A Shift in the Ridesharing Landscape

Lyft, Inc LYFT stock faces a downturn following the extended collaboration between its rival Uber Technologies, Inc UBER and Waymo (formerly Alphabet Inc’s Google Self-Driving Car Project).

Uber and Waymo’s plans to introduce autonomous ride-hailing services utilizing Jaguar I-PACE vehicles in Austin and Atlanta by 2025 through the Uber app have put Lyft in a challenging position.

Uber’s strategic diversification into food delivery, freight, and same-day services has allowed the company to evolve beyond its initial ride-hailing model, which has contributed to its recent successes.

In the fiscal second quarter of 2024, Uber reported a robust 16% revenue growth to $10.70 billion, surpassing analyst expectations. Notably, Mobility revenue surged by 25% to $6.13 billion, while Delivery and Freight segments also demonstrated significant growth.

Uber’s total trips increased by 21% to 2.8 billion, hinting at a resurgence in ride demand as the economy recovers from pandemic-related impacts.

Conversely, Lyft has announced plans to streamline its operations by laying off a portion of its workforce and divesting assets related to bike and scooter operations in a bid to trim operating expenses.

By the end of December 31, 2023, Lyft’s employee count stood at 2,945 after letting go of 1,072 employees in April 2023.

Despite these challenges, Lyft marked a 41% growth in sales in the second quarter, reaching $1.44 billion, outperforming analyst forecasts. Additionally, Lyft observed a 15% year-over-year rise in the number of rides to 205 million.

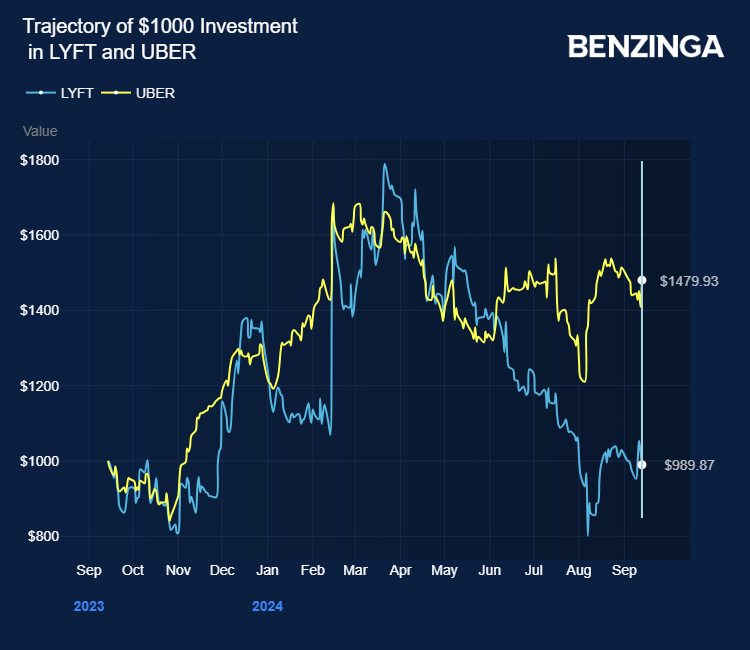

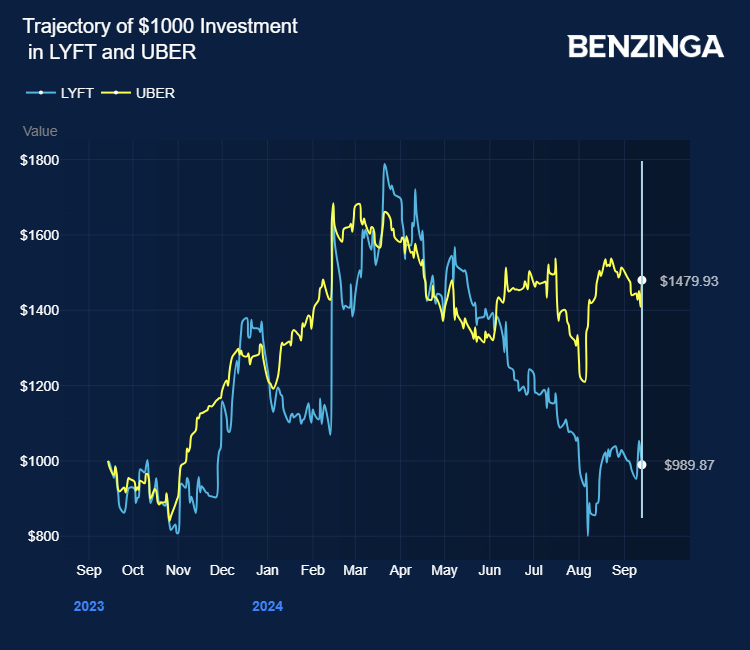

While Uber’s stock has surged by 49% over the past year, Lyft has experienced a slight 0.18% decline in its stock value.

Investors seeking exposure to both Uber and Lyft can consider options like Vanguard Total Stock Market ETF VTI and iShares Russell 1000 Growth ETF IWF.

Price Action: LYFT stock is currently down by 4.68% at $11.08 as of the latest market check on Friday.

Photo Courtesy Lyft