The “Magnificent Seven” stocks commanded the market in 2023. The weakest performer, Apple (NASDAQ: AAPL), surged by 49%, while the leader, Nvidia (NASDAQ: NVDA), soared by nearly 240%. Despite their substantial gains, the question looms: do these stocks still have the potential to thrive in 2024?

The answer is a resounding yes, with several of them presenting enticing opportunities at their current valuations.

Rich Valuations of Apple and Nvidia

Breaking down the “Magnificent Seven” into buy, sell, and hold categories, it is evident that Apple and Nvidia’s stock prices have far outstripped their underlying operational performance.

Nvidia’s extraordinary success in 2023 was propelled by the artificial intelligence (AI) arms race, resulting in a remarkable 206% year-over-year revenue surge in its fiscal 2024 third quarter. While the stock’s uptrend is justifiable given the impressive sales growth, concerns arise regarding Nvidia’s position within a cyclical industry. The company experiences boom and bust cycles, and its current prosperity might be short-lived if future demand for its high-powered chips wanes. Moreover, trading at 65 times earnings, Nvidia is commanding quite a premium.

Conversely, Apple’s stock skyrocketed despite a decline in sales throughout 2023. An additional setback ensued when a U.S. International Trade Commission order temporarily halted the import and sale of some Apple Watches due to a patent dispute. This impending hurdle signals a challenging year ahead for Apple, compounded by its higher valuation compared to fellow “Magnificent Seven” members Alphabet (NASDAQ: GOOG, GOOGL) and Meta Platforms (NASDAQ: META), making it an unattractive option among its peers.

Evaluating Microsoft and Tesla

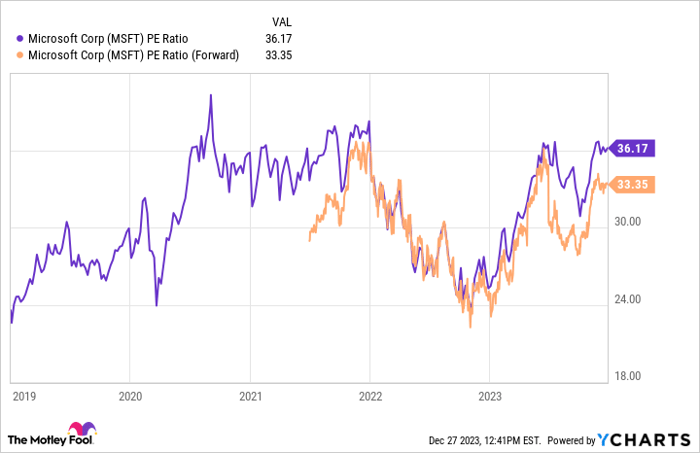

Microsoft’s robust financial performance in 2023, with steady revenue and earnings per share (EPS) growth, paints a strong picture. However, the steep premium at which it is trading raises historical valuation concerns, making it a cautious hold rather than a sell.

Tesla’s valuation remains enigmatic, deeply entrenched in future product expectations. With forthcoming headwinds related to federal EV tax credit reductions for certain Tesla models, exercising caution is prudent, as its stock is not presenting a bargain at current prices.

Promising Prospects for Advertising Companies

Alphabet, Meta Platforms, and Amazon are all positioned as attractive investments currently. After weathering a weak advertising market in 2022 and 2023 due to recession fears, Alphabet and Meta are experiencing substantial growth in their advertising businesses, propelling them for a strong recovery year in 2024. Similarly, Amazon’s robust performance in historically weak quarters bodes well for 2024, potentially revealing a clearer picture of its profitability.

The Hype and Reality of Nvidia Stocks in 2024

Investing in Nvidia: A Strategic Move?

Should you invest $1,000 in Nvidia right now?

Prior to acquiring stocks in Nvidia, it is advisable to consider the recommendations by The Motley Fool’s Stock Advisor analyst team that recently pinpointed 10 outlook-brightening stocks for investment, with Nvidia failing to make the cut. The touted 10 selected stocks, according to the team, are anticipated to yield significant returns in the imminent years.

Their “Stock Advisor” initiative is engineered to equip investors with a simple and effective strategy for success, inclusive of portfolio development guidance, routine analyst updates, and two fresh stock picks each month. It is noteworthy that, since 2002, “Stock Advisor” has more than trebled the returns of S&P 500*. For more information on these, view the list of 10 recommended stocks.

*Stock Advisor returns as of December 18, 2023

Analysis of The Speculations on Nvidia

Following Nvidia’s exclusion from the list of highly-recommended stocks, speculation has run rife in investment circles. Some investors demonstrate unwavering confidence in the prospects of Nvidia, while others remain skeptical about its future performance. Amidst the chatter, a few questions emerge:

- Is Nvidia well-positioned to navigate the impending market conditions?

- What are the key factors driving Nvidia’s stock performance?

- How might an investment in Nvidia align with your long-term financial goals?

Currently, the sentiment surrounding Nvidia’s stocks is a hotly-debated topic among investors.

Insights from Historical Context

Historically, Nvidia has been a disruptor in the tech industry, consistently pushing the boundaries of innovation. From its inception, the company has weathered several storms, adapting itself adeptly to changing market dynamics. Notably, in recent times, Nvidia has made substantial advances in artificial intelligence and semiconductor technology, positioning itself as a forerunner in these domains.

The historical trajectory of Nvidia offers crucial insight into the company’s resilience and potential to endure market turbulence.

The Motley Fool’s Position and Future Perspective

Given the affiliation of certain prominent industry figures with The Motley Fool’s board of directors, including individuals formerly linked with tech giants like Facebook, Amazon, and Alphabet, The Motley Fool’s recommendation carries significant weight in investment circles. However, as with all market speculations, it is imperative to conduct thorough research and seek a balanced array of opinions before making investment decisions.

As the year unfolds, market watchers eagerly anticipate how Nvidia will navigate the evolving financial landscape and what this may entail for investors.