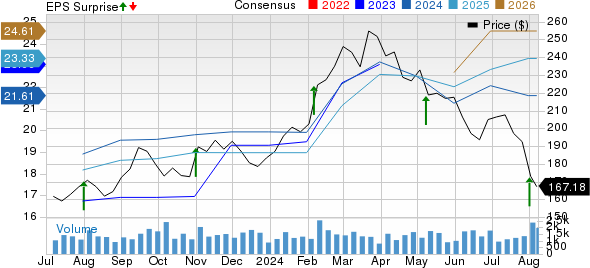

Toyota’s shares have taken a 13.6% hit since the release of its fiscal first-quarter 2025 results on Aug 1. This Japanese automotive powerhouse delivered earnings of $6.35 per share, surpassing the Zacks Consensus Estimate of $4.01 but falling from the previous year’s $7.05 per share. While consolidated revenues stood at $75.9 billion, exceeding the consensus target of $72.5 billion, they declined from $76.8 billion in the same quarter last year.

As of Jun 30, 2024, Toyota boasted cash and cash equivalents of ¥7.59 trillion ($47.21 billion). Long-term debt rose to ¥22.19 trillion ($137.9 billion) from ¥21.15 trillion as of Mar 31, 2024.

Segmental Performance

The Automotive segment’s net revenues for the fiscal first quarter surged 11% year over year to ¥10.76 trillion ($69.02 billion), outperforming expectations. Operating profit in this segment reached ¥1.11 trillion ($7.16 billion), surpassing both the prior year’s figures and estimates.

Financial Services witnessed a 30% increase in net revenues to ¥1 trillion ($6.45 billion) with an operating income of ¥159.7 billion ($1.02 billion). Other businesses reported net revenues of ¥315.7 billion ($2.02 billion), slightly missing the projected amount. However, operating profit in this segment improved.

Outlook for FY25

Toyota projects a total retail vehicle sales of 10.95 million units for fiscal 2025, a decrease from the previous fiscal year. Sales are expected to reach ¥46 trillion, with operating income projected to be ¥4.3 trillion, marking a decline year-over-year. Additional metrics such as pre-tax profit, R&D expenses, and Capex also show fluctuating trends.

Comparative Analysis with Peers

General Motors, Ford, and Honda also reported their latest earnings. General Motors exceeded expectations with solid results in the GMNA segment, while Ford saw a decline in adjusted earnings. Honda, on the other hand, surpassed the Zacks Consensus Estimate for earnings.