The Importance of Analyst Recommendations

Investors often turn to analysts’ recommendations when making decisions about buying, holding, or selling a stock. The musings of these Wall Street heavyweights bear weight, as reports about rating updates can sway a stock’s price. But do these recommendations hold the key to sound investment decisions?

Alibaba’s Brokerage Recommendations

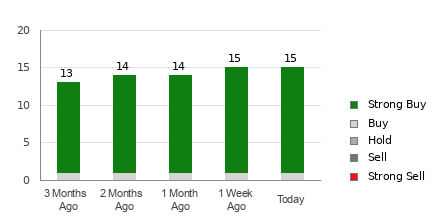

The average brokerage recommendation (ABR) for Alibaba stands at 1.27, indicating a consensus leaning between Strong Buy and Buy based on actual recommendations from 15 brokerage firms. Of these, 13 Strong Buy ratings comprise a significant 86.7% of the total recommendations.

Understanding ABR and Its Limitations

While the ABR suggests buying Alibaba, investors should exercise caution. Studies show that brokerage recommendations have limited success in identifying stocks with the most potential for price appreciation. This stems from an inherent bias; analysts affiliated with brokerage firms often lean toward positive ratings, regardless of a stock’s true momentum.

Zacks Rank as a Reliable Indicator

When considering investment decisions, it’s vital to weigh the ABR against more robust indicators. The Zacks Rank, with a track record of accurately predicting stock performance, relies on earnings estimate revisions as a core metric. Comparing the ABR with the Zacks Rank can provide a more informed perspective for investors.

ABR Versus Zacks Rank

While both ratings operate on a scale from 1 to 5, ABR is influenced solely by brokerage recommendations and often features decimal values, while the Zacks Rank is a quantitative model rooted in earnings estimate revisions, represented as whole numbers.

Looking Beyond Brokerage Recommendations

Analysts’ predisposition to issue optimistic ratings underscores the importance of digging deeper into a stock’s potential. Conversely, the Zacks Rank’s foundation in earnings estimate revisions demonstrates practical relevance, with proven correlation to short-term price movements.

Alibaba’s Earnings Estimate Revisions

Recent data shows a 3.1% decline in the Zacks Consensus Estimate for Alibaba, indicating growing pessimism among analysts regarding the company’s earnings prospects. This consensus has culminated in a Zacks Rank #4 (Sell) for Alibaba, emphasizing the need for caution.

Final Considerations

Given the decline in earnings estimates and the Sell rating from Zacks, it’s prudent to approach Alibaba’s Buy-equivalent ABR with skepticism. Investors must exercise their judgment and conduct thorough research beyond surface-level brokerage recommendations to make informed decisions.