Brokerage Recommendations: A Closer Look

Investors, perched on the edge of Wall Street’s financial labyrinth, often seek guidance from a flock of brokerage analysts for insights on buying, selling, or holding a stock. But do these recommendations truly hold weight when it comes to decision-making?

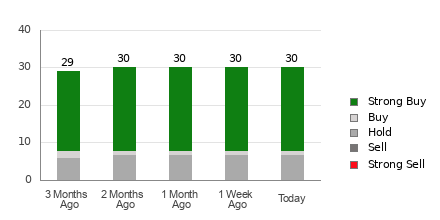

Peering into the realm of Dynatrace (DT), one finds a chorus of 30 brokerage firms painting a rosy picture, with an average brokerage recommendation (ABR) tipping the scales at 1.50. This numerical dance, oscillating between Strong Buy and Buy, is a melody stitched together by the voices of 22 Strong Buy and one Buy, harmonizing at 73.3% and 3.3% respectively.

Deciphering the Enigma of Brokerage Trends

“To buy, or not to buy—that is the question.” Echoing Shakespeare’s timeless enigma, investors ponder the tug-of-war between ABR revelations and concrete investment decisions. Studies unveil a stark reality: brokerage recommendations often wear a cloak of positivity, fuelled by vested interests, leading analysts to play the role of the ever-optimistic town crier.

The Zacks Rank, akin to a seasoned navigator on this tumultuous sea of stocks, stands firm with a track record etched in gold, steering investors towards the shores of potential riches. This five-tiered ranking system, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serves as a beacon illuminating the path to profitable investments.

The Zacks Rank: Illuminating the Path Forward

“Two paths diverge in the stock market, and I— I took the one less biased.” Divining the Zacks Rank from the ABR is akin to sifting grains from chaff. While both ratings parade a 1-5 scale, their underpinnings couldn’t be more divergent. The ABR marches to the tune of analysts’ whispers, often tainted by the shadow of vested interests. In contrast, the Zacks Rank, a sage driven by earnings estimate revisions, beckons investors towards a more objective vista.

Where analysts, drenched in optimism, may lead astray, the Zacks Rank stands as a lighthouse, anchored in the empirical realm of earnings estimate trends and stock price movements.

Delving Into Dynatrace’s Investment Landscape

Penetrating the mist shrouding Dynatrace’s investment potential, one finds the Zacks Consensus Estimate holding steady, unwavering in its prophecy of $1.28 for the current year. Steadfast analyst perspectives painting a picture of stability, coupled with a Zacks Rank #3 (Hold), suggests a horizon where Dynatrace treads in harmony with the market’s cadence.

As investors tiptoe along the tightrope of financial decisions, caution whispers in the wind, urging prudence towards the Buy-equivalent ABR for Dynatrace.