The buoyant surge in demand for artificial intelligence (AI) chips has catapulted shares of Advanced Micro Devices (NASDAQ: AMD) soaring over the past year, despite the chipmaker’s AI-related business originally failing to gain traction in 2023. This fervor may stem from investors’ reluctance to miss the wave in this rapidly expanding market, predominantly dominated by Nvidia.

AMD’s delayed foray into the AI chip market in 2023 saw tech behemoths flocking to procure Nvidia’s graphics processing units (GPUs) for training large language models like ChatGPT. Nonetheless, AMD managed to carve out a niche in this lucrative sphere, projected to yield a colossal $384 billion in annual revenue by 2032, boasting a robust compound annual growth rate of 38%. AMD’s management affirmed that their efforts in this business segment should bear fruit in 2024.

Mixed Signals from Wall Street

Despite this promising forecast, Wall Street remains unimpressed with AMD’s AI-related revenue guidance for the year, which fell short of expectations. However, scrutinizing the company’s AI business unveils the potential for a substantial upsurge this year.

Finding Silver Linings in AMD’s AI Guidance

In October of last year, AMD forecasted $400 million in revenue from selling its MI300 series of AI GPUs in the fourth quarter of 2023. The roll-out of AMD’s MI300 family of processors in December marked the commencement of a revenue escalation in the AI sector for the tech giant.

On the company’s fourth-quarter 2023 earnings conference call, AMD CEO Lisa Su remarked that the “Data Center GPU business accelerated significantly in the quarter, with revenue exceeding our $400 million expectations, driven by a faster ramp for MI300X with AI customers.” AMD’s collaboration with industry heavyweights such as Microsoft, Meta Platforms, Oracle, and others to deploy its MI300 Instinct family of data center GPUs elucidates Su’s projection that AMD’s data center GPU revenue will surpass $3.5 billion in 2024. This marks a substantial surge from its preceding estimate of $2 billion, evidently indicating burgeoning interest from its customer base for its new chips.

Essentially, AMD’s projected quarterly revenue run rate from the data center GPU business could reach almost $900 million in 2024, based on the $3.5 billion annual revenue forecast from this segment. This would more than double the revenue generated from the sale of data center GPUs in the previous quarter.

The Potential for Further Upsurge in AMD’s AI Guidance

Nvidia has clenched a market share of over 80% in the AI chip market, establishing itself as the dominant player in the space. However, AMD is anticipated to assert its presence this year, capturing between 15% and 25% of the AI chip market.

There are factors that could augur well for AMD in securing a larger share of the AI chip market. A DigiTimes report suggests that AMD could seize a notable portion of its foundry partner, Taiwan Semiconductor Manufacturing’s advanced packaging capacity to manufacture more AI chips. It is anticipated that AMD’s share of TSMC’s advanced packaging capacity could be as much as half of Nvidia’s in 2024. Consequently, AMD could snag a third of TSMC’s manufacturing capacity for producing AI chips.

If AMD manages to produce a substantial number of AI chips this year, it could bridge the gap in supply. This is crucial as waiting periods for Nvidia’s AI processors reportedly extend nine to 12 months. Given the robust specifications of AMD’s flagship MI300X processor and its potential to rival its Nvidia counterpart, consumers in search of fast AI hardware could turn to AMD.

Analyst Srini Pajjuri from Raymond James estimates that AMD could ship anywhere between 250,000 and 500,000 units of its MI300 Instinct data center chips this year. While the price point of AMD’s latest AI chips remains undisclosed, there is a high likelihood that they are competitively priced to vie for a larger share in the AI chip market.

Should AMD price its AI processors at $25,000, the lower end of the H100’s price range, and sell 250,000 units this year (based on Raymond James’ estimate), it could generate $6.25 billion in revenue from this market. The higher end of Raymond James’ shipment estimate suggests that AMD’s data center GPU revenue could surge to $12.5 billion.

Hence, AMD’s conservative AI-related revenue guidance could soon be eclipsed as the company secures additional supply and cultivates greater customer commitments to adopt its AI processors. The accelerating growth of AMD’s AI chip business is poised to drive robust growth in 2024 and beyond.

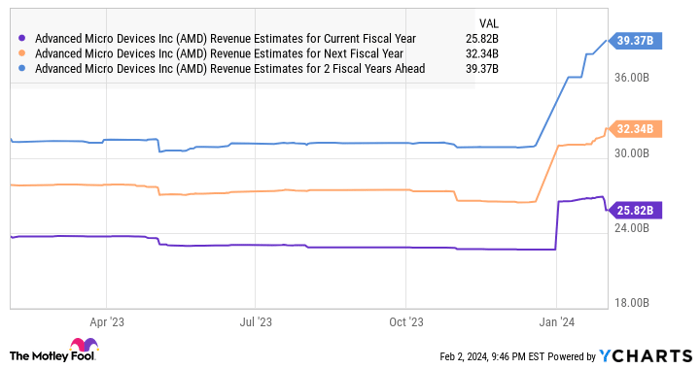

Ultimately, wise investors would be prudent to look beyond AMD’s recent results, recognizing the potential for substantial growth in its fast-emerging AI chip business. This is clearly illustrated by the chart below:

The Future Shines Bright for AMD: AI Revenue Holds Promise

AMD’s Revenue Outlook

In 2023, AMD experienced a 4% decrease in its annual revenue, amounting to $22.7 billion. However, it is crucial to note that a meager $400 million originated from AI chip sales. This is a pivotal factor, pointing to substantial potential growth prospects for AMD, particularly exceeding the forecasts set by Wall Street’s analysts. The notable surge in AI revenue holds the promise of fueling a positive trajectory for this tech stock in the long run, triggering a truly astonishing rally.

The Significance of AI Revenue

With approximately 95% of its revenue coming from non-AI sources, the emergence of AI as a growing revenue stream represents a turning point for AMD. This realization reminds investors that AMD, particularly within the AI sector, has the potential to propel its growth trajectory, shaping the future of its stock value in an arresting manner.

Expert Recommendations

Expert voices have advocated for investors to seize the opportunity, emphasizing the top-ranking performance of Advanced Micro Devices as a viable investment. Prominent investment pundits have cited AMD as one of the “10 best stocks for investors to buy right now,” further corroborating the untapped potential within this tech giant.

Historical Growth

AMD’s narrative is laced with compelling historical context, exemplifying its ability to captivate investors’ attention and drive substantial returns. The company’s resilience and innovation throughout its history highlight the bedrock of potential prosperity that investors can embrace and relish.

Final Thoughts

Despite the apparent dip in annual revenue, it is imperative to recognize the burgeoning AI revenues as a beacon of hope for AMD’s future prosperity. This turning point underscores the dynamic potential of AMD as a lucrative investment choice, casting a radiant glow on the path ahead for investors willing to seize the moment.