Before diving into the swirling waters of Wall Street recommendations, investors often cast a furtive glance at what the almighty analysts are pontificating. There’s a buzz around the corner and it’s all about Celestica – a stock making ripples in investment circles. Let’s delve into the murky waters of brokerage recommendations and unravel the mystery behind the numbers.

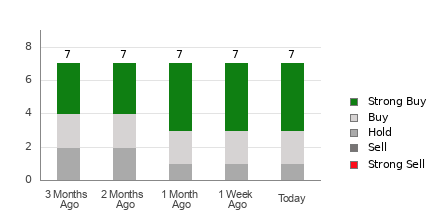

A quick glance at the dartboard reveals that Celestica is donning an average brokerage recommendation of 1.57 on the 1 to 5 scale (ranging from Strong Buy to Strong Sell). Seven brokerage firms have cast their die, with the number crunching churning out an ABR equivocating between Strong Buy and Buy. But, dear investor, do not let these numbers sweep you away just yet.

Of the seven sages who have spoken, four trumpet Strong Buy, while two beckon Buy – accounting for 57.1% and 28.6% of the pie respectively. Yet, before you lay your bets, take heed.

Reading between the Lines: Navigating Brokerage Recommendations

The drums are beating for Celestica, but should you march to their rhythm? Analysts, with their rose-tinted glasses, often paint a sunnier picture than reality. The nudges from brokerage houses may not always lead you to the land of milk and honey where riches abound.

Why, you ask? These emissaries of finance, with their stakes in the game, tend to sway the axis with a bias that veers sharply towards the sunny side of the street. For every “Strong Sell” they whisper, five “Strong Buys” echo in the alleyways. Their compass doesn’t always point north for the common man, leaving investors adrift in a sea of uncertainty.

But fear not, for every cloudy day has a silver lining. Behold the Zacks Rank – a beacon shining brightly through the murky mist. Steeped in history and audited to a T, this tool sorts the wheat from the chaff, leading investors to the promised land – profits galore!

Demystifying the Numbers: ABR vs. Zacks Rank

Though the ABR and Zacks Rank may dance on the same scale, they are as different as night and day. Broker recommendations steer the ABR ship, twitching the needle to show a decimal world. On the flip side, the Zacks Rank is a different beast altogether – a titan built on the cradle of earnings estimate revisions, showcasing a whole number symphony.

The crux of the matter? Analysts may sway, but earnings estimates hold the fort. The Zacks Rank harks back to the beating heart of a company – its earnings. History whispers tales of price movements mirroring the rhythm of earnings estimate revisions, offering a lifeline amidst the market storm.

While the ABR may slumber in the past, the Zacks Rank dances to the tune of the present. As analysts tweak their crystal balls, earnings estimates dance the tango – keeping the Zacks Rank evergreen and ever so relevant.

To Buy or Not to Buy: Whisperings in the Wind

Celestica stands at the crossroads, shrouded in the mist of consensus estimates. Unwavering voices echo in the chambers of Wall Street, painting a portrait of stability. The Zacks Rank, molded by whispers of change, unveils a #3 (Hold) for Celestica – urging caution amidst the clamor of Buy-equivalent ABR.

Trading in the waters of Celestica? Tread carefully, dear investor, for the wind whispers tales of stability amid the tumultuous seas of investment.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.