Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Let’s delve into what these financial gurus think about Grab Holdings Limited (GRAB) before exploring the trustworthiness of brokerage advice and how investors can leverage it to their advantage.

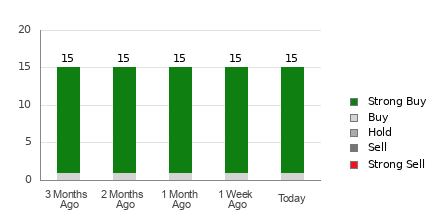

Grab currently holds an average brokerage recommendation (ABR) of 1.03 on a scale of 1 to 5 (ranging from Strong Buy to Strong Sell). This metric is derived from actual recommendations (Buy, Hold, Sell, etc.) made by 15 brokerage firms. An ABR of 1.03 falls between Strong Buy and Buy.

Out of the 15 ratings contributing to the current ABR, 14 are Strong Buy and one is Buy, with Strong Buy and Buy representing 93.3% and 6.7% of all recommendations respectively.

Examining Trends in Brokerage Recommendations for GRAB

Although the ABR indicates a positive outlook for Grab, relying solely on this data for investment decisions may not be prudent. Research has shown that brokerage recommendations often fall short in guiding investors towards stocks with the highest potential for price appreciation.

Ever wondered why? Brokerage analysts are inclined to recommend stocks positively due to the vested interests of their firms. As per research findings, for every “Strong Sell” recommendation, there are five “Strong Buy” recommendations.

Therefore, the motivations of these institutions may not always align with those of individual investors, offering limited insights into a stock’s future price trajectory. It is advisable to utilize this information to complement your own analysis or a reliable tool adept at predicting stock price movements.

With a robust, externally audited performance history, our exclusive stock rating system, the Zacks Rank, categorizes stocks into five tiers from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a dependable indicator of a stock’s short-term price performance. Thus, validating the Zacks Rank alongside ABR could significantly aid in making informed investment choices.

Comparing Zacks Rank and ABR

Despite both appearing on a 1 to 5 scale, Zacks Rank and ABR are distinct metrics.

ABR stems purely from brokerage recommendations and is typically displayed with decimals (e.g., 1.28). Meanwhile, the Zacks Rank operates as a quantitative model that allows investors to leverage earnings estimate revisions, presented as whole numbers ranging from 1 to 5.

Brokerage analysts, due to their employers’ interests, have historically been excessively optimistic in their stock recommendations, often leading to misleading guidance rather than insightful advice.

Conversely, the Zacks Rank hinges on earnings estimate revisions, demonstrating a strong correlation with near-term stock price movements based on empirical evidence.

Moreover, the Zacks Rank gradations are distributed proportionately among all stocks for which brokerage analysts furnish earnings estimates for the ongoing year, maintaining equilibrium at all times.

Another notable discrepancy between ABR and Zacks Rank lies in timeliness. While ABR may lag in currentness, the Zacks Rank remains prompt in predicting future stock prices as brokerage analysts make continual adjustments to their earnings estimates to mirror evolving business trends.

Is it Wise to Invest in GRAB?

Regarding earnings estimate revisions for Grab, the Zacks Consensus Estimate for the current year has shown no change over the past month, standing at -$0.01.

The persistence of analysts’ views on the company’s earnings potential, evident from the unaltered consensus estimate, could justify the stock’s performance in line with the broader market in the immediate future.

Based on the recent consensus estimate stability and three other earnings-related factors, Grab holds a Zacks Rank #3 (Hold). for further Zacks Rank #1 (Strong Buy) stocks, refer to the complete list here.

Hence, exercising caution with regards to Grab’s Buy-equivalent ABR may be judicious.