The investment world often looks to Wall Street analysts for guidance when contemplating trading decisions. These analysts, employed by brokerage firms, can significantly impact a stock’s price through their ratings and recommendations. But should investors place their trust solely in these recommendations? Let’s scrutinize the sentiments of Wall Street analysts and their impact on Netflix (NFLX).

Netflix’s Brokerage Recommendation Trends

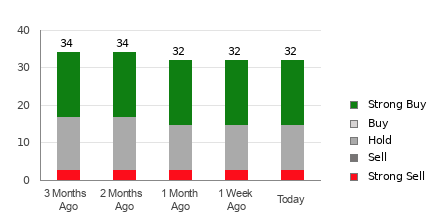

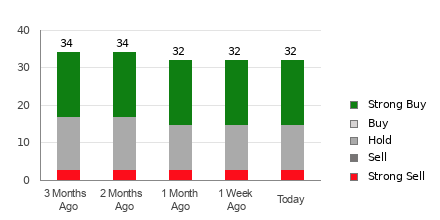

Netflix currently carries an average brokerage recommendation (ABR) of 1.99, representing a consensus between Strong Buy and Buy, based on ratings from 37 brokerage firms. Among these, 54.1% advocate Strong Buy, while 2.7% recommend Buy.

Given this ABR endorsement, caution is advised when basing investment decisions solely on this metric. Studies indicate that brokerage recommendations have limited success in predicting stocks with significant price increase potential. This tepid reliability is due to the strong positive bias analysts often demonstrate towards stocks covered by their firms.

Understanding ABR vs Zacks Rank

It’s crucial not to conflate ABR with the Zacks Rank. While both metrics range from 1 to 5, they are fundamentally distinct. ABR derives from brokerage recommendations and is typically shown with decimals, whereas the Zacks Rank relies on quantitative models incorporating earnings estimate revisions, and is delineated in whole numbers.

Brokerage analysts have a propensity for issuing overly optimistic ratings influenced by their firms’ vested interests. Conversely, the Zacks Rank draws heavily from earnings estimate revisions, statistically indicating a strong link between earnings trends and stock price movements.

The Zacks Rank also stands out for its timeliness in reflecting current market conditions, as it responds swiftly to analysts’ revisions based on evolving business dynamics. This contrasts with ABR, which might not always reflect the most up-to-date sentiments.

Is NFLX a Worthwhile Investment?

Netflix’s Zacks Consensus Estimate for the current year has surged by 0.5% over the past month, settling at $12.11. This uptick is underpinned by the buoyant outlook among analysts, evident in the unanimous elevation of EPS estimates, culminating in a Zacks Rank #2 (Buy) for Netflix.

Therefore, while the collective ABR leans towards a Buy, investors might find it prudent to temper their decision-making exclusively by corroborating this metric with the Zacks Rank, which has demonstrated effectiveness in predicting stock price movements.

Note: This article expresses opinions and viewpoints solely based on the provided information and is not an inducement for any investment decisions.