Investors often glean valuable insights from the musings of Wall Street analysts before delving into the realm of stock purchases. The pulse of brokerage recommendations can seemingly dictate market sentiment and influence investment behavior. But how much weight should one truly accord to these prognostications?

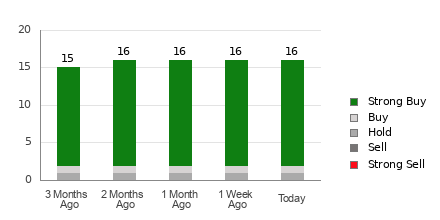

Before we embark on our journey to decode the enigma of broker ratings, let’s first dissect the current landscape as it pertains to Synopsys (SNPS). The status quo reflects an average brokerage recommendation (ABR) of 1.19 for Synopsys, which translates to a consensus leaning towards the “Buy” end of the spectrum. Supported by assessments from 16 brokerage firms, the ABR emanates from a confluence of 14 “Strong Buy” recommendations and 1 “Buy” recommendation, embodying an aura of cautious optimism.

The Illusion of Broker Recommendations

The allure of the brokerage recommendation trend chart for SNPS can often be beguiling, swaying the undiscerning investor with its flashy figures and color-coded bars. However, embarking solely on this corsair’s vessel might steer the hapless trader into stormy waters, as recent studies have cast doubt on the efficacy of broker ratings as a reliable navigation tool.

Have you ever pondered why this may be? The murky waters of brokerage allegiances cloud the judgment of these analysts, leading to a biased penchant for offering overly rosy forecasts. A stark revelation from our own investigations highlights the glaring fact that the scales are tipped heavily in favor of “Strong Buy” endorsements, outnumbering their polar opposite, the “Strong Sell,” by a margin as wide as the Grand Canyon.

The sagacious investor thus treads cautiously, treating brokerage ratings as but a pinch of salt rather than the main course, perhaps leveraging them to corroborate their independent research or as a mere blip on the radar in an ocean of investment options.

Leveraging the Zacks Rank

Amidst the cacophony of bullish brokerages, a beacon of hope emerges in the form of the Zacks Rank, a tool bestowed with a pedigree of robust scrutiny. Breathing life into stocks by assigning them to five distinct echelons, ranging from Zacks Rank #1 (“Strong Buy”) to Zacks Rank #5 (“Strong Sell”), this instrument stands as a bastion of reliability in an unpredictable world.

A stark disparity emerges when we contrast the Zacks Rank with the chimerical ABR. Where broker recommendations wax poetic in decimals, the Zacks Rank opts for blunt wholes, rooted in algorithms that deconstruct the labyrinth of earnings estimates. Herein lies the crux of the matter – brokerage bards may lull you into a trance, but the Zacks Rank offers a sobering reality check, tethered to empirical evidence linking earnings estimate revisions to price movements.

Through the looking glass of historical context, it becomes glaringly evident that brokerage whims are akin to fleeting zephyrs, while the Zacks Rank hums a tune of stability deeply resonant with a long history of sound advice.

The Synopsys Conundrum

Peering through the crystalline lens of earnings, we find Synopsys ensconced in a realm of stability, its Zacks Consensus Estimate for the current year holding steady at $13.03 over the past lunar cycle. Analyst gazes pierce the horizon with unwavering resolve, perceiving a vista where Synopsys’ fortunes align harmoniously with the broader market’s tempo.

This harmonious dance with consensus estimates has etched a Zacks Rank #3 (“Hold”) upon Synopsys, a badge denoting a balanced stance amidst the ebbs and flows of market sentiment. A prudent observer may opt for caution in the face of the buoyant ABR, recognizing the nuanced symphony of factors that steer the investment ship.

Beyond the mists lies a realm of hydrogen fuel stocks, where doyens of clean energy beckon with promises of innovation and growth. The siren song of opportunity echoes in the halls of investment lore, coaxing the discerning investor to ponder the hidden gems that await amidst the frothy waves of technological evolution.