Wall Street analysts often have one-year price targets available for the stocks they cover. While a single analyst may have a high or low target, taking the aggregate yields useful information.

The average stock price target on Nvidia (NASDAQ: NVDA) stock is $153, with a high of $200 and a low of $90. Nvidia’s stock currently sits at around $120, which indicates a roughly 30% upside. So, with that kind of upside potential in store for Nvidia, is it time to buy?

Nvidia’s GPUs have been critical for AI model training

Considering that the market returns 10% annually on average, if Nvidia can deliver 30% returns, then it’s a no-brainer. It’s that simple.

But it’s never that simple.

Nvidia’s meteoric rise has been tethered to the massive demand for artificial intelligence (AI) computing power. Its graphics processing units (GPUs) excel in this task, and Nvidia’s GPUs far outperform its competitors. It’s clear that the demand for AI will continue rising, but the question is, will the thirst for computing power be there?

Eventually, the tech giants will reach equilibrium with AI demand and the computing power they have available. When that happens, there will be a large demand shock for Nvidia as its GPUs will not be nearly as sought after. But the question is, will this occur in the quarter, year, or decade? Nobody knows the answer to that, but it seems like it will be at least a year later.

Commentary from some of Nvidia’s largest customers indicates that capital expenditures will ramp up in 2025, indicating its GPUs will still be in high demand.

So, demand will be there for at least 2025 (which the price target is good for). But has that growth already been baked into the stock?

Nvidia’s new margins have become integral to the investment thesis

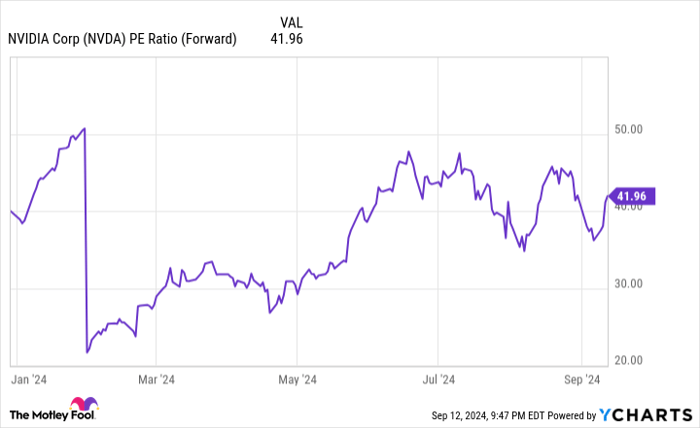

It’s no secret that Nvidia’s stock has achieved a high valuation due to its expectations. Right now, it trades for 42 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

That’s not a cheap price, and with a price in that range, it also projects further strong growth in the following years.

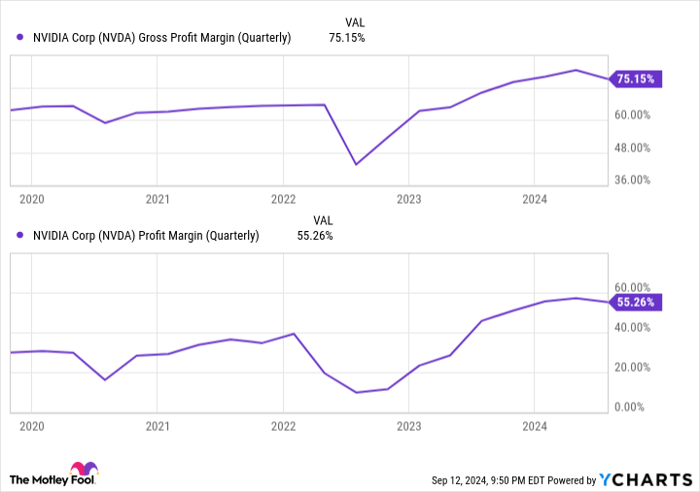

However, one item to watch that could sink Nvidia’s ship is its margins.

A part of Nvidia’s story that hasn’t been discussed as much as the massive GPU demand is its margin expansion. Since its GPUs became hot commodities, its margins increased.

NVDA Gross Profit Margin (Quarterly) data by YCharts

However, they trended lower in the past few quarters, which could be noise or a cause for concern. Even if Nvidia’s revenue continues to rise, if its margins revert to historical levels, its profits will be drastically reduced and cause the stock price to drop.

So, could Nvidia’s stock rise 30% over the next 12 months? I’d say absolutely. And if it does, it’ll be a fantastic stock to own. However, one item to watch during this time is its margins. If they start to slip, don’t be surprised if the stock falls. I think Nvidia’s margins will be fine through at least 2025, so now may be a good time to pick up some Nvidia shares while they are on sale.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.