Before committing hard-earned cash to the fluctuations of the stock market, many a wise investor turns to the forecasts of Wall Street analysts. But, have you ever wondered if these prognostications are truly the golden ticket they’re touted to be? Let’s delve into the world of number-crunching experts and see what the buzz surrounding Celestica (CLS) is all about!

Analysts’ Verdict on Celestica (CLS)

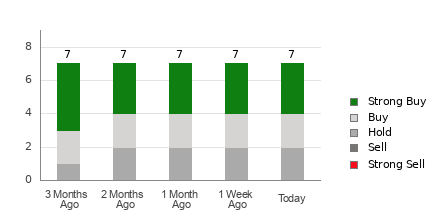

The pulse on the street indicates that Celestica holds an average brokerage recommendation (ABR) of 1.86. This score falls between Strong Buy and Buy on a spectrum that spans from 1 to 5 – Strong Sell to Strong Buy. Parsing the ratings from seven different brokerage firms, three shout Strong Buy while two espouse a mere Buy. So, what’s the verdict?

The Skinny on Brokerage Trends for CLS

Scouring the grapevine, an ABR nudging you towards Celestica emerges. But, don’t let this singular statistic be your North Star of investment guidance. Studies show that these firm-driven ratings have a shaky track record when it comes to actually predicting stock value hikes.

Why the disconnect, you ask? Well, the not-so-secret sauce lies in the analysts’ cozy relationships with the very stocks they critique. Grappling with a tilt toward optimism, these analysts slap a resounding “Strong Buy” label roughly five times more often than they cry “Strong Sell.” With this imbalance, is it truly the voice of reason you seek?

Thus, a word to the wise – harness these recommendations as a check against your personal market scrutiny or some other crystal ball that boasts a sturdier reputation.

The Zacks Rank – A Beacon in the Storm

Enter the Zacks Rank, a proprietary tool ushering us through the financial fog. This nifty contraption segregates stocks into a neat grid of five categories, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Unraveling the stock’s near future, the Zacks Rank stands as a harbinger of impending winds of fortune.

Setting the ABR apart, the Zacks Rank is rooted in raw data – specifically, earnings estimate revisions. This stark shift in methodology ditches the smoke and mirrors of brokerage favoritism, opting for the grounding force of objective numbers!

Is Celestica (CLS) a Diamond in the Rough?

Diving into Celestica’s earnings estimate matrix, we unearth a static Zacks Consensus Estimate holding strong at $3.32 for the current year. Such unwavering analyst confidence could signal a steady sail for the stock in the market’s ebb and flow.

Couched in this unmovable metric and tethered to a Zacks Rank #3 (Hold), Celestica waits in the wings. Could it be the poster child for “average is awesome” in an ocean of speculative gambles?

As you tiptoe around a Buy-like ABR for Celestica, remember – the dance of the stock market is fraught with the unexpected. So, proceed with caution, dear investor, as you navigate these stormy seas of financial opportunity!