The Influence of Brokerage Recommendations

Investors often heed Wall Street analysts’ advice when making decisions on stock investments. The reports issued by these financial experts can sway stock prices. But do these recommendations truly hold weight?

Before delving into the topic of brokerage recommendations reliability, let’s examine the sentiments of Wall Street analysts towards ADMA Biologics (ADMA).

Analyst Recommendations for ADMA

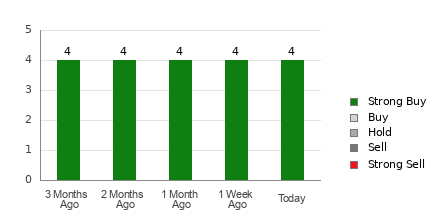

ADMA Biologics currently boasts an impressive average brokerage recommendation (ABR) of 1.00, indicating a Strong Buy sentiment based on feedback from four brokerage firms. All four recommendations collectively endorse a Strong Buy rating, covering 100% of all opinions.

Although the numerical endorsement appears near-perfect on paper, caution is advised when relying solely on this data for investment decisions. Numerous studies have shown the limited effectiveness of brokerage recommendations in predicting substantial stock growth.

The Fallacy of Brokerage Recommendations

Brokerage firms, due to their vested interests, tend to exhibit a strong bias towards stocks they cover. Research indicates that for every “Strong Sell” rating, brokerage firms assign a whopping five “Strong Buy” recommendations.

Thus, these recommendations may not consistently align with the interests of individual investors, making them unreliable indicators of a stock’s future performance.

The Power of the Zacks Rank

In contrast to brokerage recommendations, the Zacks Rank offers a robust, quantitatively-driven approach to assessing stocks. This stock rating tool has a proven track record of accurately predicting short-term price movements by analyzing earnings estimate revisions.

While brokerage recommendations may lack timeliness and objectivity, the Zacks Rank demonstrates a strong correlation between earnings estimate trends and stock price fluctuations, offering a more reliable investment guide.

This nuanced difference between the two approaches highlights the advantage of leveraging the Zacks Rank as a supplementary tool in your investment strategy.

Judging ADMA’s Investment Potential

Reviewing the Zacks Consensus Estimate for ADMA Biologics reveals a stagnant forecast of $0.35 for the current year, signaling a Zacks Rank #3 (Hold) designation. Such stability in consensus estimates implies potential market performance in line with broader trends.

While the stock holds a Buy-equivalent ABR, exercising caution in interpreting this recommendation is advisable, with the Zacks Rank offering a more nuanced and reliable perspective for investors.

A Closing Thought

As you navigate the complex landscape of investment advice, remember that Wall Street’s bullish outlook must be approached with a critical eye. Leveraging tools like the Zacks Rank alongside traditional brokerage recommendations can provide a more comprehensive view of a stock’s investment potential.