Unveiling the AI Market’s Symphony

Palantir Technologies PLTR orchestrated a premarket crescendo, leading the charge for big data and deep-learning enterprises, while Arista Networks ANET navigated a surge in equity value, setting the stage for practical applications of artificial intelligence amidst the broader technology landscape.

The AI Market’s Growth Trajectory

Analysts foresee the AI sector soaring to a $225 billion market value by 2027, a staggering leap from the $2.2 billion it represented in 2022. This meteoric rise hints at a transformational journey, enhancing productivity in realms like the foreign exchange market.

A Glimpse into Contrarian Views

Despite the optimism, skeptics like New Street Research and Goldman Sachs warn of a potential correction in AI stocks. Notable examples like semiconductor titan NVIDIA Corp NVDA have faced scrutiny, highlighting concerns around lofty valuations.

Leveraging AI Volatility with Direxion’s ETFs

Amidst the AI dichotomy, Direxion offers risk-tolerant traders an avenue through leveraged ETFs. The Direxion Daily AI and Big Data Bull 2X Shares AIBU and the Direxion Daily AI and Big Data Bear 2X Shares AIBD cater to both bullish and bearish sentiments, amplifying market movements for short-term exposure.

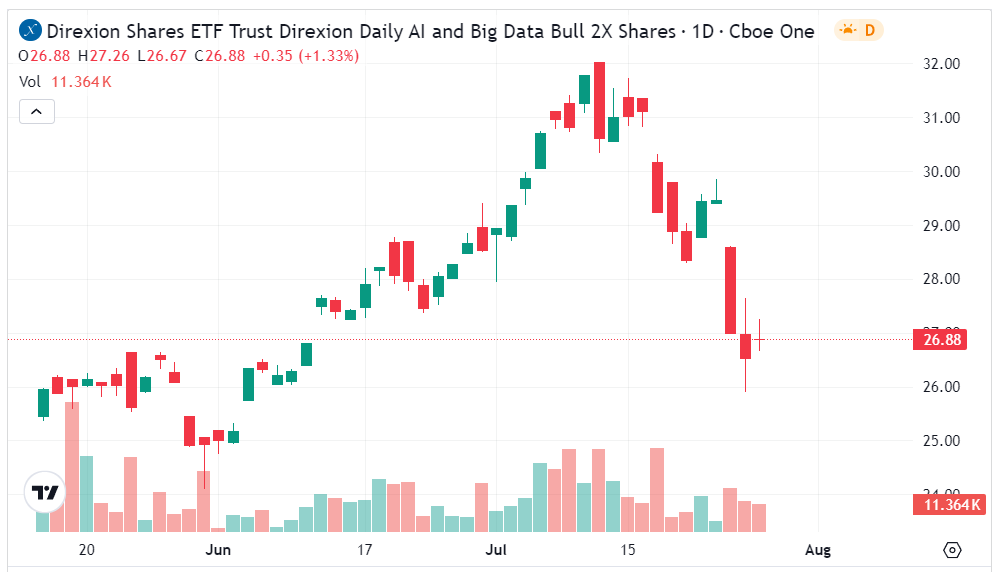

Analyzing Performance through ETF Charts

The AIBU Chart: Reflecting the tech sector’s turmoil, AIBU’s price fluctuations mirror the overarching volatility in AI stocks, hinting at potential recovery spurred by resilient performers like PLTR and ANET.

- AIBU closed at $26.95, below its 20-day moving average but exhibited resilience with an upward gap from the previous day.

The AIBD Chart: In contrast, AIBD capitalized on tech industry upheavals, gaining over 6% amidst market uncertainties, although facing subdued volumes and potential challenges ahead.

- AIBD concluded the session at $22.86, above its 20-day moving average, signaling resilience in adverse market conditions.

Featured photo by Gerd Altmann on Pixabay.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.