An Apple a Day, But Not for Warren Buffett

In the realm of investing, few names carry as much weight as Warren Buffett and his conglomerate, Berkshire Hathaway. So when Berkshire decided to shed a portion of its Apple shares, the financial world took notice.

Shaky Foundations: Apple’s Business Struggles

Despite Apple’s stronghold in the tech industry, cracks have started to appear in its seemingly impenetrable armor. The company’s product cycle has matured, leading to diminishing returns with each new iteration. While Apple managed a 2% revenue growth in the first quarter of fiscal year 2024, its overall performance has been lackluster compared to its former glory.

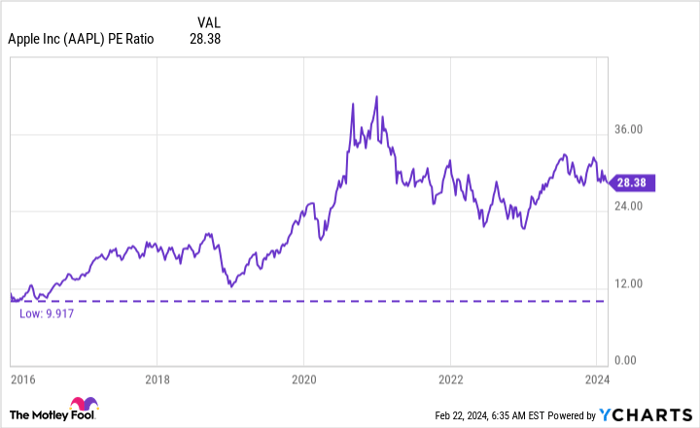

Apple’s stock price paints a conflicting picture. Despite modest growth, the stock has soared by 40% since the beginning of 2023. This surge has inflated Apple’s valuation to an eye-watering 28 times earnings, a figure typically reserved for high-growth firms, a status Apple no longer embodies.

As Berkshire’s strategic move suggests, the market has begun to recognize Apple’s overvaluation, with the stock price dipping by 5% in the current year as opposed to the S&P 500’s 5% increase.

Valuation Woes: The Price Doesn’t Match Performance

Berkshire’s actions might signal more Apple sell-offs in the future if the price remains inflated. The consensus among Wall Street analysts, suggesting Apple should be ideally valued at a PE ratio of 22, further underlines the current overvaluation of the stock.

But even at this level, some argue Apple remains too pricey given the tepid revenue growth forecasts of 1.3% in FY 2024 and 6.3% in FY 2025, indicating a shift from growth to value for the tech giant.

While Apple’s immense cash reserves present a silver lining—with over $100 billion in free cash flow generated in the past year—they have primarily been funneled into stock buybacks and dividends rather than transformative investments.

As investors contemplate Apple’s future trajectory, heeding Buffett’s cue to trim Apple exposure might be a prudent move. With the market ripe with undervalued opportunities, it could be wise to explore greener pastures for investment.