Spotify’s Earnings Triumph

In the frenzied pre-market landscape, an air of anticipation surrounded the unveiling of Spotify Technology as it laid bare its second-quarter earnings report. Despite SPOT enduring a bearish spell leading up to this moment, the Q2 figures bore the promise of a hearty rebound, in light of optimistic analyst prognostications.

Lo and behold, the results painted the exact picture the company desired. Spotify notched earnings of 274 million euros (or approximately $298 million), translating to 1.33 euros per share – a resounding beat against the consensus estimate of 1.05 euros. On the revenue front, the company raked in 3.8 billion euros, aligning closely with market forecasts.

Anchoring this stellar performance was the surge in monthly active users (MAUs) by 14%, breaching the 626 million mark. Premium subscribers, an indispensable metric, witnessed a 12% uptick to 246 million, eventually exceeding analyst expectations by a million souls. Moreover, the ad-supported revenue stream saw a 13% upswing to 456 million euros, fueled by music streaming and podcast ventures.

By Monday’s market curtain fall, SPOT shares lingered around $295.45, a moderate uptick from the previous session’s denouement. Yet, the musical crescendo was truly felt during Tuesday’s pre-market soiree as Spotify stock crescendoed to $336, recording a scrumptious 14% advance.

The Allure of the MUSQ ETF

While Spotify commands a prime seat in the realm of audio-content royalty, it is but one maestro amongst a symphony of other players. Notably, Alphabet Inc unleashes its own melodic prowess through YouTube Music, poised to divulge its quarterly report imminently. Yet, for retail investors, maneuvering through these diverse offerings presents a daunting challenge, paving the way for the MUSQ Global Music Industry ETF MUSQ to steal the limelight.

Brought to the fore earlier this year by Benzinga, this thematic exchange-traded fund unfurls a symphonic tapestry, uniting the realms of streaming, content and distribution, live events and ticketing, broadcast radio, technology, and artificial intelligence under one harmonious roof. The ETF’s diversified holdings reflect the diverse tapestry upon which the music industry dances, with SPOT commanding a 3.88% stake of the fund, while Alphabet’s grip extends to 5.8%.

Furthermore, MUSQ orchestrates a melodic choir featuring the likes of Tencent Music Entertainment Group TME and Live Nation Entertainment Inc LYV, ensuring no single entity holds the baton to dictate market movements, thus diversifying risk for investors.

The Harmonious Trajectory of MUSQ

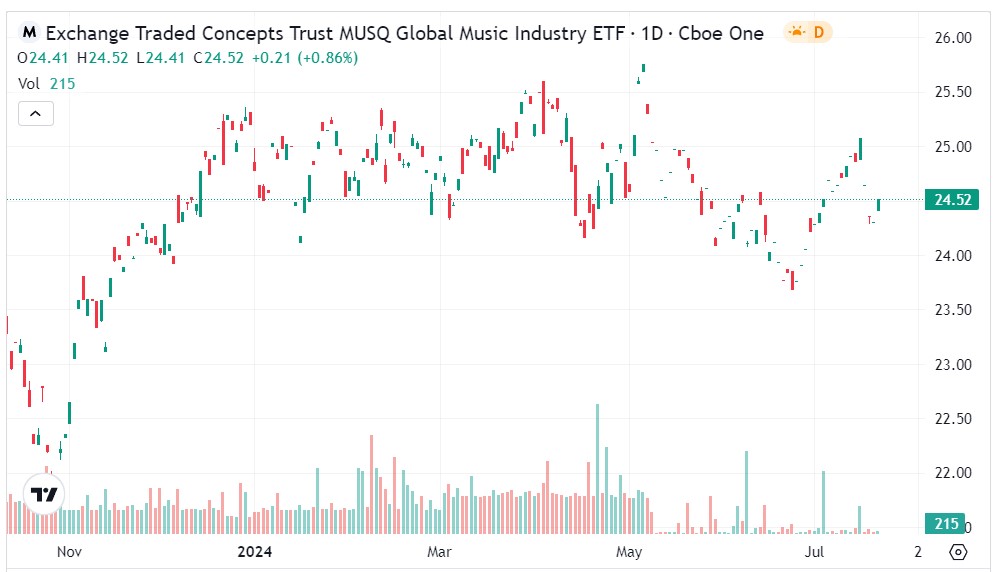

By Monday’s curtain call, the MUSQ ETF had composed a cadenza at $24.52, marking a near 1% crescendo from Friday’s tug. A crescendo followed the June 24 lull, propelling the fund to newer melodic heights.

- With Spotify’s pre-market ovation setting a blazing tempo, MUSQ could indeed capture an enchanting crescendo.

- Although the ETF had danced a discreetly downward tango from December’s finale till the June 24 interlude, its current trajectory harmonizes to a serene denouement.

- A mellifluous U-shaped revival isn’t far-fetched, especially with Spotify’s sonorous quarterly reverberations.

- Moreover, MUSQ’s steps resound above both the 50-day and 200-day moving averages, familiar echelons of market vitality.

Featured image by javier dumont from Pixabay.