Do Wall Street analysts hold the key to unlocking a stock’s true potential? For many investors, these financial mavens wield considerable influence through their ratings. But is their impact as significant as it appears? Let’s delve into the ratings game and explore what the brokerage experts have to say about Netflix (NFLX), as well as the reliability of their recommendations and how to leverage this insight effectively.

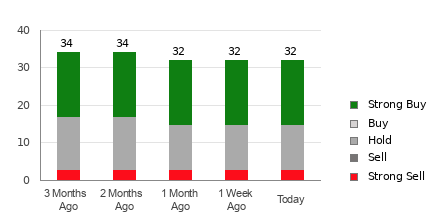

Netflix’s Brokerage Recommendations

Netflix currently holds an average brokerage recommendation (ABR) of 1.90. This calculation, ranging from 1 to 5 (Strong Buy to Strong Sell), aggregates the recommendations from 36 brokerage firms. A rating of 1.90 suggests a position between Strong Buy and Buy.

Of the 36 recommendations contributing to the ABR, 21 are Strong Buy and one is Buy. Notably, Strong Buy and Buy account for 58.3% and 2.8% of the total, respectively.

Are Brokerage Ratings Reliable?

While the ABR suggests a bullish outlook for Netflix, it’s prudent not to base investment decisions solely on this metric. Numerous studies have cast doubt on the efficacy of brokerage recommendations in identifying stocks with substantial price appreciation potential.

Why the skepticism? The inherent bias of analysts employed by brokerage firms is a major factor. With a tendency to rate stocks positively due to their employers’ vested interests, these analysts issue notably more “Strong Buy” ratings than “Strong Sell” ratings, often misleading investors rather than guiding them effectively.

The Zacks Rank: A Reliable Alternative

Contrastingly, Zacks Rank offers a more dependable gauge of a stock’s short-term price performance. Supported by an externally audited track record, the Zacks Rank classifies stocks into five categories, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model draws strength from earnings estimate revisions, demonstrating a robust correlation between near-term stock price movements and trends in these revisions.

Comparing ABR vs. Zacks Rank

Although both ABR and Zacks Rank utilize a 1-5 scale, they are fundamentally distinct measures. While ABR solely hinges on broker recommendations and is typically displayed in decimals, the Zacks Rank is a quantitative model rooted in earnings estimate revisions and is presented in whole numbers. This crucial disparity underscores the contrasting reliability of the two metrics.

Investment Potential for NFLX

Considering the earnings estimate revisions for Netflix, the Zacks Consensus Estimate for the current year has risen by 0.1% over the past month, settling at $12.08. This upturn, coupled with analysts’ increasingly bullish stance on the company’s earnings prospects, has culminated in a Zacks Rank #2 (Buy) for Netflix.

As a result, the Buy-equivalent ABR for Netflix may indeed serve as a useful reference for investors seeking to gauge the stock’s potential.

For investors, the road to sound investment decisions is paved with vigorous analysis and diligent consideration of varied insights. While Wall Street analysts certainly have a role to play, a more discerning approach, supplemented by the likes of the Zacks Rank, can empower investors to navigate the intricate world of stock investing with greater acumen.