Investors often seek that perfect entry point when looking to buy stocks, a number that could be considered the “magic number.” For Ford Motor stock (F), the consensus seems to have settled around $10. This price not only acted as a support level last November but also aligns with the recent positive developments in the company’s vehicle delivery statistics for August and its enticing high dividend yield.

Ford, an iconic American automaker deeply rooted in the history of the automobile industry, is known for producing both internal combustion engine vehicles and electric vehicles (EVs). What’s more, a patent application filed by Ford suggests a visionary plan to convert roads into EV charging systems, showcasing the company’s innovative spirit.

Despite a temporary decline that saw Ford stock edge toward the critical $10 mark, recent news surrounding the automaker remains relatively positive. While a recall of over 90,000 vehicles due to engine intake valve issues did hit the headlines recently, it’s unlikely to overshadow the overall bullish sentiment towards F stock. This highlights a potential contrarian opportunity for those eyeing a strategic entry point in Ford.

Exploring the Appeal of Ford Stock’s Dividend Yield

When a stock price declines, the resultant rise in dividend yield can be an attractive feature for income-focused investors. Ford’s current high dividend yield further bolsters its appeal, with the company consistently rewarding shareholders with dividends. The stability of Ford’s dividend payments combined with its relatively low share price makes it an appealing choice for those looking to build income from their investments.

Delving deeper into Ford’s dividend structure, we find that the stock trades at $10.27 per share with a dividend payout of $0.15 per share quarterly. Given Ford’s strong profitability track record, the likelihood of a sudden dividend cut is minimal. Even if the dividend were halved, Ford’s dividend yield would still be competitive when compared to sector averages, making it an attractive proposition for long-term investors.

Evaluating Ford’s Valuation and Growth Potential

Examining Ford’s valuation metrics reveals a compelling case for investment. A low valuation coupled with a high dividend yield presents an intriguing opportunity for value-focused investors. Ford’s significantly lower Price-to-Earnings (P/E) ratio compared to sector averages underscores its undervaluation in the market, further supporting the bullish thesis on F stock.

With Ford’s non-GAAP trailing 12-month P/E ratio standing at 6.26, significantly below the sector median of 14.11, the stock presents a strong value proposition. This attractive valuation multiple, complemented by the company’s robust earnings potential, positions Ford as a favorable investment choice for value-conscious investors.

Ford’s Strong Sales Performance in August

Adding to the positive narrative surrounding Ford is the company’s impressive sales figures for August. With nearly 183,000 vehicles sold, representing a 13.4% year-over-year increase, Ford outperformed industry estimates. Notably, the surge in sales of electric vehicles, particularly the F-150 Lightning electric pickup trucks, highlights Ford’s commitment to innovation and sustainability.

Furthermore, Ford’s significant growth in hybrid vehicle sales, up by nearly 50% in August, underscores the company’s broader appeal across different vehicle segments. This strong sales performance not only reflects Ford’s market resilience but also indicates a promising outlook for the company’s future growth trajectory.

Analyst Insights and Potential Upside for Ford Stock

According to analysts on TipRanks, Ford stock holds a Moderate Buy rating, based on a mix of Buys, Holds, and Sells. With an average price target of $13.75, implying a potential upside of 32.46%, analysts remain cautiously optimistic about Ford’s growth prospects.

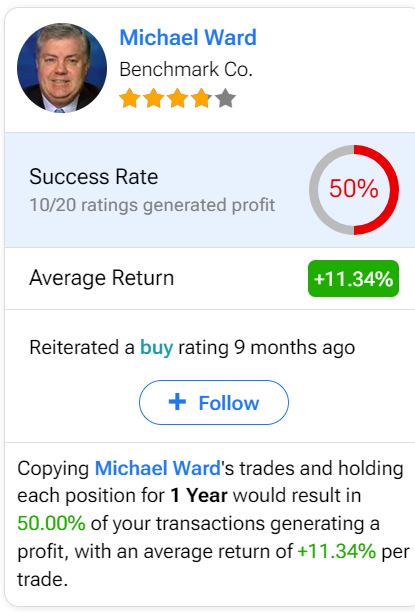

For investors seeking guidance on their investment decisions, following analysts like Michael Ward of Benchmark Co., known for his accurate stock predictions and solid returns, could provide valuable insights into the future performance of Ford stock. As market sentiments fluctuate, relying on expert analysis and forecasts can help investors make informed decisions regarding their investment portfolio.

Final Thoughts: Navigating the Ford Investment Landscape

In conclusion, the recent dip in Ford’s share price does not appear to be backed by substantial negative developments within the company. With robust sales figures, a favorable valuation, and an attractive dividend yield, Ford stock presents a compelling case for investment. As the stock hovers around the $10 mark, prudent investors may find this juncture to be an opportune moment to consider adding Ford to their portfolio.