When considering investments, Wall Street analysts are often seen as reliable guides. They provide valuable insights that can sway investor decisions, influencing stock prices. But can their recommendations always be trusted?

Before delving into the reliability of brokerage recommendations and how to leverage them effectively, let’s take a look at how these financial experts perceive General Motors (GM).

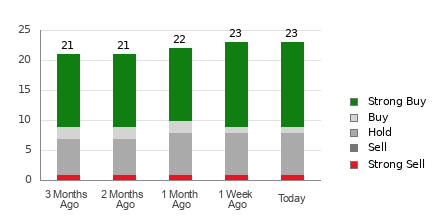

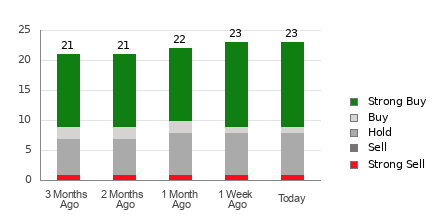

Currently, General Motors boasts an average brokerage recommendation (ABR) of 1.83, falling between Strong Buy and Buy on a scale of 1 to 5. This score is based on inputs from 23 brokerage firms, with 60.9% indicating a Strong Buy and 4.4% a Buy rating.

Deciphering Brokerage Recommendation Trends for GM

The ABR for General Motors may suggest a buy, but relying solely on this metric could be unwise. Studies reveal that brokerage recommendations often lack the foresight to pinpoint stocks with the most potential for price growth.

Why is this the case? Analysts at brokerage firms, driven by institutional interests, tend to skew ratings positively. For every “Strong Sell” recommendation, there are five “Strong Buy” suggestions — a clear indication of bias. This misalignment raises doubts about the reliability of these recommendations for individual investors.

Amidst this backdrop, tools like Zacks Rank gain importance. This proprietary stock rating system, backed by rigorous audits, categorizes stocks from Strong Buy (Zacks Rank #1) to Strong Sell (Zacks Rank #5), offering valuable insights into future price movements.

Distinguishing Zacks Rank from ABR

Despite appearing on a similar scale, Zacks Rank and ABR differ significantly in their methodologies. While ABR depends solely on brokerage recommendations, Zacks Rank is rooted in earnings estimate revisions, a critical driver of stock performance.

Brokerage analysts, beholden to institutional interests, often overrate stocks, providing misleading guidance. In contrast, Zacks Rank, driven by earnings estimates, correlates closely with short-term price movements.

Moreover, Zacks Rank ensures balance by proportionately assigning ranks across all stocks with analyst estimates. This model’s timeliness in reflecting changing trends sets it apart from the often-dated ABR.

Is General Motors a Viable Investment?

General Motors’ robust earnings estimate revisions have propelled its Zacks Consensus Estimate for the current year by 4.9% to $9.38. This upward trajectory, marked by analyst optimism and high consensus, positions GM at a Zacks Rank #2 (Buy).

Thus, while ABR may offer a broad perspective, complementing it with tools like Zacks Rank could enhance investment decisions. By balancing institutional insights with rigorous analytics, investors can navigate the complexities of the stock market more effectively.

Therefore, using a multi-faceted approach to analyze investment opportunities, including General Motors, can lead to more informed and potentially profitable decision-making.