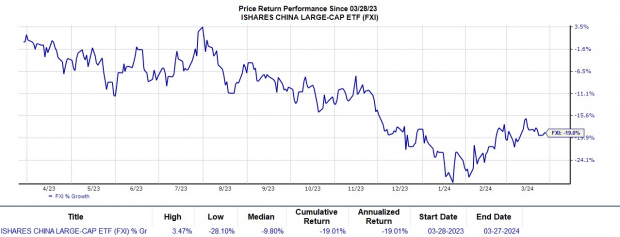

Within the flourishing Zacks Internet-Commerce Industry, companies like JD.com JD and PDD Holdings PDD stand out with a Zacks Rank #1 (Strong Buy). This echoes the growth trajectory of e-commerce giants like Amazon AMZN, demonstrating their prowess in capturing market share and maintaining an upward earnings trend.

Image Source: Zacks Investment Research

Thriving Sales Projections

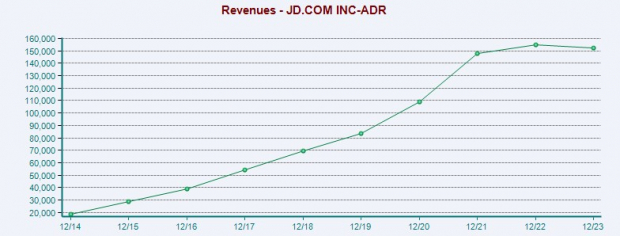

JD.com’s sales are anticipated to soar, with expected annual earnings growth and substantial earnings per share projections for fiscal years ahead. Meanwhile, PDD Holdings exhibits remarkable growth potential, with both revenue and EPS estimates signaling impressive financial performance in the coming years.

Image Source: Zacks Investment Research

Attractive Valuations and Discounts

Both JD and PDD are trading below their 52-week highs, presenting an appealing entry point for investors. Their low P/E ratios compared to industry and S&P 500 averages offer a discounted opportunity for those eyeing substantial returns in the Chinese market.

Image Source: Zacks Investment Research

Emerging Player in Smart Energy Vehicles

Li Auto LI is carving a niche in China’s smart energy vehicle market, reflecting the evolution towards electrified vehicles and autonomous driving. With a Zacks Rank #2 (Buy), Li Auto showcases strong growth potential, especially with its forward earnings multiple presenting an attractive proposition for investors.

Image Source: Zacks Investment Research

Promising Outlook for Iqiyi

Often likened to Netflix, Iqiyi IQ is gaining traction as a strong investment contender with a Zacks Rank #2 (Buy). The company’s positive performance in the Film and Television Production and Distribution Industry underscores its potential for growth and profitability, aligning with the evolving entertainment landscape in China.

Insightful Analysis on Chinese Stocks Outlook and Investment Opportunities

Encouraging Financial Projections

Chinese stocks, including iQIYI, Inc., are currently trading at just $4 with a forward earnings multiple of 8.7X, making them an enticing prospect for investors eyeing growth potential.

Projections for iQIYI reveal a promising future, with anticipated annual earnings seeing a 14% increase in FY24 and a substantial 38% surge in FY25 to reach $0.65 per share. Alongside this, the company’s revenue is expected to demonstrate steady growth, with a 7% rise forecasted for this year and a further 5% jump in FY25, culminating in $4.91 billion in sales.

Moreover, recent estimates indicate a modest increase in earnings projections for both FY24 and FY25 over the past 60 days, underlining a positive trajectory for the company.

Potential for Strong Rebound and Long-Term Investment

Given the optimistic outlook for Chinese stocks like iQIYI, Inc., there is a strong indication that these equities are primed for a significant rebound in the foreseeable future. The company’s performance hints at the likelihood of them evolving into sound investments as we progress into 2024 and beyond.

With the market sentiment expected to improve for Chinese equities, particularly if China can allay concerns surrounding its economic slowdown, now presents a favorable window to start considering strategic positions.

Looking Beyond the Numbers

Delving into the realm of iQIYI, Inc. allows investors to peer beyond the sheer numbers and appreciate the underlying growth potential that these stocks harbor. This reinvigorated interest in Chinese equities signifies a testament to the cyclical nature of the financial markets, as optimism emerges amidst challenging economic climates.

Examining the historical backdrop of financial market cycles sheds light on the transformative power of resilience and adaptability that companies like iQIYI embody, reinforcing the notion that economic downturns can pave the way for remarkable resurgence.