Diving into Brokerage Recommendation Trends for LLY

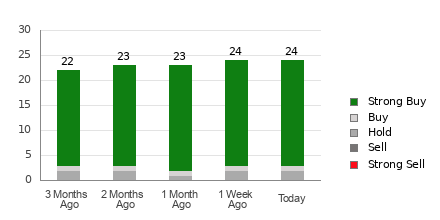

The stock market echoes with the whispers of brokerage analysts, their ratings like enchanting sirens leading investors on a quest for the holy grail of profitability. Lilly, the pharmaceutical titan, finds itself amidst the tempest, with an average brokerage recommendation (ABR) of 1.19, a harmonious melody between Strong Buy and Buy.

Within the mythological landscape of Wall Street’s analysts, 21 melodious voices sing in unison, proclaiming Strong Buy for Lilly, while the lone troubadour whispers Buy, composing a symphony of 87.5% and 4.2% recommendations, respectively.

Understanding the ABR and Zacks Rank

The ABR may seem to be the oracle’s prophecy, but beware the mesmerizing allure. Analysts, with their vested interests, mold their recommendations through a lens of rose-colored glasses. In contrast, the Zacks Rank transcends the realm of subjective opinion, guided by the objective starlight of earnings estimate revisions.

While the ABR may be a relic of ancient times, cloaked in uncertainty with its lack of timeliness, the Zacks Rank emerges as the stalwart guardian, swiftly adjusting to the tides of earnings estimate revisions, a lighthouse guiding investors through rocky waters.

Peering into the Crystal Ball: Is LLY a Hidden Treasure?

As the whispers of analysts crescendo into a chorus of optimism, the Zacks Consensus Estimate for Lilly gleams like a precious gem, rising 0.1% to $16.49 in the past lunar cycle. The convergence of analysts’ faith in uplifting EPS estimates heralds a Zacks Rank #1 (Strong Buy) for Lilly, a beacon beckoning forth fortune-seeking investors.

Thus, as the mystique surrounding Lilly unravels, the Buy-equivalent ABR emerges as a guiding star for intrepid investors navigating the labyrinth of market fluctuations.

Embark on the Infrastructure Stock Odyssey

An epic of monumental proportions unfolds as the tale of U.S. infrastructure development takes center stage, promising wealth beyond mortal comprehension. The saga of infrastructure stocks, poised for ascension, beckons forth investors to seize the opportunity of a lifetime.

Are you prepared to embark on this odyssey of growth and prosperity, venturing into the realm of stocks destined for greatness? Unveil the secrets of 5 visionary companies poised to reap the rewards of this historic venture with the Zacks Special Report, a treasure trove offered freely to those bold enough to seek it.