Right now, the prospect of escalating geopolitical conflict in the Middle East has many investors running for the hills. But in fact, Wall Street’s famous ‘fear gauge’ – the VIX – is signaling that they should be doing the opposite. It seems that now may actually be a great time to buy stocks.

The Volatility Index (VIX) is widely considered Wall Street’s ‘fear gauge.’ It measures the stock market’s expected volatility based on S&P 500 index options. So, in that respect, it measures how worried investors are about the market at any given point in time.

It’s a sentiment indicator. And like most sentiment indicators, it is often a contrarian signal.

As the legendary Warren Buffet once said, “It pays to be greedy when others are fearful and fearful when others are greedy.”

That certainly is the case with the VIX – especially so over the past year.

Interpreting the VIX for Stock Market Optimism

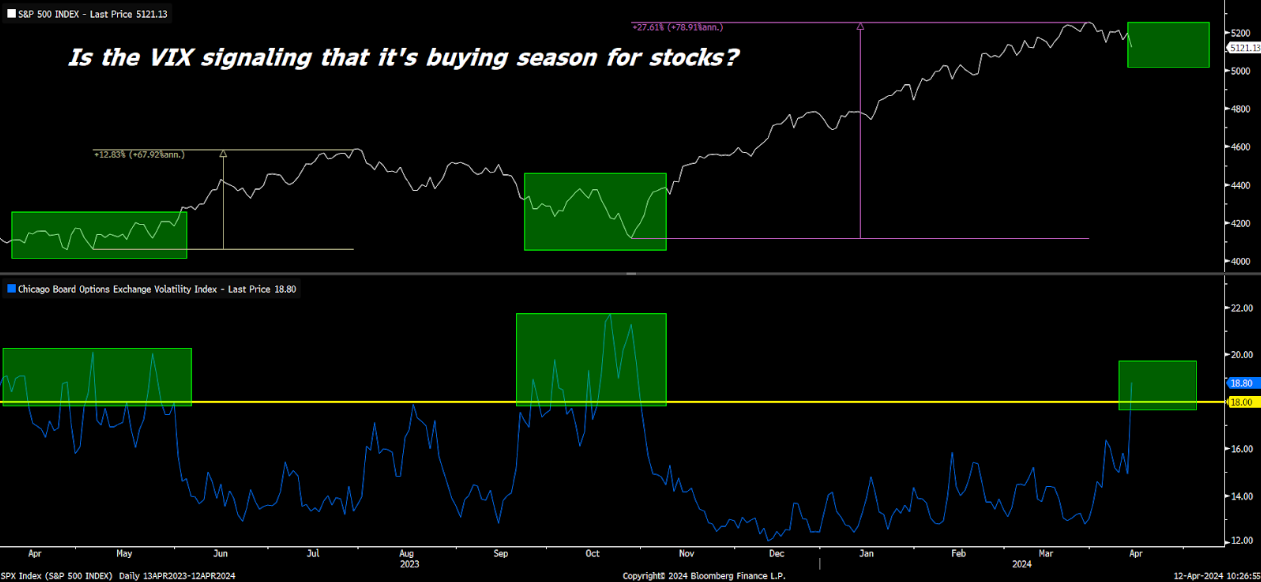

Since early 2023, the VIX has typically fluctuated between 12 and 16. But every single time it has spiked above 18, stocks were on the verge of a huge upward rally. In fact, the best times to buy stocks since early 2023 were when the index spiked above 18.

This happened in April/May 2023 and October 2023. Each time, the VIX spiked above 18 and investors were worried about economic scenarios that never came to pass. In both instances, stocks made significant gains shortly after.

Currently, the volatility index is spiking above 18 again amidst concerns of war, reinflation, and recession. However, indications predict that these risks may be overblown, with the potential for the U.S. economy to continue growing and inflation to decline.

In essence, the VIX is suggesting that it is a favorable time to invest in stocks.

In other words, the VIX is telling us that it is buying season for stocks.

Sure, that may run counter to everything you’re hearing in the news at the moment. But remember: it’s a reporter’s job to scare you with sensationalized headlines and keep watching (or reading) their stuff.

But my job is to make you money.

And the data is telling me that, right now, we have the opportunity to do just that.

Economic Forecast and Investment Strategy

We recommend taking advantage of the current market dip by investing in stocks as we anticipate a turnaround in the near future. Stocks that are purchased now have the potential to see significant growth in the coming months.

Our analysis suggests that this approach will be validated over time as the market dynamics shift.

We are particularly excited about an under-the-radar AI stock that we believe presents an optimal opportunity to capitalize on the generational AI Boom. This stock may lead the AI race, offering investors a unique entry into the AI market.

While industry giants battle for AI supremacy, the true winner might be a lesser-known startup backed by Elon Musk. Investors have the chance to participate in this promising startup’s journey, poised to disrupt the AI industry in the coming years.

For more detailed information, delve into the specifics.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Stay Informed with InvestorPlace

We think it may be the No. 1 way to play the generational AI Boom.

But moreover, we think it offers investors the perfect backdoor way into what we see as the most interesting AI startup in the world.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.