The PCE Price Index: Navigating Economic Terrain

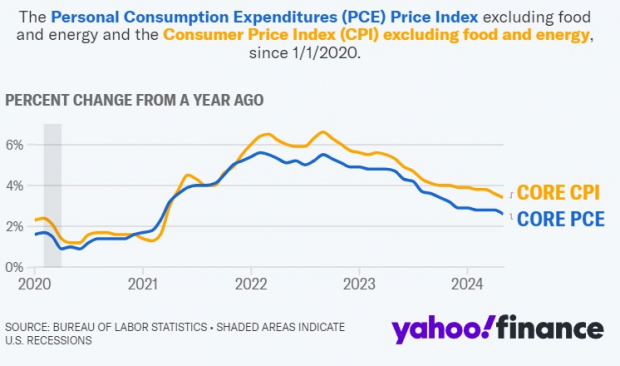

The Personal Consumption Expenditures (PCE) Price Index stands as a barometer, tracing the ebbs and flows in the costs of goods and services devoured by consumers amidst the American economic landscape.

Core PCE & The Federal Reserve: A Metric of Significance

Core PCE represents a cornerstone economic metric within the Federal Reserve’s arsenal, providing a compass for assessing inflation by observing the average fluctuations in consumer goods prices sans volatile elements like food and energy.

A Silver Lining in the Statistics: a 0.1% Uptick

The recent Core PCE revelation offers a ray of hope, indicating a modest 0.1% increase in May juxtaposed with the previous month’s 0.3% surge. On a yearly scale, Core PCE saw a 2.6% uptick, marking the slowest annual rise in three years.

An Economy in Relief

While still surpassing the Fed’s coveted 2% annual inflation goal, the May Core PCE data paints a sanguine picture, gesturing towards a resurgence in both the economy and stock market sentiment.

Stocks to Watch as the Market Reacts

Given the recent moderation in the Consumer Price Index (CPI) figures, investors are eyeing stocks expected to flourish in a more amiable financial backdrop. Here are three standout companies poised to benefit:

Image Source: Yahoo Finance

The Technological Vanguard

Nvidia (NVDA) emerges as a vital player in the tech sector, with reduced inflationary pressures brightening its prospects. Its dominion in AI chip production positions the company favorably as spending on artificial intelligence escalates.

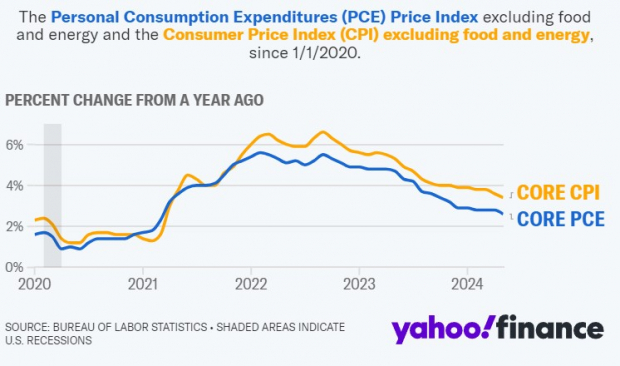

Image Source: Zacks Investment Research

Retail Royalty

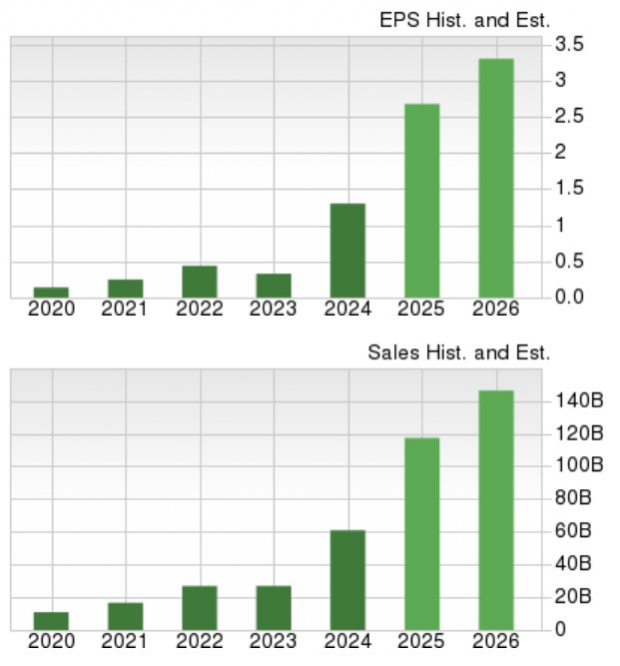

Amazon (AMZN) reigns supreme among retail-driven enterprises, basking in the glow of a stabilized inflationary climate. The stock’s recent surge of 10% this month mirrors investor confidence, with gains already soaring to 27% in the fiscal.

Image Source: Zacks Investment Research

The Banking Behemoth

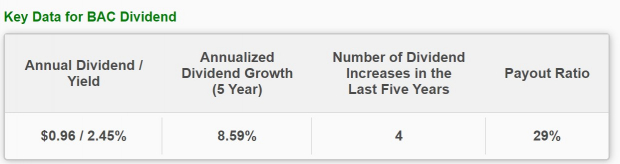

Bank of America (BAC) stands to reap rewards from a subdued inflationary setting, foreseeing potential spikes in loan volumes and deposits. Sporting a Zacks Rank #2 (Buy), the bank’s adept use of technology positions it as an attractive investment opportunity.

Image Source: Zacks Investment Research

The 2.45% annual dividend yield offered by Bank of America (BAC) holds its ground against industry giants, trailing only Citigroup’s 3.44% among the top four domestic banks while surpassing Wells Fargo’s 2.44% and JPMorgan’s 2.31%.

Image Source: Zacks Investment Research

In Retrospect

As Q2 concludes, the recalibration of core PCE bodes well for businesses and the wider economy, casting Nvidia, Amazon, and Bank of America in the spotlight as stocks to observe in the forthcoming quarter.